USD Weekly Fundamental Outlook: Fed Signals More Hawkish Rate Hike Path, Dollar Correction Looks Overdone

The USD’s consolidation continued, despite the more hawkish than expected Fed message last Wednesday. The dollar closed the week lower, driven by various counter-factors such as optimism on the war in Ukraine and general risk-on sentiment with a rebound in equity markets.

However, as we’ve said here previously, even if a peace deal is reached today, the sanctions on Russia will (most likely) remain in place for a long time. The economic sanctions will continue to exert negative pressures on economies most closely linked to Russia, such as European countries, via higher commodity prices. This factor can keep the USD broadly supported in the coming weeks and months, especially versus the most impacted European currencies.

Then, there is the possibility of a disappointment of recent hopes for a peace deal. The latest news from the ground in Ukraine do not suggest any lessening of hostilities, and both the Russian and Ukrainian sides haven’t signaled readiness to abandon some of their hard lines in the negotiations (a prerequisite for a peace deal). So, have the markets gone too far pricing in Ukraine peace deal hopes? It certainly looks like so, and if a peace deal does not become a reality by Friday, we could already see last week’s moves reversed.

The Fed was much more hawkish than many anticipated, signaling more rate hikes ahead this year than economists expected. Chairman Powell also said QT (quantitative tightening) could begin as soon as the next meeting (May 4). Further, he confirmed that a more potent 50bp rate hike was discussed and definitely on the table for future meetings. Despite the lackluster initial USD reaction, all this Fed hawkishness combined with the negative economic outlook for Europe and other countries points to more dollar strength in the weeks ahead.

The US calendar is not particularly busy this week, but there are a number of FOMC speakers, including Chairman Powell. Traders will focus on their comments around inflation, rate hikes, and quantitative tightening. Renewed hawkish discussions of 50bp rate hikes could potentially be another catalyst (in addition to the others above) for fresh USD gains this week.

EUR Weekly Fundamental Outlook: Euro Recovers on Ukraine Hopes, but Rally Unlikely to Be Sustained

The euro was one of the primary beneficiaries of the risk-on sentiment and optimism for a peace deal in Ukraine. But there is little to suggest the EUR’s gains (especially in EURUSD) are sustainable. With the war in Ukraine and the economic sanctions on Russia, the outlook for the Eurozone economy is much grimmer than before. This crisis will definitely harm Eurozone GDP growth to a much greater degree than in other countries that are not as close to the war zone. Lower growth also means that the ECB (despite them trying to sound hawkish) cannot be as hawkish as other central banks whose economies are less impacted. Such central bank policy divergence in principle should lead to a weaker currency (EUR in this case).

The negative impact from the war was already captured in the ZEW economic sentiment index last Tuesday, which plunged to -38.7 compared to a consensus forecast of a positive 10.3. This week, investors will look for similar evidence in the latest preliminary (flash) services and manufacturing PMI surveys (Thur) and the German Ifo business climate index (Fri), which are similar leading measures of economic health in the euro area.

On balance, investors’ focus is likely to return to the negative growth outlook for Europe sooner or later, thus making the current EUR resilience look vulnerable to a reversal. Eventually, these dynamics should lead to a resumption of the EUR downward.

EURUSD Technical Analysis:

EURUSD climbed north of 1.10 again last Wednesday and has held above it. However, it couldn’t push through the important 1.1150 technical resistance. In fact, upon testing it, the bullish attempt was rejected. While another test is certainly possible, the rejection on Friday shows that there is decent selling interest at levels above 1.11. Above 1.1150, the next resistance higher remains at 1.13. However, such a scenario would seriously threaten the current bearish trend.

The 1.10 level remains an important line in the sand. Notably, the rising retracement trendline seems to come near it also (see chart). This could mean that a break below 1.10 is the trigger signal for the next bearish leg in EURUSD. In addition, the pair is also trading below a falling resistance trendline that last week stood near that same 1.1150 zone.

A break below 1.10 should signal that a revisit of the 1.08 area is becoming likely. Below it, the next round number levels of 1.07, 1.06, and 1.05 will be in focus as support zones. 1.05 is the most prominent one, which is also a critical technical support zone on weekly and monthly charts.

GBP Weekly Fundamental Outlook: BOE’s Less Hawkish Hike Disappoints Pound Bulls

Despite raising rates by 25bp, the Bank of England disappointed the most hawkish of market expectations. This sent the pound on a quick and deep plunge, although some of the decline recovered on Friday. Perhaps the surprise was even bigger because the jobs reports released just two days earlier (Mar 15) were all-round robust.

