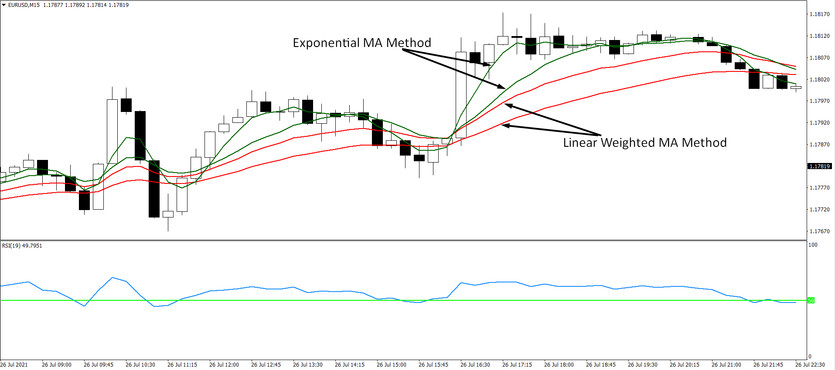

The Hallway strategy is an indicator system that includes four moving averages and an RSI indicator.

It is better to trade on it during the European and American trading sessions. All trades are made within the day. It is better not to transfer positions through the night and not to trade at night in principle.

The essence of the system boils down to the fact that you need to catch the directional movement within the day and use this movement to get the best short-term trend. The Hallway strategy is especially recommended for the major currency pairs EURUSD and GBPUSD.

System settings

First, you need to plot two exponential moving averages EMA with periods of 16 and 30 on the chart. They are used as indicators of the current trend, determinants of the local trend. The other two, linear-weighted, moving averages with periods of 5 and 12 are used to obtain trading signals in the direction of the trend determined by two exponential MA.

The RSI indicator with period 19 and level 50 is used as a signal confirmation filter.

Conditions for opening long positions

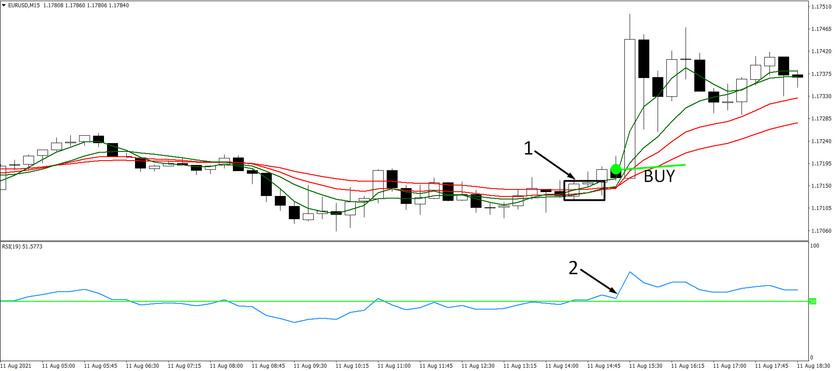

1. Both weighted moving averages cross both exponential moving averages from the bottom up. In this case, exponential moving averages serve as local dynamic levels of support or resistance.

2. The RSI indicator should cross the 50 level from the bottom up. Maybe this crossover was already some time ago, but then the RSI should be above the 50 level, confirming the upward trend.

If these conditions are met, a buy trade is opened.

Conditions for opening short positions

The same conditions apply to sales but with mirrored meanings.

1. Weighted moving averages cross the moving exponential lines from top to bottom.

2. At the same time, the RSI should also cross from above its level 50 or be below it, indicating the presence of a downtrend.

Stop Loss and Take Profit

Stop Loss should be set for the nearest local maximum or minimum and, accordingly, behind the moving averages.

And you can exit a trade when a moving average with a period of 5 crosses in the opposite direction the exponential moving average closest to it, which serves as either support or resistance for the current trend.

Conclusion

As you can see from the description, the Forex strategy for the 15-minute Hallway chart is a Forex moving average strategy that uses four types of averages with different periods to receive signals in the direction of the current trend and quickly exit from it. The system is perfect for fast markets and other highly volatile currency pairs besides EURUSD and GBPUSD.

Clear and simple rules for entering a position with a tight stop and the rules for exiting it at the moment of moving averages cross do not leave the possibility of its ambiguous interpretation, which often prevents the trader from correctly assessing the situation. With adequate adherence to the rules of risk control, this simple strategy can be a good means of additional income for a trader.