US Dollar 2021 Fundamental Analysis: Global Reflation & 0% Rates Likely to Keep USD Bear Trend Intact During 2021

2020 was all about the coronavirus pandemic and the ensuing economic recession. Fx markets and USD pairs experienced wild rides at the start of the crisis in March, ending an 18-month period of relative calm and low volatility.

The dollar appreciated sharply during the March liquidity crunch but then depreciated steadily after the Federal Reserve put out the fire by slashing rates and injecting massive amounts of “newly printed” dollars into financial markets. The Fed’s actions have essentially stripped the USD from one of its main advantages, i.e., higher interest rates than other developed nations. Considering that the dollar was already at fundamentally overvalued levels, the deprecation starting in April came as no surprise.

With the Fed set to keep rates at 0% for longer while continuing to engage in large QE purchases, the USD bear trend seems to be firmly in place. The global reflation narrative, as the world recovers from the COVID-19 recession, should also keep growth prospects in favor of riskier currencies and against the US dollar. Furthermore, the result from the Presidential Election put another nail in the coffin for the greenback as democrat Joe Biden emerged victorious. This means that the two main pillars that kept the USD strong in 2018 and 2019 – i.e., trade wars and tax cuts - will most likely be taken away under the Biden administration. Without them, the path of least resistance for the dollar is lower.

Expect the coronavirus pandemic to continue dominating news headlines and to drive markets for the first half of 2021 as vaccines are rolled out in greater numbers. Then from the H2, if everything goes as expected with vaccinations, we will likely see a return to more normal market drivers, and we may even slowly start to forget COVID-19. Under this positive scenario, there will be little that can stop the dollar from depreciating further.

Euro 2021 Fundamental Analysis: Next Generation EU Drives EUR Higher

The highlight of 2020 for the euro currency has to be EU countries coming together to deliver a unified response to the COVID-19 crisis. EU politics reached another important historic milestone in 2020 in the agreement to issue common debt as part of the COVID-19 recovery package. The markets viewed this as the EU standing up the challenges of the crisis, and consequently rewarded the EUR currency by bidding it up.

Another factor that helped the EUR in 2020 was the adjustment from undervalued territory. This was particularly evident vs the dollar in the EURUSD exchange rate. Now that the EUR is closer to what most fundamental valuation models determine as “fair value,” the pace of appreciation can be expected to slow. Another argument in favor of this is that the ECB strongly dislikes fast appreciation of the euro, and it may not be long before they try to talk it down again like board member Lane did in September. Word on the street is that 1.25 in EURUSD may be the new pain threshold for the ECB; however, it’s important to remember that as long as the EUR’s appreciation is not quick and abrupt, the ECB will likely be willing to tolerate it.

The global reflation theme during the recovery from the recession is also a supportive factor for EUR vs safe-haven currencies, albeit not against risky currencies such as AUD, NZD, CAD, and emerging market currencies. With that said, the story for 2021 seems clear – weaker USD, stronger EUR, but even stronger emerging market currencies.

EURUSD 2021 Technical Analysis:

EURUSD finally broke the major resistance trendline in summer 2020, marking the end of a 12-year downward channel. The next key technical resistance higher is the 1.25 zone. It is a confluence technical zone between the three major lows of 2008, 2010, and 2012, and the 2018 high. The question is, will 2021 prove to be a year when EURUSD records just another high in this zone, or does it finally breakthrough?

The bullish momentum is now strong, but so is the resistance in the 1.25 area. While a breakout is possible, it’s unlikely that it will come as a smooth ride without setbacks. Some reaction at this resistance is highly probable. Note that the resistance can stretch as high as 1.27 before any meaningful downside reaction occurs.

Looking at the other direction, the obvious first key support zone lower is the 1.20 area. But the broken 12-year resistance trendline won’t be tested until the 1.15 level. This means if EURUSD goes for a retest of the broken resistance – now turned into support – then the price may trade down to 1.15. What happens there will be crucially important for the newly established bull trend. The 1.15 support will need to hold for this trend to remain intact.

EURUSD Monthly Chart – Finally breaks out of that 12-year channel formation

British Pound 2021 Fundamental Analysis: The “Modest” Brexit Deal Is a Positive but GBP’s Structural Issues Aren’t Going Away

After 4.5 laborious years of negotiations, Brexit is finally over. The EU and the UK reached a trade deal and Great Britain left the EU on January 1 this year.

The details of the deal reveal that the two sides agreed on just enough to avoid a “hard’ no deal Brexit, but not much beyond it. Long-term, this is likely to limit the growth prospects for the UK economy. Furthermore, structural issues like the UK’s large current account deficit should continue to be headwinds for the currency over the longer-term horizon.

