Today's trading day began with the resumption of growth in US stock indices and, oddly enough, the dollar. Usually, according to a recent trend, the correlation of the dollar to US stock indices has a negative value. When stock indexes rise, the dollar usually falls. Today we see the opposite picture. The DXY dollar index, in turn, received a tangible positive impetus at the beginning of today's European session after the release of disappointing data on the level of retail sales in Germany, which indicated a decline in December by -9.6% (against the forecast of -2.3% and growth by +1.1% in November).

Economists attribute this to a second lockdown, which led to the partial closure of retailers starting December 16.

Although, according to the German Federal Bureau of Statistics Destatis, retail sales grew in December by 1.5% on an annualized basis, and in 2020 as a whole, retail sales in real terms increased by 3.9% compared to 2019, the euro reacted with a fall in the foreign exchange market, including in the EUR / USD. And since the euro occupies over 50% of the DXY dollar index basket, the DXY rose sharply after the publication of data on retail sales in Germany.

At the time of publication of this article, WTI futures were traded near the level of 90.75, corresponding to the highs of January.

Despite the fact that later (at 09:00 GMT) positive data on business activity in the manufacturing sector of the Eurozone were published, the euro remains under pressure. The purchasing managers' index (PMI) for the manufacturing sector from IHS Markit was revised upward to 54.8 from a preliminary estimate of 54.7 (in December, the index was at 55.2). A reading above 50 indicates increased activity from the previous month.

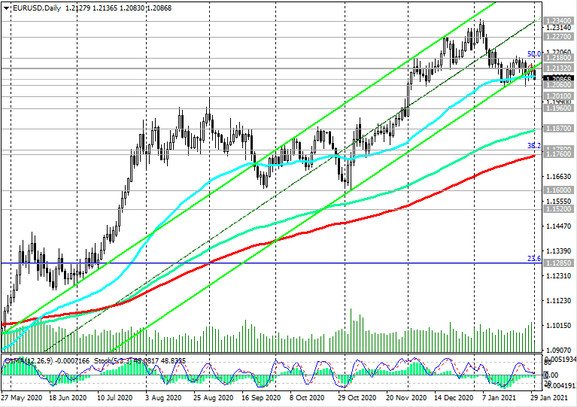

As of this writing, the euro / dollar pair is traded near 1.2087, down 0.33% to today's opening price.

Economists also note that the ECB has practically no instruments for weakening the euro, the use of which would not harm the economy, and verbal intervention from the ECB leaders about the possibility of further lowering interest rates (note that the main interest rates of the ECB are at 0% and -0.5%), in the absence of real action, can undermine investor confidence.

At the same time, the dollar maintains its main trend towards further weakening for a number of strong fundamental reasons. Therefore, the EUR / USD pair is likely to remain upwardly inclined, especially if the outlook for the European economy becomes more positive. Economists expect this in the spring.

If the vaccination against coronavirus in Europe soon begins to bring positive results, the optimism of market participants investing in the European economy will only increase, which will push the euro, as the funding currency of the European stock market, to grow. In this regard, it is worth taking a closer look at this currency pair with the aim of buying it from the current levels, despite the fact that from a technical point of view, a short-term downward trend prevails (see "Technical Analysis and Trading Recommendations").