A forex broker is a company that serves as a liaison for the execution of forex trading transactions of buyers and sellers in order to earn commission, once the deal is final. A forex broker generally provides supporting trading services to forex traders that include trading platform equipped with advanced charts and tools for the utilization of their customers or traders, wide range of trade able markets, leverage facilities etc.

A forex trader can buy or sell the currencies through the trading software / platform provided by a forex broker. In forex market buyers and sellers are residing in different locations – forex is OTC market, so it is hard to find each other without a mechanism that brings into line their trading interest. There is a need of a platform where buyers and sellers can interact with each other for the sake of trading and the forex broker provides that platform.

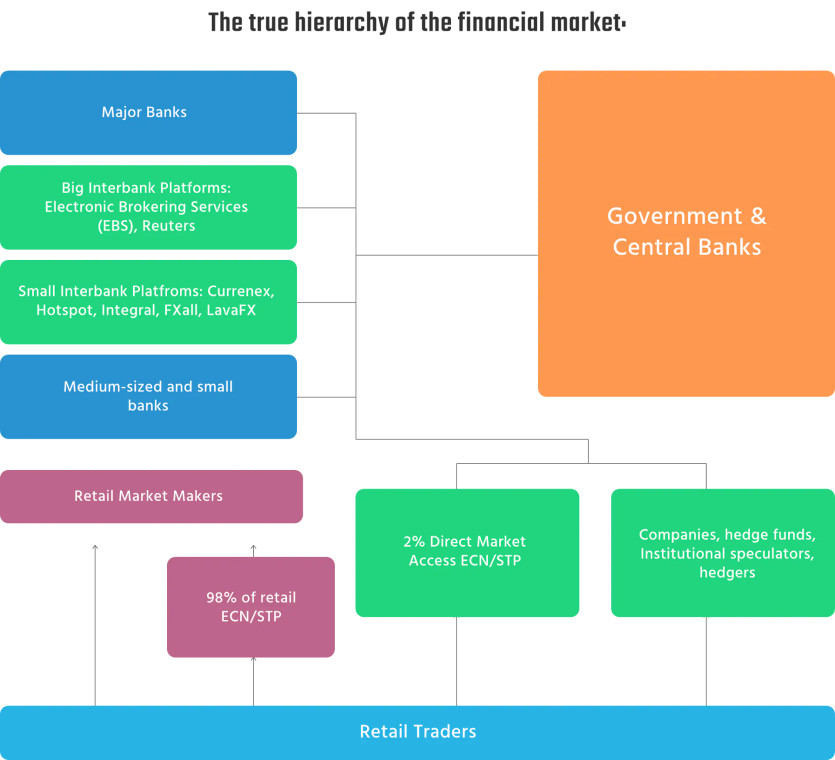

Forex brokers are broadly categorized as Dealing Desk (DD) and No Dealing Desk (NDD) Brokers. Dealing Desk brokers are also known as Market Makers (MM) while No Dealing Desk are further categorized as Straight through Processing - STP brokers and Electronic Communication Network - ECN brokers.

Dealing Desk (Market Maker) Brokers

The dealing desk broker acts as a liquidity provider and settle the customer orders from its inventory (b-book). That’s why direct dealing broker is also know as Market Maker - the broker serves the purpose of the market for a trading customer. The direct dealing broker fills the trading orders either by matching with the other customer orders or by meeting them from the on-hand inventory. So the dealing desk broker is the counter party in every trade.

The Market Maker brokers offer bid and ask prices or quotes by adding the spread in the form of extra pips to the interbank quotes. The dealing desk brokers make money by taking the advantage of spread and usually offer fixed spread. The stiff competition between the brokers makes their quotes very identical with the inter-bank quotes, just having some little difference.

The fact that market makers are a counter party to all your orders creates a space for dirty practices of market making brokers. The nature of the market maker's business model is clear – every time you open a BUY trade, the market maker opens a SELL trade against you. If your trade will be profitable, then the trade of the market maker broker will be loosing. Your orders with market makers will never get executed at the real interbank market. Fair market makers can further hedge your orders at true interbank market, but in fact - almost no usual retail market maker does this. Therefore, the main goal of dirty market makers is pretty clear – to do not allow traders to make any profits with them.

No Dealing Desk Brokers

No Dealing Desk (NDD) Brokers provide a direct approach to the interbank market where the currencies are traded. No dealing desk broker is not the counter party in any transaction while connecting the traders / liquidity providers (banks, financial institutions) for the sake of trading. No dealing Desk brokers are two types i.e. Straight through Processing, STP brokers and Electronic Communication Network, ECN brokers.

Straight through Processing - STP Brokers

The straight through processing broker directly forwards the trading order to number of liquidity providers (interbank market) that have different quote rates for the trading transaction. The broker’s platform sort out the best favorable rate for the trader from the available quotes in order to perform a trading transaction. The broker makes a profit by adding the markup in the spread.

Electronic Communication Network - ECN Brokers

The ECN brokers do not pass on the trading order of the traders directly to liquidity providers while ECN broker allows the traders to directly interrelate with other traders in the market by using the electronic communication network in order to obtain the best trading quotes (Bid and Ask Price).

However, interbank liquidity providers are always included in the ECN engine too as self-traders themselves would not create enough market liquidity. So the ECN brokers match the trade for their traders with other market traders or liquidity providers (like in the case of STP) and charge fix fee or commission on each transaction. The advantage of ECN forex accounts is lower spreads than in case of the STP trading accounts.

Hybrid Brokers

The brokers who directly pass on orders to the liquidity providers or to the real market are considered as A-booking (NDD Model) and when the trading orders of the customer are managed internally - this is known as B-booking (Dealing Desk – market making). The hybrid model is simply used as a tool in order to manage the risk of trading through traders’ classification. The hybrid model used to serve as hedging tool by placing certain traders in A-Book and placing the others on B-Book in order to minimize the risk and increasing the profit of brokers. The fact is that the vast majority of today's brokers are hybrids – they can promote their "fair ECN / STP" pricing, while still performing dirty practices at their b-books (Dealing Desks).

Our team therefore recommends you to choose a real and fair ECN / STP broker!