However, for 2021, investors are relieved that the feared no deal Brexit had been removed. This should be enough to attract more flows into GBP and support the currency in the coming months. But the rally is likely to be limited because of said structural issues, especially against well-positioned currencies for 2021, such as the euro.

The UK was also the first country to roll out the COVID-19 vaccines, so that may provide some additional advantage in the near-term as the UK economy may be the first one to fully reopen. Overall, the near-term prospects look good for the pound sterling, but less so is the longer-term outlook.

GBPUSD 2021 Technical Analysis:

After finishing another wild trading year, GBPUSD is now moving closer to the major 1.40 – 1.42 resistance area. The pair traded as low as 1.14 during the March USD liquidity crisis, but the 1.20 major support area held in the end. GBPUSD has been recovering steadily since then and recently broke above the important 1.35 resistance zone. With no additional big resistance in the way, the 1.40 - 1.42 area is within reach now.

There, however, GBPUSD ought to meet strong resistance. The monthly chart below shows how important this resistance is. It is a confluence of three major lows and one major high for the pair, stretching over a period of 30 years. That’s a major resistance area, and it won’t be cracked easily.

To the downside, 1.35 is the nearest established technical zone that should act as moderate support. The 1.30 level is in the middle of this 1.20 – 1.40 band, and may act as an equilibrium price again if GBPUSD fails to sustain higher levels. The 1.20 area, of course, remains the major support in this technical picture.

GBPUSD Monthly Chart – En route to 1.40 where strong resistance awaits

Japanese Yen 2021 Fundamental Analysis: Not Many Factors to Support Safe-Haven JPY in a Risk-On Narrative

The safe-haven JPY also experienced wild price swings during the March disruptions across financial markets. Eventually, markets stabilized and JPY, together with other safe-haven currencies, started to depreciate as investors shifted their focus on the post-COVID economic recovery instead of the raging crisis.

While moving gradually lower, USDJPY has remained relatively confined throughout 2020 without a clear sense of direction (although it ended the year around 500 pips lower from the open). What happens from here onward in USDJPY will depend on US yields and the performance of the US economy compared to the rest of the world, as well as policy actions in Japan.

Rumors are that Japanese officials won’t like to see USDJPY breach the 100.00 level, and this level may prove to be an important line in the sand if BOJ officials confirm this via words or actions. Japan has a new Prime Minister in the name of Yoshihide Suga, but he is expected to keep on the same path as his predecessor Shinzo Abe. That means expansionist BOJ policy and keeping the yen weak. That, in combination with the broad reflation, risk-on theme in markets, should continue to keep JPY on the soft side versus risky currencies.

USDJPY 2021 Technical Analysis:

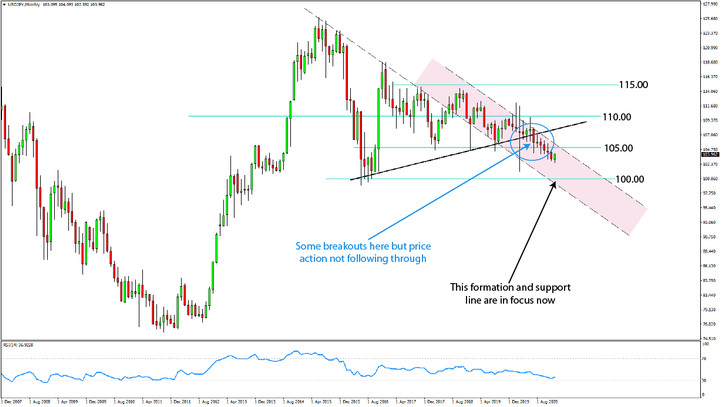

The USDJPY pair remains as stuck at the start of 2021 as in the previous four years. There is no sign on the horizon that USDJPY can break this loosely but well-defined range between 100.00 and 115.00.

Other than the unusual fact that USDJPY is now trading below the 105.00 level, little has changed on this monthly chart over the past 12 months. 105.00 held as support during 2018 and 2019, with the price finally slipping below it in 2020. Still, it is a rather unconvincing break below the pivotal support. As can be observed from the price action (see monthly chart below), the move is slow and gradual, looking more like a part of a consolidation than a trend. Furthermore, we can see that the price is yet to break the range that was set by the March 1000 pips high-wave candle. In a sense, USDJPY is still technically consolidating from the wild gyrations in March.

The nearest key resistance is the 105.00 zone, while the closest key support is at the 100.00 zone. A bullish break above 105.00 will clear the road for a move to the 110.00 resistance. On the other hand, a break below 100.00 has the potential to open up significant downside room for USDJPY.

USDJPY Monthly Chart – Not getting exciting; Rangebound is still the name of the game here