Range trading can be defined as a trading style that aims to profit from those market situations when the price is moving sideways. The main argument behind this style of trading rests on the fact that the price practically spends most of the time moving sideways and thus the main idea in range trading is to find some type of a range in the market and look to sell at the top and buy at the bottom of that range.

A range does not have to be a horizontal one, however, rather it can be in any form inside of which the price is contained for a certain period of time. Consolidation patterns, such as flags, triangles, and channels can also be considered ranges that can be traded if they appear on the larger timeframes. In general, the trading range will be defined on a larger-scale timeframe while traders will look for entry opportunities on lower timeframes.

One thing that must be kept in mind when trading ranges is that the price can very often act in choppy and unexpected ways. It’s important to be aware of this and don’t get too caught up believing in one particular trade and holding it for too long because, at the end of the day, the market can really break a range in either direction. Still, as long as the price is contained within the range the support and resistance zones would still be valid.

There are certain characteristics of price behavior that are specific to range trading and some trading indicators and tools that work particularly well when the market is ranging which traders can use to successfully exploit such situations in the market.

And, in this article, we’ll cover some of those basic guidelines for range trading the Forex market.

Use Technicals to define the range

Aside from using the basic lines on the chart to define the range with support and resistance levels, other indicators can also be used to help us determine if a specific market is trending or ranging at the moment.

Probably one of the most famous indicators for determining the state of the market is the Average Direction Index or ADX. This tool basically shows how strong the current trend is, where values of 25 and greater are an indication that there is a trend in the market while ADX values below 25 indicate that the market is ranging.

You can read more about the ADX in our article that specifically covers this diverse and handy indicator.

Some people also like to look at moving averages to define if the market is trending or ranging. The basic logic behind this approach is to watch the slope and the order of the moving averages.

Overlapping moving average lines suggest the market is ranging, while situations where moving averages are nicely lined up and pointed in the same direction are a sign that a strong trend is in place.

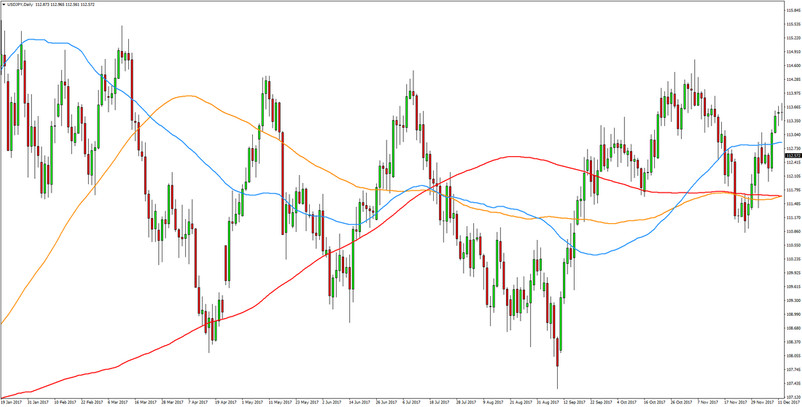

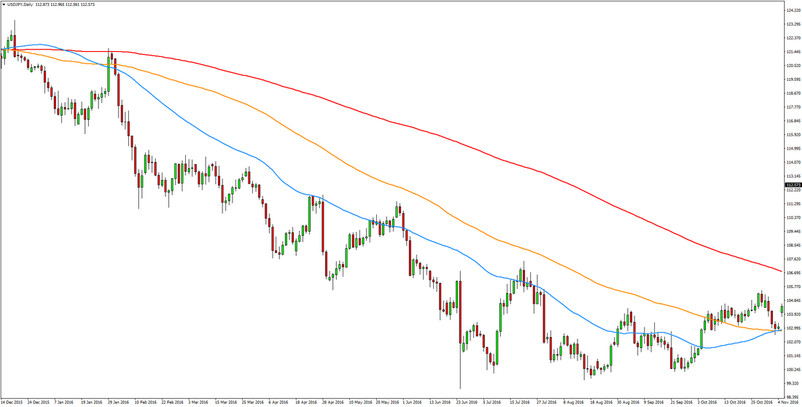

Examples of the two cases are shown on the charts below:

Chaotic moving averages are a sign of ranging market (blue 50 - period ma, orange - 100 period ma and red - 200 period ma)

Moving averages that are aligned in order and direction suggest that there is a trend in the market (blue 50 - period ma, orange - 100 period ma and red - 200 period ma)

Use oscillators to generate range trading signals

Oscillators work particularly well when the price is ranging and they work poorly during strong trends, thus, it’s a good idea to use them when the price is ranging and avoid them when the market is trending.

Specifically, overbought/oversold oscillators work very well for range trading the Forex market – most popular of which are the Stochastic and the RSI.

Below is an example of how overbought/oversold readings on the oscillator accurately predicted the tops and bottoms during this sideways range in the EURJPY currency pair.

Notice how many times the RSI oscillator accurately picked the tops and bottoms during this range

Don’t forget about Fundamentals

For successful range trading, it’s best if the fundamentals are in a status quo situation – unfavorable to either one of the two currencies in a given currency pair.

Trading ranges most often appear in a fundamental environment when the market is waiting for something to happen. This is for both larger scale (long-term) and smaller scale (short-term) events. When the fundamentals tilt strongly in favor of one currency over the other that’s when a strong trend is likely to develop on the chart and when range trading strategies stop working.

Ranges also often develop after large moves. So, when the big fundamental shift has been fully priced in, it’s likely that a range will develop as the market digests the previous move and awaits for what will come next (whether things will now turn or fundamental trends will continue to favor one currency over the other).

On lower scale ranges (shorter-term), one fundamental event can decide the fate of that range. So, in this regard keeping an eye on the Forex calendar is crucial.

Although the fundamental part is more difficult to define and definitely requires more time to be understood than the technical analysis side, it’s very much worth the extra effort in helping you trade more profitably.

Be sure to read our posts on fundamental analysis to help you learn these concepts faster.

General guidelines for range trading

Lastly, here are some general tips to keep in mind when range trading the Forex market:

- Avoid entering in the middle of the range because as we said earlier price can often move in an unexpected manner and whipsaw your position along the way. This is why it’s always best to only look for long entries at the bottom (support) of the range and for short entries at the top (resistance) of the range.

- Take profits quickly. Due to the nature of the price action within a range, moves are quickly erased and reversed. Spiking price action is also common which is why it’s recommended to lock in profits quickly once the target or an important technical level has been reached.

- The same can be said of stops. If the position moves against you there is no point in holding it for much longer because the price may just break the range in the opposite direction leaving you with a larger loss than you initially planned and prepared for.