Are you ready?

You will find only unbiased and true information here - our team is not an Introducing Broker or Affiliate partner of any brokerage companies.

Our website was founded in order to provide other traders with relevant and fair information about FOREX trading.

Forex brokers pray that you don’t read this page further…

The choice of the right broker is a far more complex issue than it may seem at first glance. Most traders are clued about the online trading from brokers’ advertising campaigns (especially sales phone calls) or from their partners (so-called Introducing Brokers). But are you sure that you’re trading with the right broker and that the broker does fair business with you?

Why is the choice of the broker so important, and how can brokers differ?

Why is the choice of the broker so important, and how can brokers differ?

The choice of a broker is actually extremely important. All brokers and distorted forex sources will teach you that successful trading consists of trading system, money management and psychology. This is true, but in fact one more piece of important information is missing - your results also strongly influence the broker with whom you are trading.

Brokers differ from each other, in fact very much so! But how?

Huge Differences in Qualities of Forex Brokers

Among forex brokers you can find a difference in fees (spreads or commissions), hidden fees (especially slippage), quality and speed of technologies, and in the whole broker´s approach (for example, whether the broker is trying to push you to trading aggressively or whether they are more focused on the development of high-quality technologies and improving trading conditions).

Also the fact is that the vast majority of poor-quality forex retail brokers trade against their clients, mislead, and manipulate the price and the execution of orders. Their only point of interest is the loss of their clients, which creates a profit for the broker. Such brokers usually hunt Stop-Losses, have slow or even freezing technologies, increase slippage, do re-quotes or just delay execution and fill orders at a worse price.

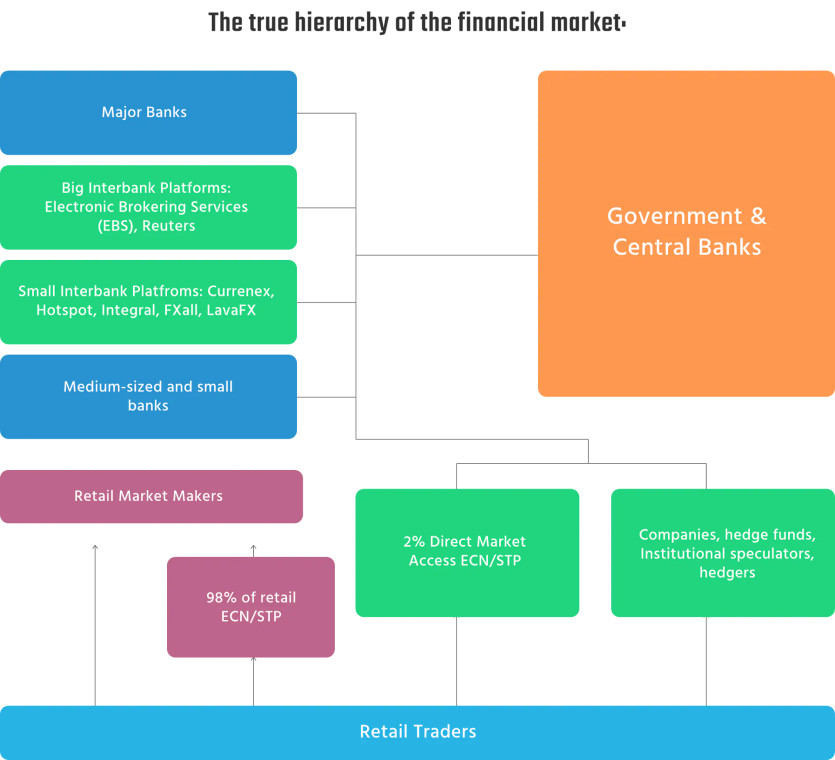

Counterparty of your Trades and Misinformation

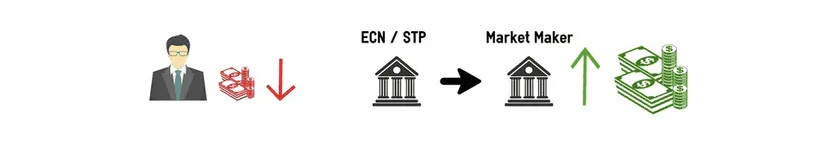

There is also a big difference in whether the broker themselves makes a counterparty to all of your trades (market maker, b-book broker), and in this case their main goal is your loss, from which the broker profits. Or, on the other hand, if the broker sends your orders to the true interbank market, where counterparty to your trades are banks, funds and other liquidity providers.

Lots of traders recognized the need for choosing the right forex broker for successful FX trading and are seeking STP / ECN (a-book) brokers. Almost every broker is offering STP / ECN accounts, but all trades usually end on the account of only one market-making company, which is owned by the broker. This means that such a broker meets STP / ECN standards, but the point of interest is still the client’s loss.

Scammers

Special category of forex brokers are scammers and cheaters. Traders who trade with unreliable brokers often have a problem with the withdrawals of their profits or even their whole deposits, while quality brokers usually process all transactions during a few business days. So, the differences between brokers are truly gigantic!

If you are a professional trader, you need a professional broker - not the usual FX broker who is not interested in your profits!

Ultimately, there are three types of brokers:

1) Retail market makers - dealing desk (b-book) brokers - these brokers do not hide the fact that they act like a counterparty to all your trades.

As you can see in the diagram above, your orders with the market makers never get to the true interbank market. The advantage for market makers is that they are not only profiting from spreads and commissions, but all your losses mean profit for the market-making broker.