However, the BOE instead chose to focus on the risks to the economy going forward. The UK is also very exposed to the Russia-Ukraine conflict, and high energy costs will negatively impact UK growth. The bank’s decision highlighted the risks that we have also discussed here in the previous editions of our weekly Fx, that the economy is about to start slowing, and the Ukraine crisis has only made things worse. With the dovish rate hike and statement, the BOE has signaled that it doesn’t want to add more pain by tightening the economy further at this stage with more rate hikes. For the Fx market, this means that GBP is vulnerable to further losses, especially vs. the currently “strong” currencies like the USD, CAD, AUD.

Inflation is expected to hit 6% y/y when the CPI report is published this Wednesday. But the Bank of England (like most market participants and economists) expect inflation to start coming down without the need for aggressive tightening. This outlook allows them to slow down the pace of tightening, at least for the moment. The retail sales report (Fri) will also be in focus this week, while traders will also keep a close eye on the annual budget release and speech by the chancellor of the Exchequer Rishi Sunak (Wed).

News out of Ukraine and general risk sentiment will also affect the pound as in any other week. Thus, GBP is also at greater risk of a decline, should risk sentiment take a turn for the worse.

GBPUSD Technical Analysis:

GBPUSD bounced from the 1.30 level precisely to the pip and is trading above 1.32 already in the new trading week.

The focus is now turning to the 1.33 resistance zone, where potentially stronger bearish pressures are likely to emerge. The 55-day and 100-day moving averages stand near the 1.34 level, which would be the next resistance zone if GBPUSD goes that far.

The nearest support on the daily chart remains pinned at the prior lows and psychological zone of 1.30. If the bearish trend resumes here and GBPUSD turns down again, a break below 1.30 should clear the way for further downside action.

The next support zone lower is 1.2850, ahead of the much more significant 1.25 area on the weekly chart.

JPY Weekly Fundamental Outlook: BOJ Firmly Dovish; Yen Plunges to 6-Year Lows Against Dollar

The Bank of Japan didn’t budge about rising commodity prices or their impact on inflation, and signaled no intention of joining other central banks on a more hawkish policy direction. During the regular press conference, Governor Kuroda said he sees no reason for the BOJ to stop the easy monetary policy and that they welcome the weak JPY as a good development for the Japanese economy. That was all JPY bears wanted to hear to take the currency to a fresh cycle low. USDJPY reached a 6-year high (February 2016) and could soon attack levels north of 120.00.

The rebound in equity markets and the move higher in Treasury yields also helped to push the yen lower (JPY pairs higher). In essence, last week’s action seems to be another “perfect storm” moment for the JPY, which we had quite a few of in the past year. The dovish BOJ only added to the already existing bearish forces of risk appetite, rising bond yields, and more expensive commodities (negative for JPY because Japan imports almost all its essential commodities).

The same factors will remain in the driving seat this week too. Perhaps the primary risk to short yen positions (long JPY pairs) is a possible reversal in risk sentiment and equity markets or a move back down in bond yields. There are several places such a sentiment change may come from (Ukraine being one of them), so JPY traders need to remain vigilant, despite the strong bullish trends visible on the charts of JPY pairs.

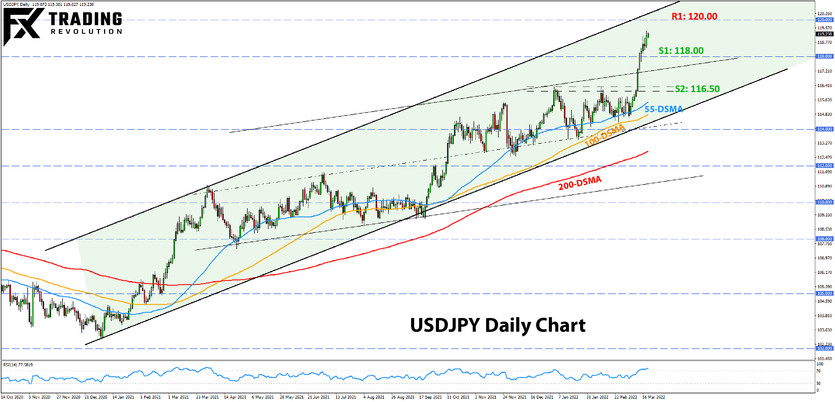

USDJPY Technical Analysis:

USDJPY climbed another 190 pips since last Monday and is now trading above 119.00. The long-term trend is bullish here, and the 120.00 zone is now within reach and likely the next destination for USDJPY. However, it’s also worth noting that this is a historically significant area for USDJPY, so some selling pressures may emerge here, and a stronger price reaction is a clear possibility.

Above 120.00, traders will watch the rising channel’s upper trendline for resistance levels. Round number levels like 121.00 and 122.00 could also come into focus as pivotal junctures on the charts.

To the downside, 116.50 should now act as the main support, with perhaps 118.00 being a modest support zone. The 114.00 area should be the next support lower.