Understanding the Concept of Smoothing

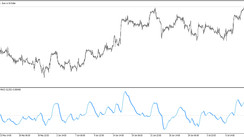

In the realm of technical analysis, smoothing represents an efficient strategy aiming to minimize market noise embedded within price data. This is achieved by averaging the data over a predefined timeframe and can include various techniques such as moving averages and exponential moving averages.

Deciphering the Smoothing Process

When you execute a smoothing function on a price series, you are fundamentally averaging the random price fluctuations. This facilitates ease of data interpretation and plays a pivotal role in uncovering trends and patterns that might be confounded by market noise.

Common Methods of Smoothing

Different smoothing techniques abound, but the frequently utilized ones include:

Moving averages: The easiest type of smoothing, computed by averaging the price over a defined number of periods.

Exponential moving averages: This is a more evolved type focusing more on recent prices while reducing importance to older prices. Hence they are quicker to react to market changes.

Additional smoothing methods: A plethora of other techniques such as weighted moving averages, Savitzky-Golay filters, and Kalman filters also exist.

The Role of Smoothing in Trading

Smoothing can remarkably influence trading by:

Minimizing noise: It ensures an efficient eradication of noise interference in price data, thereby aiding in the identification of trends and patterns.

Detecting trends: Trends that might have been hidden by noise can be discovered through smoothing.

Limiting whipsaws: It can effectively minimize whipsaws, which are deceptive signals that can potentially incur losses.

Enhancing accuracy: Smoothing techniques can enhance the precision of technical indicators, thus increasing their reliability for trading-related decisions.

Mastering the Selection of Right Smoothing

The appropriate smoothing strategy primarily hinges on your trading style and target market. For volatile markets, a shorter smoothing period might be optimal to manage noise. Conversely, in less volatile markets, a longer smoothing period may be ideal for trend identification.

Considerations When Choosing a Smoothing Technique

Lending consideration to the trading timeframe, market volatility, and your personal trading style significantly aids in the selection of the most appropriate smoothing technique.

The use of smoothing in technical analysis has garnered diverse opinions from experts. While some regard it as a crucial trading tool, others deem it unnecessary. Ultimately, the decision to utilize smoothing rests with the individual trader.

A Conclusion on Smoothing in Technical Analysis

Integrating smoothing into technical analysis requires a careful understanding of its functioning and the various techniques available. By utilizing these strategies appropriately, traders can maximize their market potential.