The leading US stock indexes Dow Jones Industrial Average and S&P 500 finished last week on a positive note, returning to the zone of record highs.

Investors are analyzing signals that indicate, on the one hand, the readiness of the American economy for a period of sharp growth, and on the other hand, the continuing growth in the yield of US government bonds, which is an additional factor in the strengthening of the dollar.

While US 10-year bond yields have stabilized around 1.700%, below the local multi-month high of 1.754% reached earlier this month, the DXY dollar index remains inclined to further growth. As of this writing, DXY futures are traded near 92.85 mark, just below the local monthly and last week highs of 92.94, which is also in line with November 2020 levels.

Economists expect that further improvement in the US economic situation will lead to a stronger dollar.

As reported last Friday at the University of Michigan, consumer sentiment index for March rose to 84.9 points from 83.0 in February, and the index of current conditions was 93.0 points instead of 91.5 in the previous period.

On Wednesday (12:15 GMT) ADP data on the number of US private sector jobs will be released, and on Friday there will be a report on the number of US non-farm jobs, and these numbers are likely to support the dollar as are expected to be strong. According to economists' forecast, the growth in the number of workers in the US private sector in March amounted to +525,000 (against an increase of 117,000 in February, 174,000 in January, a fall of -123,000 in December), the number of new jobs created outside the agricultural sector, amounted to +0.630 million (against +0.379 million in February, +0.049 million in January, -0.140 million in December, +0.245 million in November), and unemployment fell to 6.0% (against 6.2% in February, 6, 3% in January, 6.7% in December and November).

It is also expected that discussions will soon begin in Congress for a new package of economic assistance in the amount of $ 3 trillion, and possibly more, aimed at stabilizing certain sectors of the economy. The new stimulus package of financial assistance to the US economy should spur both the growth of US assets and stock indices and the demand for them, as well as inflation. Both of these factors should also have a positive effect on the dollar quotes.

Today is the start of the last week of the month and quarter. Large options expire on Wednesday, March 31, Easter holidays begin on Thursday-Friday, and data on the US labor market will be released on Friday. Therefore, an increase in volatility should be expected in the market in the coming days.

Meanwhile, the euro continues to weaken under the pressure of the difficult situation with the coronavirus. The number of new infections continues to rise in almost all major countries of the Eurozone. Against this background, the issue of introducing vaccination certificates and extending lockdowns in a number of European countries is increasingly being raised.

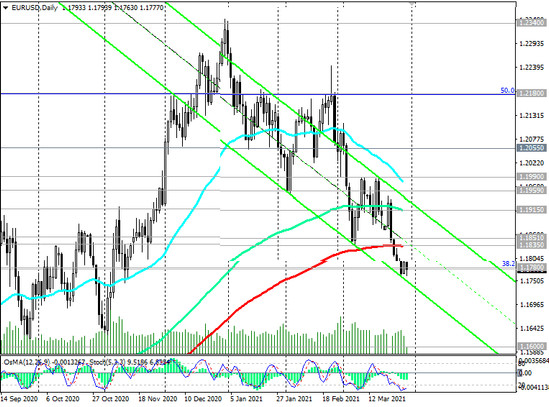

In general, the situation is in favor of a further fall in the EUR / USD pair. Currently, it is traded in the zone below the key long-term level 1.1835, at the support level 1.1780 (see "Technical Analysis and Trading Recommendations"). A breakdown of the support level 1.1780 will strengthen the negative dynamics of EUR / USD and direct it towards the support levels 1.1600, 1.1550.