It means that your profit is a potential loss for the market-making broker, and for this reason the efforts of fair market maker can hedge profitable clients' positions on the interbank market, but this rarely happens.

The fact is that Market Makers can hedge your orders at an interbank market. However they do not usually do it, as there main point of interest is their profit (= your loss).

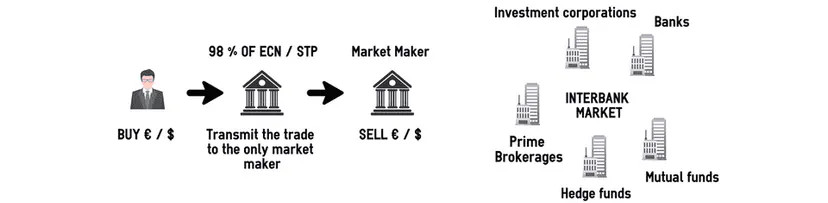

2) 98% of retail ECN / STP brokers. These ECN / STP brokers own or have a contract with only one market maker, which act like a counterparty to all your trades, and there is a high conflict of interest as in the first case.

The license for ECN / STP brokers says that these brokers cannot act like a direct market maker and that they must always send your transactions to another entity for an execution. These brokers can advertise that they are true ECN / STP brokers, and still profit from the losses of traders, so in fact they simply send client´s trades to the only one market maker.

You can usually identify these brokers if they offer ECN / STP accounts with offers like % bonuses on deposits, fixed spreads, high financial leverage, zero spreads and similar.

FX retail ECN /STP brokers usually transmit your trades to the only market maker, which is owned by the ECN /STP broker.

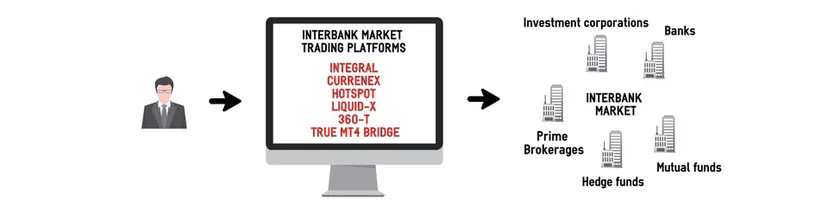

3) 2% Direct Market Access ECN / STP (a-book) brokers who actually send all your trades for execution to the interbank market without any conflict of interest.

Actually, only about 2% of the total number of all brokers in the world are fair, and only with these brokers can you, without conflicts of interests, be long-term profitable in forex trading. These brokers have more liquidity providers and do not perform any artificial interventions to the trading of traders.

They profit only from the spread / commission, so they try as much as possible to help traders and their main goal are long-term profitable traders.

Team FX trading revolution explicitly recommends trading through a brokerage which provides direct interbank market access

MetaTrader 4 has to be connected through a bridge to one of the interbank market trading platforms. In the case of 98% of the ECN / STP retail brokers, MT4 is connected through a bridge to the only one existing market maker!

EXPLORE THE FOREX TRUTH WHICH YOU ARE NOT SUPPOSED TO KNOW

Based on the facts above, there are huge differences between FX retail brokers. 98% of FX retail traders think that they lose because of their trading strategy, but most of the time they lose because of their broker. Most traders think that they pay only spread / commission. But forex trading includes one more cost that a lot of FX brokers use for their profits - it's called "execution costs" or "slippage".

Slippage is the difference between the expected price of a trade, and the price the trade actually executes at.

Also unfair brokers can widen spreads and do other dirty practices that cause more losses and less profits to you. You can read more about "Dirty Practices of Brokers that Cost You Profits" in the educational article here.

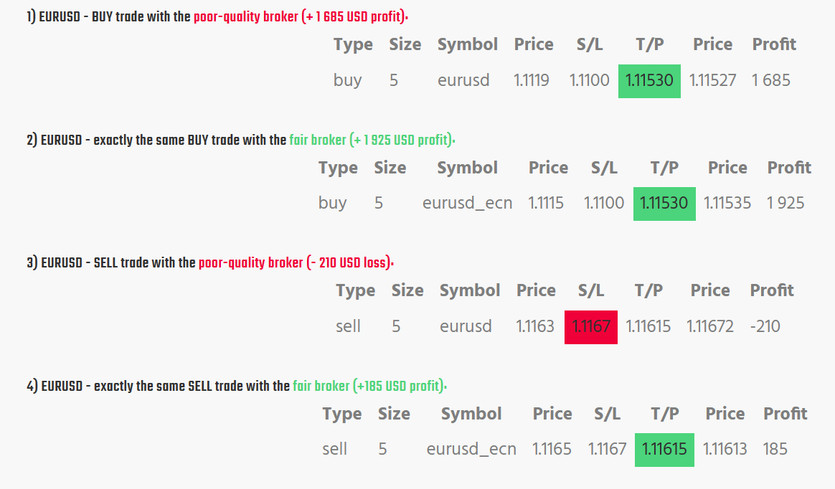

Enough theory - we have tested hundreds of FX retail brokers on real accounts from around the world. And now you can see a comparison of real results between low-quality and high-quality broker below. The same automated trading strategy, the same execution times - different trading conditions, different results!

Also note that with higher orders volume or after hundreds of executed trades, the differences will be much higher and keep growing!

As you can see, the differences in real accounts between brokers are huge!