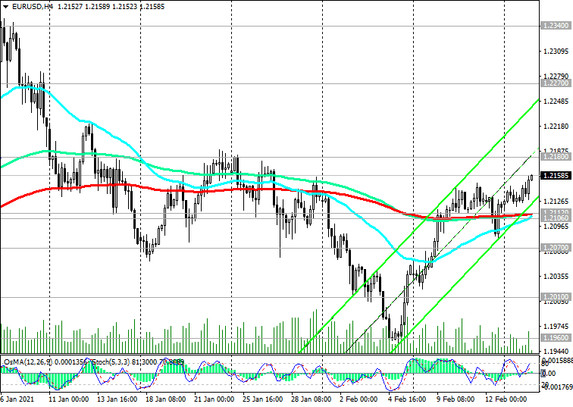

At the start of today's European session, EUR / USD is traded near the 1.2160 mark, above the important short-term support levels 1.2106 (EMA200 on the 1-hour chart), 1.2112 (EMA200 on the 4-hour chart).

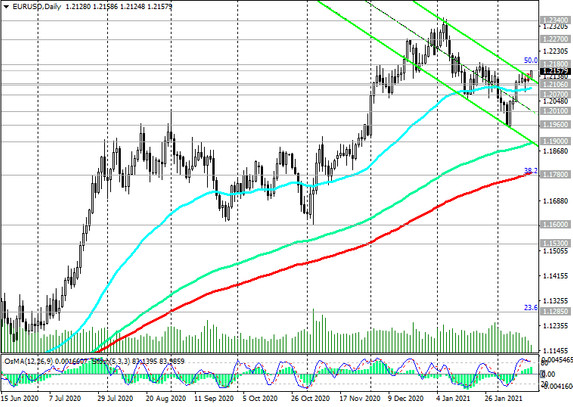

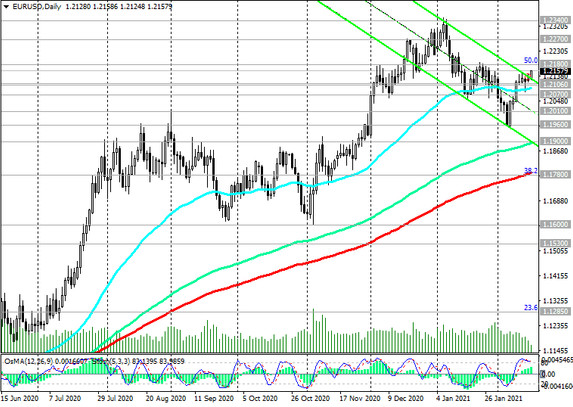

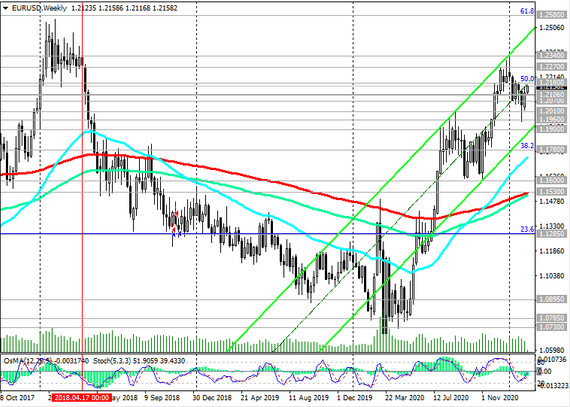

Above these levels, preference should be given to long positions. A breakdown of the resistance level 1.2180 (Fibonacci level 50% of the upward correction in the wave of the pair's decline from the level of 1.3870, which began in May 2014) will indicate the resumption of the bullish trend in EUR / USD.

An alternative scenario will be associated with the weakening of the euro and the fall of the EUR / USD pair. A signal for selling will be a breakdown of the support level 1.2106. If the downward dynamics develops, EUR / USD may decline to the long-term support levels 1.1900 (EMA144 on the daily chart), 1.1780 (Fibonacci level 38.2% and EMA200 on the daily chart).

A breakdown of the support level 1.1285 (Fibonacci level 23.6%) will finally return EUR / USD to a long-term downtrend.

Support levels: 1.2112, 1.2106, 1.2070, 1.2010, 1.1960, 1.1900, 1.1780, 1.1760, 1.1600, 1.1520, 1.1285

Resistance levels: 1.2180, 1.2220, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.2120. Stop-Loss 1.2180. Take-Profit 1.2070, 1.2010, 1.1960, 1.1900, 1.1780, 1.1760, 1.1600, 1.1520, 1.1285

Buy Stop 1.2180. Stop-Loss 1.2120. Take-Profit 1.2200, 1.2220, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600