Unraveling the Essence of Treasury Inflation-Protected Securities (TIPS)

Designed as a bulwark against the voracious monster of inflation, Treasury Inflation-Protected Securities, more commonly referred to as TIPS, represent a unique class of Treasury bonds. Unlike their more conventional siblings, they operate on a different set of principles, thereby introducing a tantalizing element to an investor's portfolio. Especially for those striving to maintain their purchasing power in the turbulent sea of the economy, TIPS offer a beacon of hope.

However, it is prudent to note that every investment vehicle carries its unique set of risks, and TIPS are no exception. Despite their illustrious patronage by the U.S. government, they come bundled with their inherent perils. These perils are often magnified when one ventures into the complex world of mutual funds or Exchange-Traded Funds (ETFs). This guide seeks to illuminate the intricacies of TIPS and provide a roadmap through the opportunities and challenges of investing in them.

Decoding Treasury Inflation-Protected Securities (TIPS)

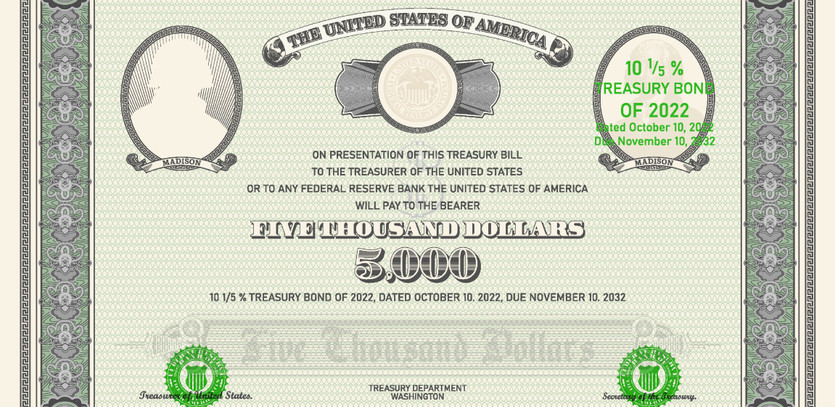

At their core, TIPS function as a financial buffer, preserving an investor's long-term purchasing power against the relentless onslaught of inflation. These are bonds issued under the authority of the U.S. Treasury that carry a fixed interest rate. However, the intrigue lies in the principal – it doesn't stay constant. Instead, it adjusts based on the fluctuations of the Consumer Price Index (CPI), an official measure of inflation. As the principal oscillates, so does the amount of interest payment, adding a dynamic layer to this investment option.

Diving Deep into the Risks Associated with Individual TIPS Investments

While the calm sea surface of TIPS might seem appealing due to their relative market stability and low inflation risk, there are potential dangers lurking underneath. Like the more conventional bonds, their prices are subject to the whims of the market and can vary over time. Therefore, it becomes incumbent upon investors to fully comprehend the advantages and risks they carry.

There's a silver lining here: TIPS are backed by the U.S. government, offering a sense of security to investors, almost making them immune to credit risk. They can count on the government's commitment to fulfill all its financial obligations related to interest and principal payments.

However, a word of caution is in order here. The price of TIPS can dance to the tunes of market dynamics between their issuance and the maturity period. But for an investor who holds onto them till maturity, these fluctuations are of little consequence. On the other hand, an investor who decides to offload them before maturity may not receive the bond’s par value, thereby introducing a layer of financial risk.

One of the attractive features of TIPS, the inflation protection, may fall short under certain circumstances. For instance, if the official CPI fails to accurately track real-world inflation or doesn't account for the increasing costs of goods and services essential to the investor, the inflation protection aspect might prove inadequate.

Another risk comes into play during a rare deflationary scenario. When prices fall, investors might deem TIPS unnecessary and might resort to selling them off, leading to a potential decrease in their market prices.

Exploring the Risks of TIPS Mutual Funds and ETFs

While TIPS function as expected for investors who buy individual bonds and hold them to maturity, those who choose to invest in TIPS via mutual funds or ETFs might find themselves sailing in different waters.

Funds do offer a degree of inflation protection as the principal value of the bonds held by the funds adjusts upward with inflation. However, unlike individual bonds, funds do not have a maturity date. Consequently, there's no guarantee of seeing a full return of principal. The fact that TIPS are highly sensitive to interest rate movements means that the value of a TIPS mutual fund or ETF can swing widely in a short time span.

To illustrate this point, let's revisit an episode from the recent past. Between November and December 2010, bond yields experienced a sharp uptick. This caused the largest TIPS ETF, iShares Barclays TIPS Bond Fund, to suffer a negative return of 3.8% in that short period.

Key Factors Shaping TIPS

To navigate the investment terrain of TIPS confidently, investors need a keen understanding of the factors that mold TIPS' price and yield. There are two main pillars that hold the edifice of TIPS:

-

Interest rate changes: TIPS prices respond to the ebb and flow of interest rates, a trait they share with other bonds. However, TIPS react to what we call "real" interest rate alterations – essentially the difference between current interest rates and inflation rates.

-

Inflation expectations: How investors foresee future inflation often serves as the primary catalyst for demand for TIPS. The spread between conventional U.S. Treasury bonds and TIPS can largely be attributed to the expected inflation rate.

TIPS in Your Investment Portfolio: The Final Word

As a distinctive type of fixed-income investment, TIPS funds can enhance a diversified portfolio by offering the promise of positive inflation-adjusted returns for long-term investors. However, they don't operate in the same manner as mutual funds that put their stakes in corporate bonds.

TIPS are not surefire investments. Despite being indexed to inflation, their value may not necessarily swell during inflationary periods. They are more attuned to the ebb and flow of investors' inflation expectations rather than the actual inflationary tide.

It's critical to note that TIPS are not a one-stop solution to broad bond diversification, despite their inherent advantages. For a robust and diversified bond portfolio, investors should consider sprinkling other types of bond funds as well.

-

Are TIPS taxable? Yes, any interest and gains accrued on TIPS are subject to federal income taxes. However, they enjoy exemption from state and local income taxes.

-

When should one consider investing in TIPS? TIPS can be a savvy investment choice when inflation is surging, as they adjust payments in tandem with rising interest rates, unlike other bonds. This strategy is typically suited for short-term investing. However, other investments like stocks might offer superior long-term returns.

-

How can I buy TIPS? Investors can procure TIPS directly from the U.S. Treasury via an account at TreasuryDirect. Alternatively, one can explore the secondary market and acquire TIPS through a bank or broker.