USD Weekly Fundamental Outlook: Weaker Economic Data Prompts Dollar Correction From Stretched Levels

The dollar corrected lower over the past week as overbought conditions combined with the economic data falling short of forecasts were enough to trigger a sentiment shift. The Empire State and Philly Fed manufacturing indexes were particularly ugly, while housing data and unemployment claims were also weaker. Taken together, those triggered a decline in US Treasury yields and the dollar.

With near-term sentiment now in a “corrective” mood, it looks likely that this US dollar retracement can extend a bit further. Sideways consolidation also looks like a probable scenario. That being the case, the long-term dynamics haven’t been altered, and the predominant bullish trend should remain intact. Fed communication is still firmly hawkish, and quantitative tightening (QT) and 50bp rate hikes will happen in the coming months. In contrast, other central banks fall significantly behind the Fed in terms of tightening policy. This divergence between the central banks should continue to support the USD and eventually extend the existing uptrend.

The Fed minutes (Wed) and PCE inflation (Fri) are in focus this week on the economic calendar. There are also numerous Fed speakers scheduled throughout the week. The durable goods report (Wed) and the preliminary GDP (Thur) will ALSO grab traders’ attention.

The FOMC minutes from the last Fed meeting will be scrutinized for the degree of tightening they are considering (whether more or less hawkish than currently seen by traders). It is perhaps the event that could cause the biggest market reaction. Still, that will depend on whether the report will reveal some surprises (which could jolt USD pairs swiftly) or confirm the Fed’s current stance (which would see a muted market reaction).

EUR Weekly Fundamental Outlook: ECB Hawks Touting the Idea of 50bp Hikes Helps Euro Recover

The euro recovered some lost ground last week, helped by the USD correction and some more hawkish comments from ECB officials. There was also no big negative news regarding the Russia-Ukraine war and European gas prices fell a little more, helping to stabilize the overly pessimistic EUR sentiment.

Comments from ECB’s Klaas Knot (hawk) that 50bp hikes could be on the table for the July meeting gained much attention in the news and helped to lift the EURUSD from levels below 1.05. There are also signs that ECB members are increasingly getting uncomfortable with the weakness of the currency, although so far, their concerns remain light (no mentions of intervention or other ECB actions). Still, this could be enough to get some bearish traders worried that EURUSD below 1.00 could inspire more ECB hawkishness and potentially a sharp rebound.

However, with all that being said, the overall weak EUR fundamentals remain in place. Unfortunately, the Ukraine war and the energy crisis in Europe are unlikely to end any time soon. Significant progress will be needed in those (and the Euro area economic prospects) before the EUR currency can stage a sustainable recovery. Thus, last and this week’s EUR rally is likely of corrective nature, potentially occurring before an eventual resumption of the trend down.

On the calendar, traders will watch the flash (preliminary) manufacturing and services PMIs tomorrow (Tue). These are still holding up relatively well given the negative environment of the Ukraine war, but potential disappointments here could arrest the EUR rally as soon as this week.

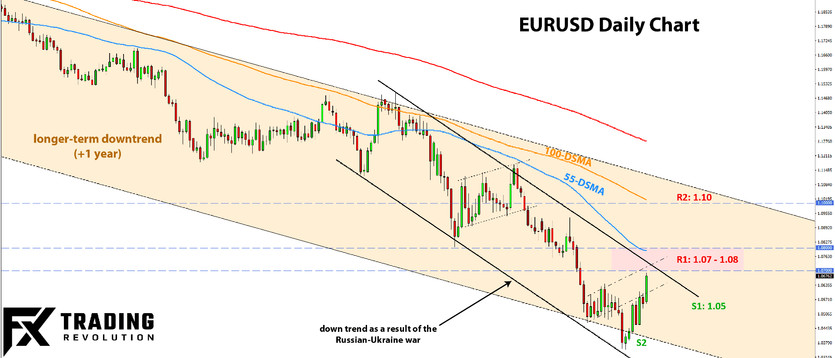

EURUSD Technical Analysis:

The EURUSD retracement has started, and the pair is already closing in on the 1.07 zone, which we’ve previously highlighted as the first key resistance to the upside. This 1.07 - 1.08 zone is a resistance that should keep the overall downtrend intact. A break above would give the first signs that the overall bearish trend is coming under threat.

Above 1.07 – 1.08, the next and final key resistance for the bearish trend is located at the 1.10 area. However, that is a more distant scenario, and for this week, it’s more likely that EURUSD will be held back below 1.08.

Support to the downside is now at 1.05, with the next one located at the 1.0350 lows.

GBP Weekly Fundamental Outlook: UK Economic Data Beats Forecasts

While many had gloomy expectations about the UK economy, last week’s reports surprised consistently on the positive side. The employment reports showed the labour market remains strong, with wage growth also stronger. Friday’s retail sales also beat expectations. Taking it all together, the data gives no reason for the Bank of England to be worried more than it currently is.

