During trading in the Asian session on Thursday, the US dollar maintained its gains on the back of positive macro statistics released on Wednesday. According to the Institute for Supply Management (ISM), the purchasing managers' index (PMI) for the service sector rose to 58.7 in January (against the revised December value of 57.7 and the forecast of 56.8).

Also released on Wednesday, the beating ADP report is also encouraging ahead of Friday's expected official employment data. This report points to an increase in the number of jobs in the private sector of the US economy by +174,000 in January (forecast was +49,000). Economists forecast that the number of weekly claims for unemployment benefits, the data on which will be published on Thursday (at 13:30 GMT) will also decline (to 830,000 from 847,000 a week earlier).

New positive economic data, pointing to continued improvements in the service sector and the US labor market, have added additional source of investor optimism after reports that Democrats appear willing to compromise with Republicans and adopt a support plan of 1.3 trillion dollars, not 1.9 trillion dollars, as promised by Joe Biden. Market participants began to take into account the faster and more significant economic growth.

The US Treasury sales continue, which gives the dollar a positive impetus. Thus, the yield on 10-year US government bonds on Wednesday rose to 1.129% from 1.105% on Tuesday, and on Thursday - to 1.151%. Growth in government bond yields is usually observed when investors expect an acceleration in economic growth and inflation, as well as an increase in government borrowing.

At the same time, the DXY dollar index rose on Thursday to the level of 91.45, which is 33 points above the opening price of today's trading day (near 91.12), and 229 points above the local almost 3-year minimum reached in early January near 89.16.

Today the focus of investors' attention is the meeting of the Bank of England. Its decision on rates will be published at 12:00 (GMT). The Bank of England's key interest rate is expected to remain unchanged at 0.10% and the target volume of asset purchases at £ 895 billion.

Bank of England executives are likely to consider that the balance of risks to economic growth is no longer tilted so much in the negative and they will more positively assess the prospects for the country's economy, economists say. A successful vaccination campaign has improved the country's economic outlook, and the pound could gain support if the Bank of England confirms its skepticism about negative rates.

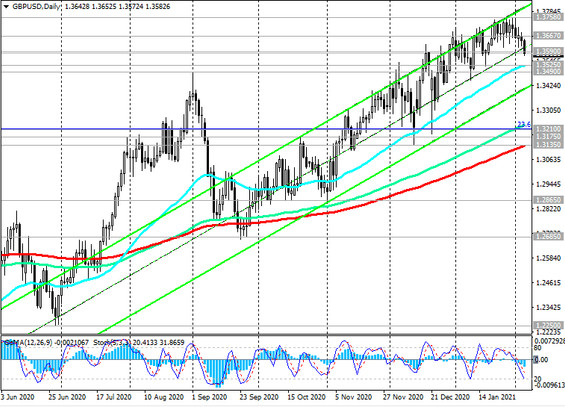

And yet, investors are cautious ahead of this event: the pound is getting cheaper, and the GBP/USD pair is declining in the first half of today's trading day. At the time of this article's publication, the GBP / USD pair was traded near 1.3585 mark, close to the important support level 1.3590, above which, in general, its long-term positive dynamics remains (see Technical Analysis and Trading Recommendations).

At 12:30, the Governor of the Bank of England Andrew Bailey will start speaking, during which he will explain the bank's decision on monetary policy. He will probably also touch on the state and prospects of the British economy after Brexit, which has been badly hit by the coronavirus pandemic.

Participants of financial markets will also expect from him to clarify the situation regarding the further policy of the central bank of Great Britain. If Andrew Bailey gives any hints of tightening or easing the monetary policy of the Bank of England in the near future, then volatility during his speech will sharply increase in the pound quotes. If he does not touch upon the issues of monetary policy, the reaction to his speech will be weak.