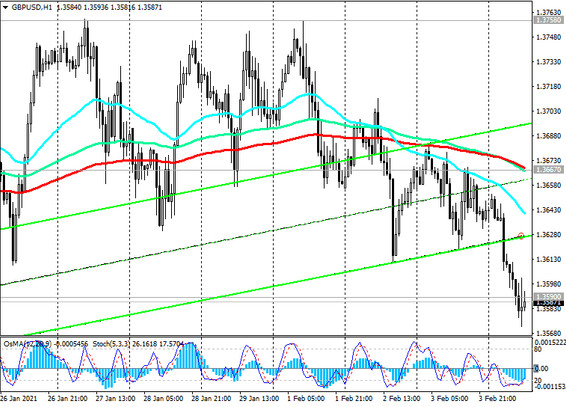

At the time of this posting, the GBP / USD pair is traded near 1.3585 mark, about 170 pips below the local 2.5-year high 1.3758 reached late last month.

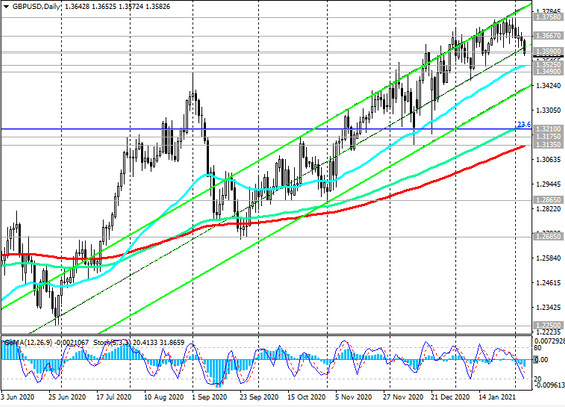

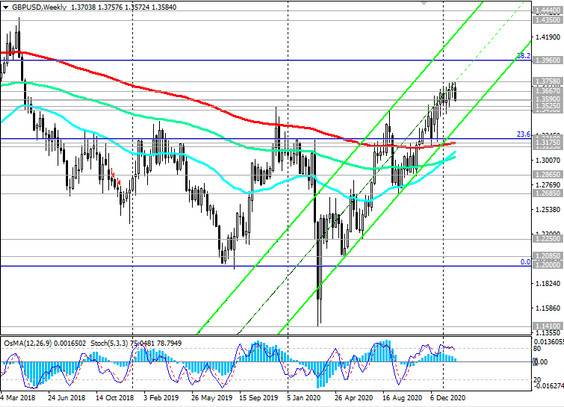

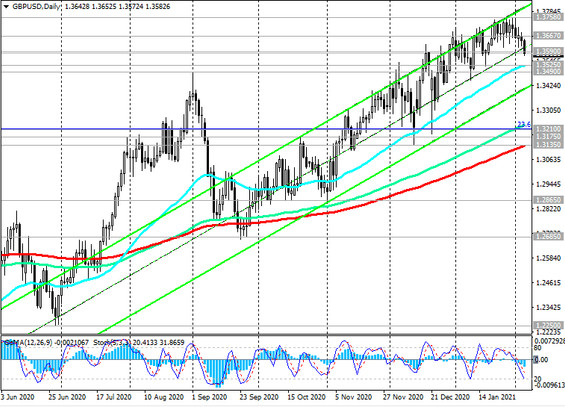

GBP / USD is traded in upward channels on the daily and weekly charts, generally maintaining long-term positive dynamics.

Staying in the zone above the key support levels 1.3135 (ЕМА200 on the daily chart), 1.3175 (ЕМА200 on the weekly chart), the pair is in the bull market zone.

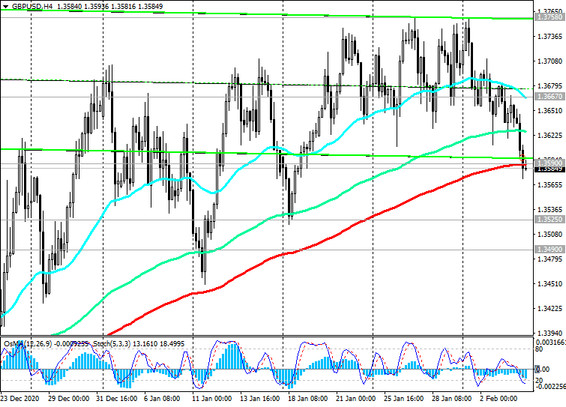

Moreover, in the area of current levels and above the support level 1.3590 (ЕМА200 on the 4-hour chart), opening of new long positions looks attractive, given the long-term positive dynamics of GBP / USD.

Growth into the zone above the resistance level 1.3667 (ЕМА200 on the 1-hour chart) will confirm the long-term bullish trend of the pair.

In case of further decline, the next good zone for placing pending buy orders will be the support level 1.3525 (ЕМА50 on the daily chart).

In an alternative scenario, a breakdown of the local support level 1.3490 could trigger a deeper decline in GBP / USD, up to support levels 1.3210 (23.6% Fibonacci level of the correction to the decline of the GBP / USD pair in the wave that began in July 2014 near the mark of 1.7200), 1.3175, 1.3135.

A breakdown of the local support level 1.2685 (September lows) will increase the risks of a resumption of the global bearish trend in GBP / USD and may provoke a deeper decline towards the support levels 1.2250, 1.2085, 1.2000 (Fibonacci level 0%).

Support levels: 1.3590, 1.3525, 1.3490, 1.3400, 1.3300, 1.3210, 1.3175, 1.3135

Resistance levels: 1.3667, 1.3758, 1.3800, 1.3900, 1.3960

Trading recommendations

Sell Stop 1.3480. Stop-Loss 1.3610. Take-Profit 1.3400, 1.3300, 1.3210, 1.3175, 1.3135, 1.3100, 1.2865

Buy by market. Buy Limit 1.3500. Buy Stop 1.3610. Stop-Loss 1.3480. Take-Profit 1.3667, 1.3758, 1.3800, 1.3900, 1.3960