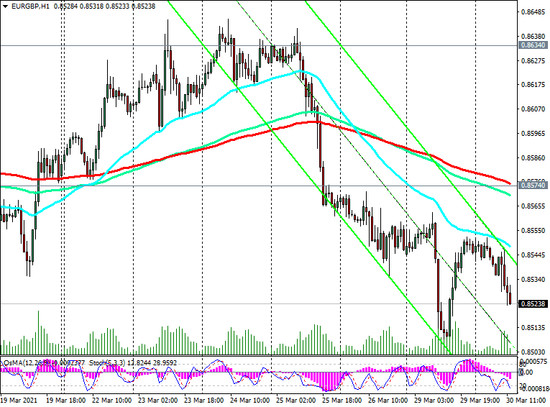

Having reached the 0.8505 mark during yesterday's European session, which corresponds to 13-month lows, the EUR / GBP pair remains under pressure due to fundamental factors, which preserves the risks of its resumption of decline.

At the moment, EUR / GBP is also under pressure, trading below the important short-term resistance levels of 0.8574 (EMA200 on the 1-hour chart, 0.8634 (EMA200 on the 4-hour chart), and declining in the descending channel on the daily chart.

Its lower border is near the 0.8400 mark, and it is likely that after the breakdown of the 0.8500 support level, this mark will become the closest target in case the EUR / GBP decline resumes.

More distant targets are located at support levels 0.8350 (ЕМА144 on the monthly chart), 0.8220 (ЕМА200 on the monthly chart).

So far, and below the resistance levels 0.8800, 0.8845 (ЕМА200 on the daily chart), a downward trend prevails.

In an alternative scenario, a confirmed breakdown of the resistance level 0.8740 (ЕМА200 on the weekly chart) will become a signal for the resumption of long positions. The first signal for the implementation of an alternative scenario is a breakdown of the resistance level 0.8574.

Support Levels: 0.8400, 0.8350, 0.8250

Resistance Levels: 0.8574, 0.8634, 0.8740, 0.8800, 0.8820, 0.8845

Trading Recommendations

Sell by market, Sell Stop 0.8490. Stop-Loss 0.8565. Take-Profit 0.8400, 0.8350, 0.8250

Buy Stop 0.8565. Stop-Loss 0.8490. Take-Profit 0.8574, 0.8634, 0.8740, 0.8800, 0.8820, 0.8845