The pound seems to like this news and has staged a solid recovery over the past week. GBPUSD is already testing levels above 1.26 today. Given the extended short GBP positioning (has been acquired over recent weeks) and light UK calendar this week, there is potential for this GBP retracement to continue.

The calendar schedule features some 2nd tier reports and speeches from BOE officials, including Governor Bailey. BOE communication will remain important in these uncertain times of negative risks to economic growth and upside risks to inflation.

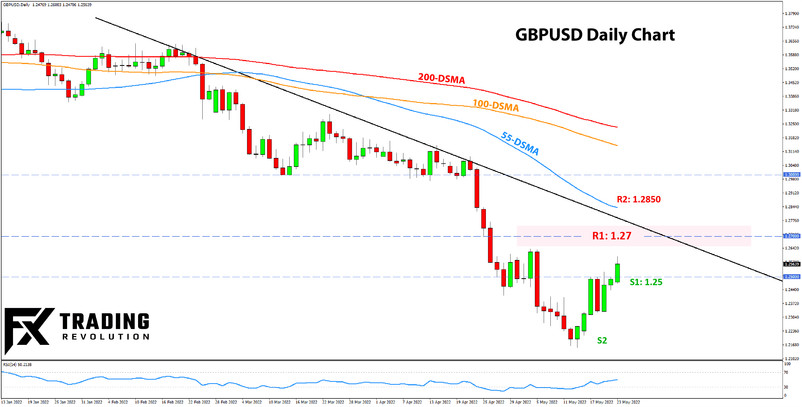

GBPUSD Technical Analysis:

GBPUSD started a solid retracement in the past week, which is extending in today’s session. The pair is already trading above the 1.25 handle.

The 1.2620 high comes into focus as the first resistance higher. However, the more important and critical resistance is at the 1.27 zone. This is a confluence resistance from several Fibonacci ratios and the falling downtrend line. Thus, a break through it is unlikely to come easily.

However, if GBPUSD moves above 1.27, it will open potential for an even larger move higher. The 1.2850 zone is the next resistance.

To the downside, the 1.25 level should remain an important line in the sand and proxy for short-term sentiment (bullish above it and bearish below it).

JPY Weekly Fundamental Outlook: Decline in US Treasury Yields Helps Yen Consolidation

The yen remained largely neutral over the past week, strengthening versus the retracing US dollar and moving modestly down versus other currencies. The Japanese yen remains in a broader consolidation, with the chances increasing for the corrective moves to extend.

US Treasury yields are off the highs and, coupled with risk aversion in equity markets, create a less damaging environment for the beaten-down Japanese yen. Commodities are also off the highs, perhaps further helping to keep the JPY away from 20-year lows versus the USD.

The key question for JPY traders remains whether US Treasury yields have topped here? As we’ve seen over the past week, even a short-term decline in yields can trigger a correction in USDJPY. If the move down here extends, then USDJPY will likely follow suit (and other JPY pairs too).

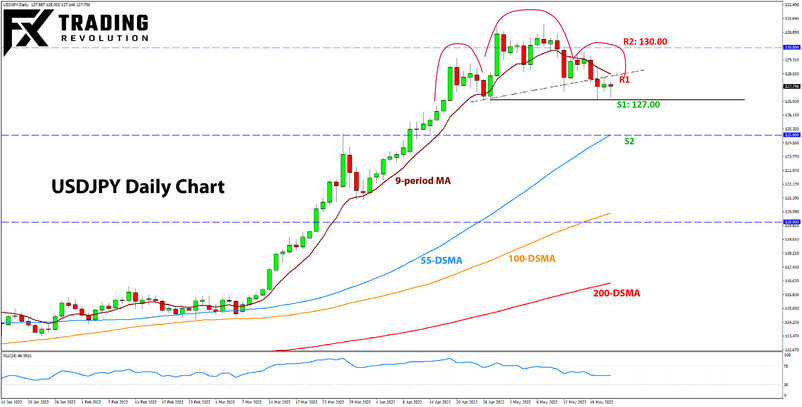

USDJPY Technical Analysis:

USDJPY continues to consolidate, but the bias is turning increasingly bearish as the pair stays near the lows, around 127.50. It managed to break below them briefly and even almost touched 127.00 last week but has since bounced slightly. Thus, the overall situation suggests that this whole 127.00 - 127.50 zone is support.

There is potential for a bearish head and shoulders pattern to emerge, which would be fully confirmed as completed with a break below the 127.00 level. In such a scenario, greater downside potential should be opened up.

The 125.00 zone is the first big support, followed by the 124.00 and 123.00 round number zones.

To the upside, traders will keep watching local intraday highs around 128.00 (on short-term timeframes) for a break that can inspire some bullish sentiment. The 130.00 area, of course, remains a key resistance.