The dollar has continued to decline since the beginning of today's trading day. At the start of today's European session, DXY dollar index futures are traded near 90.18, 76 points below the local intra-week high reached on Monday.

Growth in US government bond yields also stalled.

Investors continue to assess the plans of the new White House administration to stimulate the American economy in the amount of $ 1.9 trillion. Market participants also suggest that in the near future, the White House may announce new additional measures. American stock markets took a positive view of the change in the country's leadership and rose to new record levels.

Meanwhile, the focus of the market participants today is the ECB meeting. Its decision on rates will be published at 12:45 (GMT).

Brexit has finally taken place. But now trade conflicts, factors of political instability in Europe, as well as the growing coronavirus pandemic, due to which European countries are forced to introduce new quarantine restrictions that negatively affect economic activity, are the main threats to the European economy.

According to the IFO Institute, an extension of the lockdown, which leads to a decrease in sales, production and added value, until mid-February, could cause a recession in Germany in the 1st quarter.

Nevertheless, participants in financial markets believe that following today's meeting of the ECB, the key interest rate will remain at the same level of 0%. The ECB's rate on deposits for commercial banks is also likely to remain at -0.5%.

Investors also believe that the ECB leadership is unlikely to express excessive concerns about the strengthening of the single European currency, although some statements on this issue are still possible.

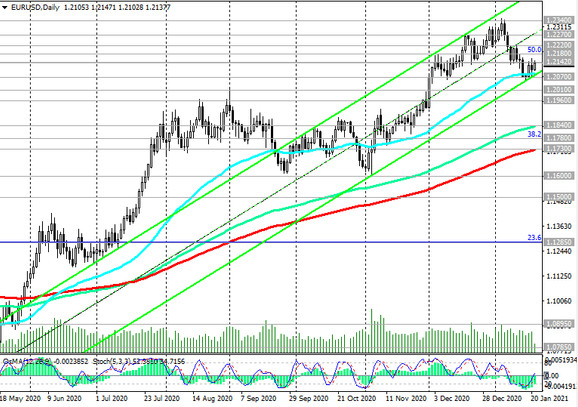

The trade-weighted euro rate is currently below its six-month average, when the ECB leadership first voiced concerns about the strengthening of currency last summer. The EUR / USD pair is likely to remain in the zone above the support level 1.2100.

German PPI released Wednesday, which rose 0.8% in December after rising 0.2% in the previous month (annualized manufacturing inflation accelerated 0.2% after falling 0.5% in November), and the core consumer price index in the Eurozone (in December it rose by 0.4% m / m and 0.2% y / y) also supported the euro.

At the same time, there is a possibility that at this meeting the ECB will announce a new program to stimulate the economy. This could put pressure on the euro.

But so far, many market participants expect the EUR / USD to grow, including amid a weakening dollar.

New packages of financial assistance from the US government, despite the fact that the Fed intends to stick to the current levels of its monetary policy for a long time, will increase the US government balance of payments deficit, pumping inflation and weakening the dollar.

Market participants will also pay attention today to the publication at 13:30 (GMT) of weekly data from the US labor market. The number of initial jobless claims in the US is expected to be 910,000 in the week of January 10-16, after jumping to 965,000 in the previous week. This is still a negative factor for the dollar. More negative data from the weekly report of the US Department of Labor will put additional pressure on the dollar, because indicate the need for new measures to stimulate the American economy and the labor market.

Also at 13:30 the ECB press conference will begin, and at 15:00 the European consumer confidence index, which reflects their confidence in the economic situation, will be published. A high result indicates economic growth and strengthens the euro, a low result weakens (forecast: in January this index fell to -15 from -13.9 in December).

Thus, in the period from 12:45 to 15:00 (GMT), an increase in volatility is expected in the euro and dollar quotes and, accordingly, in the EUR / USD pair.