Amid a weekend in the US (Presidents' Day), the dollar fell on Monday and during the Asian trading session on Tuesday against most major currencies. The DXY dollar index was down more than 0.1% to 90.18, today's low and lows in nearly 3 previous weeks.

At the same time, major world and American stock indices have grown significantly since the beginning of this week.

The dollar is declining amid growing investor optimism, hoping for a further recovery in the global economy and leaving defensive assets.

Despite the fact that negotiations in the US Congress on additional financial support for the economy in the amount of $ 1.9 trillion seem to be temporarily stalled, investors expect that the Fed's policy will remain soft for a long time, and perhaps even if accelerating inflation. And this is a negative fundamental factor for the dollar.

The dollar is also under pressure from vaccination successes in the UK and the US and a decline in new coronavirus infections, which in turn increases investor risk appetite.

On Wednesday (at 19:00 GMT) minutes from the January Fed meeting and data on retail sales in the US (at 13:30 GMT) will be released. They are expected to grow +1.0% in January, which is a weakly positive factor for the dollar after the retail sales fell by -0.7% in the previous month.

At the same time, the Fed's minutes are likely to demonstrate again the inclination of central bank leaders to continue stimulating the economy and their willingness to allow some its overheating.

Basically, economists and market participants expect another wave of dollar decline amid more massive vaccinations in the world and an even larger stimulus package in the US.

Meanwhile, the dollar is still receiving support from the growing yields on US government bonds. Thus, today the yield on 10-year US bonds is already 1.238% (after reaching a local multi-month minimum of 0.506% in August). It is impossible to completely ignore this fact.

In a normal economy, an increase in government bond yields is usually accompanied by a strengthening dollar, since it implies the sale of government bonds and the purchase of riskier assets of the American stock market, but for the dollar.

Meanwhile, while this article was being prepared, more positive data on Germany and the Eurozone came out. Thus, the index of economic sentiment from the ZEW Institute for Germany came out in February with a value of 71.2 (against the forecast of 59.5 and the previous value of 61.8), which is the highest since September. A similar index of economic sentiment from the ZEW institute for the Eurozone also turned out to be better than the forecast and the previous value (69.6 versus 57 and 58.3, respectively). Economists attribute this to hopes for success in mass vaccination in Europe and a faster recovery of the European economy after the pandemic. The ZEW report also noted the expectation of a strong recovery in consumption and retail trade, which will be accompanied by higher inflation expectations and growth in Eurozone GDP, which, in turn, according to the data presented today, was revised towards a smaller fall in the 4th quarter of 2020 ( -0.6% against the first estimate -0.7%).

All these are positive factors for the euro, which strengthened immediately after the publication of the above-mentioned data, and the EUR / USD pair continued today's and yesterday's growth.

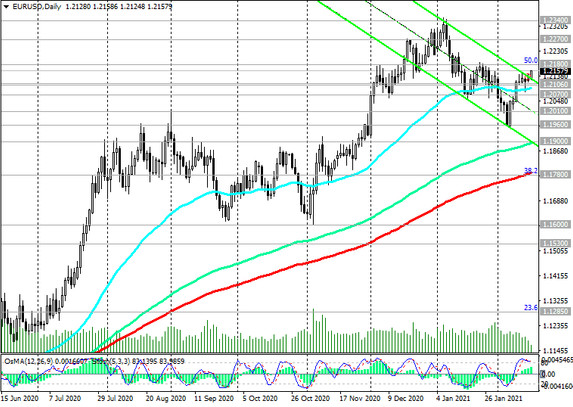

At the time of this article's publication, the EUR / USD pair is traded near the 1.2158 mark, above the important short-term support levels 1.2112, 1.2106, while maintaining an upward trend.