Inside bar pattern is a good strategy, especially if you understand other elements of price action. Like if you know how to identify trends, an inside bar strategy can give you really good trade signals. In this article, I will look at the best ways how to identify trends and how to trade the inside bar pattern profitably.

How To Identify Trends

Inside bar pattern trading is only productive if you understand the overall trend. For example, you should trade a bullish inside bar only if they happen in an active uptrend, and only trade bearish inside bar if the pattern forms within an active downtrend.

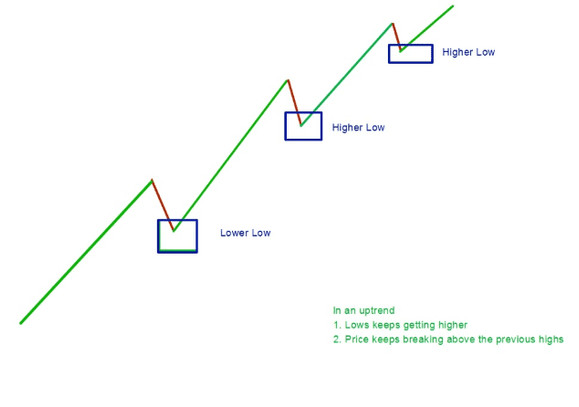

Identifying Uptrends

If the price keeps breaking above the highs of the previous candles, the lows of the previous candles keep getting higher, that is a sign that we are continuing to the upper side (see below). If a bullish inside bar happens within such moves, then it is a valid Inside Bar buy signal.

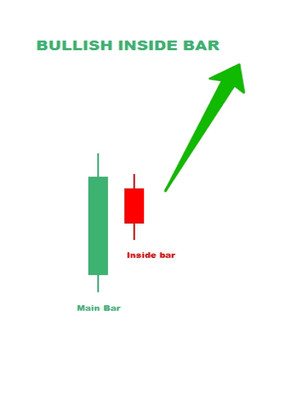

Bullish Inside Bar

If the “inside candle” is relatively small compared to the previous candle, and it’s high and low is inside the range of the previous candle’s high and low, then this is a bullish inside candle. The color of the inside candle must be different from the main bar.

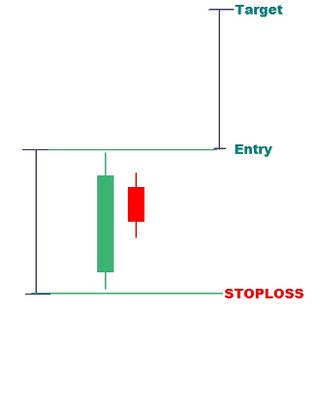

How To Trade The Bullish Inside Bar

Entering trades using this set up is very easy. Wait for the inside candle to close, and then if the next candle attempts to break above the high of the main bar, pick a buy position. Place your stop loss below the low of the Main Bar, and your take profit should be the entry price + the range of the Main Bar (Main bar High-Main Bar low).

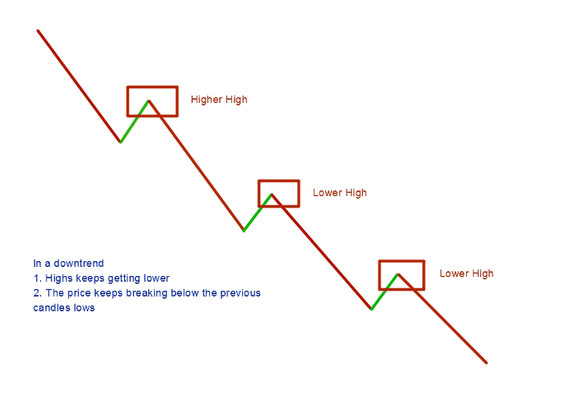

Identifying A Downtrend

In downtrends, watch for the lows of the previous candles being broken. Also, if the highs, as shown below, keeps getting lower, this is a good sign that we are continuing to the lower side, therefore if a bearish inside bar shows up, we pick a sell position as indicated below.

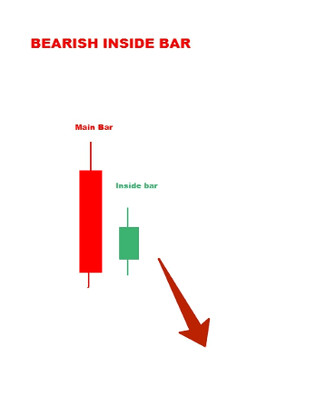

Bearish Inside Bar

If the “inside candle” is relatively small compared to the previous candle, and it’s high and low are pretty much inside the range of the previous candle’s high and low, then this is a Bearish inside candle. The color of the inside candle must be different from the main bar.

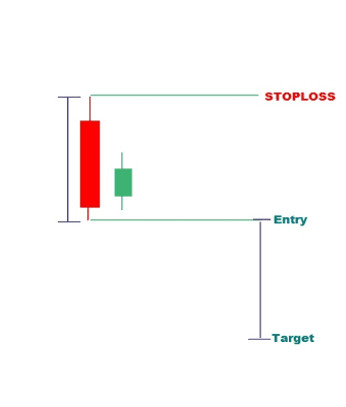

How To Trade The Bearish Inside Bar

Entering trades using this set up is very easy, wait for the inside candle to close, and then if the next candle attempts to break below the low of the main bar, pick a sell position. Place your stop loss above the high of the Main Bar, and your take profit should entry price - the range of the Main Bar (Main bar High-Main Bar low).

Key Points To Take Note Of

For a bullish inside bar, the Inside candle should be red (bearish), while the main bar should be green. And for a bearish inside bar, the Inside candle should be green (bullish) while the main bar should be red.

Just as with other strategies, you need to stick to a robust risk management strategy, have your lot size determined by the number of pips you need to place your stop-loss, and the percent of your account you can afford to risk, not the other way.