Today's W&M trading strategy uses specific patterns, where their peaks and bottoms form important price levels, which very often decide the future price development in the markets.

Despite the fact that this is one of the simplest trading strategies, its enormous advantage is that with this strategy traders are able to achieve long-term and consistent positive results, and in addition to this, this strategy is so versatile that it can be used not only in Forex, but also across other financial markets.

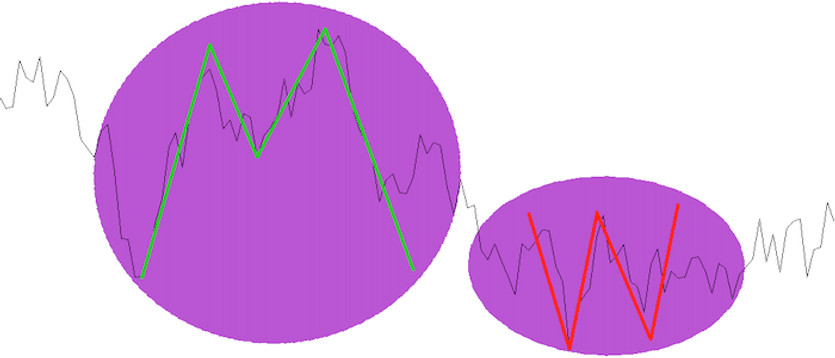

Both M and W patters can be used in different ways. Thus, we can either use their "double" tops, or in the case of W, double bottoms, or we can also trade markets using their midpoints (see chart below). Whether the current S/R level serves as a bounce level for the price up or down will always depend on the current trend. Thus, if an uptrend is established, then it is advantageous to use this S/R level as a springboard for long entries, but if a downtrend is established, then it is preferable to enter only short trades.

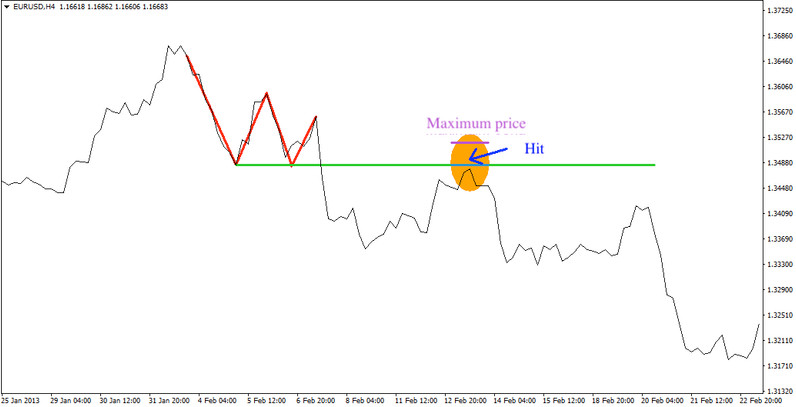

In the example below, on the other hand, we use the double bottom to draw the S/R level, which serves as a signaling element for entering a trading position in the future. Once the price reaches this S/R level (hits it from below), then it is possible to immediately start making entries to the opposite direction (due to the double bottom there is a high probability that the price will bounce back).

With today's strategy based on the W and M models, it is possible to achieve long-term success rates in excess of 60%, which is indeed more than sufficient in terms of long-term sustainability and money-management sizing.