The outlook for the US economy "is clearly brighter", Fed Chairman Jerome Powell said Monday. "The economy is now prone to explosive growth", echoed John Williams, President of the Federal Reserve Bank of New York. “Given the soft financial environment, strong fiscal support and widespread vaccination, I expect this year's GDP growth to be the highest since the 1980s”, Williams said. In his opinion, the US economy will demonstrate strong indicators this year, however, this does not make it necessary to curtail the aggressive monetary stimulus measures by the FRS.

"We are still far from our goals of maximizing employment and price stability", Williams said, adding that "the data and conditions we are currently seeing are not sufficient for the Fed to change its monetary policy".

As you know, the heads of the central bank, following a meeting last week, decided to keep interest rates unchanged and to continue monthly purchases of US $ 120 billion in government bonds. In their official statement, they expressed increased optimism about the US economic outlook and indicated the likelihood of a temporary acceleration in inflation.

The DXY dollar index declined on Monday following speeches by Jerome Powell and John Williams. The weakening of the dollar was also helped by the publication at the beginning of yesterday's American session of weaker-than-expected PMIs in the manufacturing sector of the American economy. Thus, the PMI index from ISM in April amounted to 60.7 points, which is significantly lower than the forecast of 65.0 points, as well as 64.7 points recorded in March. In addition, the ISM employment index in this sector of the economy also dropped to 55.1 points, which is significantly lower than the 59.6 points in March and the 61.5 forecast.

The DXY dollar index rallied on Tuesday, boosted by increased demand for the dollar as a defensive asset following reports of strong increases in COVID-19 cases in Asia.

India now ranks second in detected cases after the United States with 19.9 million. According to media reports, India had 368,147 new coronavirus infections and 3,417 deaths on Monday, according to media reports. Over the weekend, India reported 400,000 infections per day, a new world record.

The rapid increase in the number of cases of coronavirus infection was also recorded in Bhutan, Sri Lanka, Nepal, Thailand and Laos. The new strains of Covid-19 appear to be more infectious and deadly, making developing countries particularly vulnerable due to a lack of vaccines and adequate health resources.

The dollar is strengthening on Tuesday, while the DXY dollar index is growing again, being at the time of this article being close to 91.30, which corresponds to the highs of the previous week.

However, some economists believe it will be difficult for the dollar to develop further growth if the monthly US labor market data due on Friday falls short of optimistic expectations, because market participants expect strong performance.

Labor market data is expected to show that US employers created about 1 million jobs outside of US agriculture, and the unemployment rate fell to 5.8% from 6.0% in March.

Labor market data are extremely important in determining the direction of the further dynamics of the dollar, since they are key (along with GDP and inflation data) for future decisions of the US Federal Reserve on interest rates.

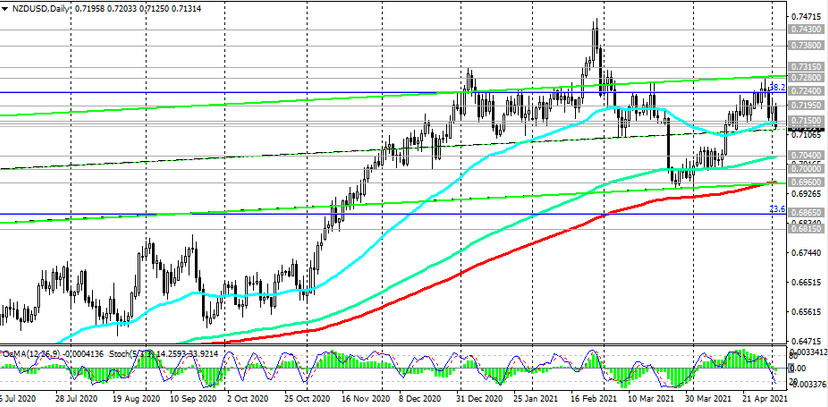

Meanwhile, as we noted above, amid fears of a rapid increase in the number of cases of COVID in Asia, the Asia-Pacific currencies have fallen sharply during today's Asian session. This applies in particular to the NZD. The NZD / USD pair dropped 0.8% (55 pips) to the current 0.7140 mark and a strong support level (see Technical analysis and trading recommendations).

Today, we should expect an increase in volatility in the NZD quotes and, accordingly, the NZD / USD pair in the period from 21:00 to 22:45 (GMT), when the RBNZ report on financial stability will be published, which assesses the health and efficiency of the financial system of the New Zealand, as well as quarterly data from the New Zealand labor market.

In the 1st quarter, the number of employed New Zealand citizens is expected to increase and the employment rate increased by +0.2% (after an increase of +0.6% in the 4th quarter of 2020 and a fall of -0.8% in Q3), while unemployment remained at the same level of 4.9%.

If other indicators of the NZ Bureau of Statistics report deteriorate, it is likely to negatively affect the NZD. Weak forecast data will have an even stronger negative impact on the NZD.

Volatility in the NZD quotes may also increase today in the period after 14:00 (GMT), when the price index for dairy products will be published.

A dairy auction two weeks ago indicated a decline in world prices for dairy products. The Global Dairy Trade Dairy Price Index came out with a value of -0.1%. Milk powder constitutes a significant part of the country's export. Another price cut will put pressure on the New Zealand currency. This index is expected to decrease by -0.3%.