Don’t be fooled by its unique Japanese name because Ichimoku Kinko Hyo ain’t Japanese place or person. Ichimoku Kinko Hyo is a term used for a type of chart indicator that weighs the future price of a momentum and establishes its future areas of support and resistance. Therefore, Ichimoku Kinko Hyo is a 3 in 1 useful tool for forex trading.

What do the words Ichimoku Kinko Hyo mean in English?

Worry no more because your confusions will end right here, right now.

The word “Ichimoku” means a glance, “Kinko” means equilibrium, while the word “Hyo” means chart. So if you would put every word in one phrase, it would say “a glance at a chart in equilibrium”.

What exactly is the Ichimoku Kinko Hyo Indicator

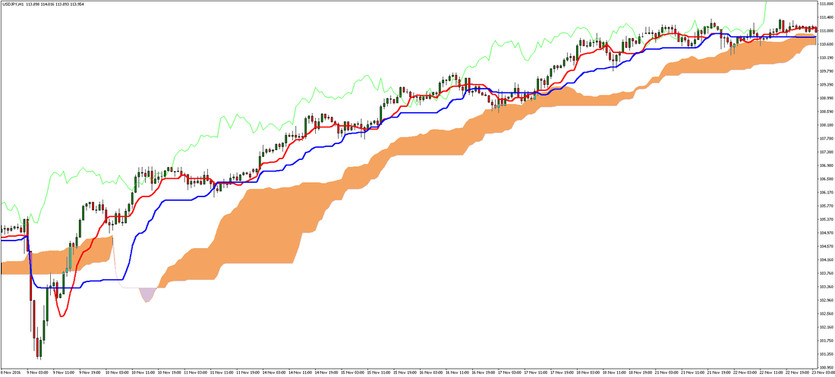

Does it still look vague to you? Ichimoku Kinko Hyo is a tool developed by a writer Goichi Hosoda and some assistants that run multiple calculations any analysis in the forex industry. A lot of Japanese trading rooms are using it up until now to analyze price action and developing a higher probability result in trading. Ichimoku Kinko Hyo is known for its intimidating chart since it uses lots of lines in different colors when applied. However, it is actually easy to understand just like other chart indicators.

To understand the function of each colored line, check out its meaning below:

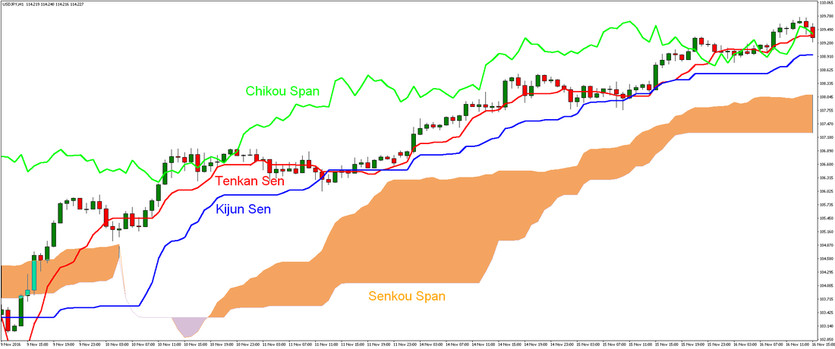

- Chikou Span: Can be seen as the green line that was also labeled as a lagging line. This line indicates the closing price of a market and plotted within a 26 period of time behind.

- Kijun Sen: Can be seen as the blue line that indicates a baseline or standard line. This can be measured by getting the sum of the highest high and lowest low for the 26 periods and divided by 2.

- Tenkan Sen: Can be seen as the red line that is also called as a turning line. This can be measured after getting the sum of the highest high and lowest low for the previous 9 periods and divided by 2.

- Senkou Spans (cloud): Can be seen as the orange zone in case of bullish trend or the light violet zone in case that there is a bearish trend. In fact, the cloud (zone) is created by two Senkou Spans lines. The 1st Senkou can be measured by getting the sum of Kijun Sen and Tenkan Sen divided by 2. It is also plotted within 26 periods of time ahead. The 2nd one can be measured after getting the sum of the highest high and lowest low for 52 periods backwards and then divided by 2. This one is plotted 26 periods ahead of time as well.

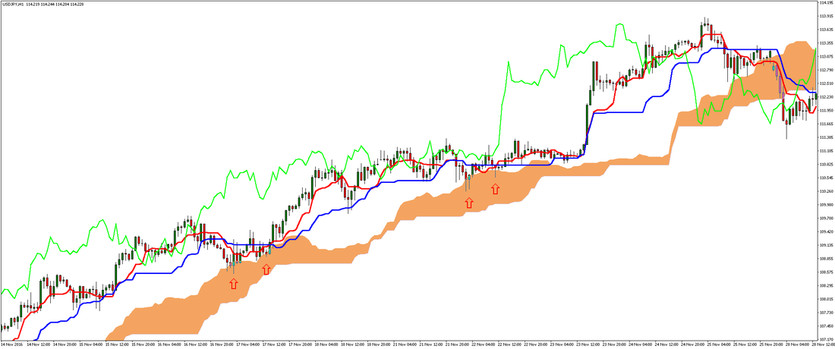

Once everything was plotted on the chart, the area between the Senkou Span lines is called Kumo or Cloud. The cloud simply acts as a moving support / resistance zone. If a price is above the cloud, then the cloud forms support zone, and vice versa. In the picture below, you can see how USDJPY bounced several times higher after approaching the Cloud.

Thanks to the Kumo, you can also easily analyze current trend. Price above the Kumo means a bullish trend, while price below the Kumo is signaling bearish trend.

The blue line - Kijun Sen - is usually used for predicting future price moves. If price is above the Kijun Sen, then further upside move is expected, and vice versa.

The red line - Tenkan Sen - is usually used as a short-term trend indicator. If the Tenkan Sen line is pointing either upside or downside, it means that there is an established trend in the market. While horizontal Tenkan Sen is signaling a sideway trend.

The green line - Chikou Span - can be used for spotting important turning points for drawing support and resistance levels. It is also possible to use it as an entry signal - if the green line crosses current market price from downside to upside, it can be considered as a buy signal, and vice versa.

Conclusion

Crystal clear? Well, it is not that necessary to munch in everything in one sitting since it’s more important to know how the lines should be interpreted. Ichimoku Kinko Hyo chart indicator may look intimidating at first, but it’s actually handy once understood. It is a 3-in-1 tool that offers more filter to price action for all currency traders.

There are just tens or maybe even hundreds of possible techniques and strategies that can be created based on the Ichimoku Kinko Hyo indicator - from using it as a support / resistance indicator or opening / closing orders based on the lines of the indicator or Price Action happening near the Kumo, to using the lines of the indicator as a trailing stop-loss level. There are simply almost no limits when testing and trading the Ichimoku Kinko Hyo indicator.