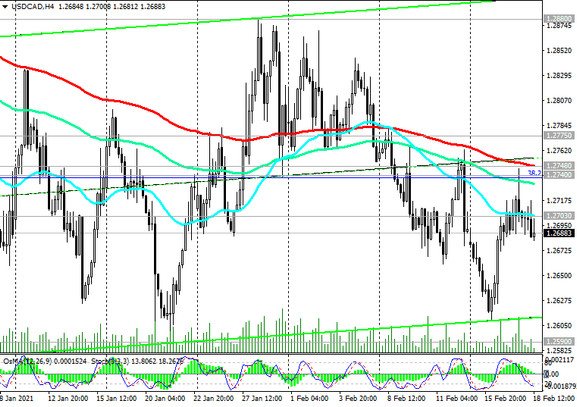

At the beginning of today's European session, the USD / CAD pair is traded near the 1.2690 mark, below the important short-term resistance level 1.2703 (ЕМА200 on the 1-hour chart), still maintaining the tendency to further decline, including amid strong fundamental factors.

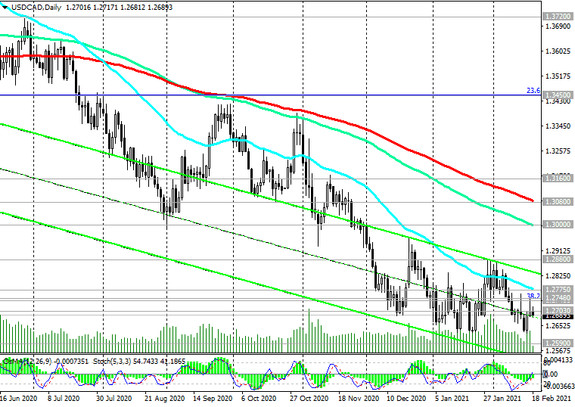

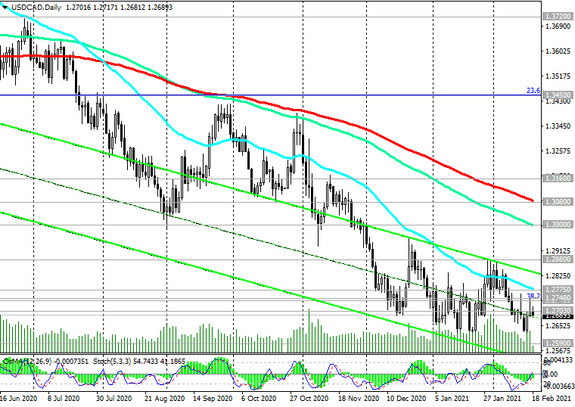

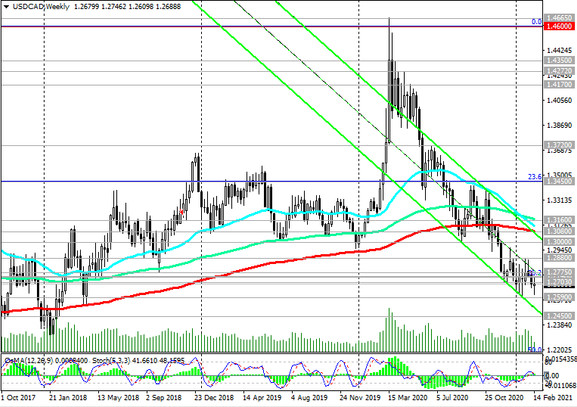

The pair remains within the descending channels on the daily and weekly charts, below the important long-term resistance levels 1.3080 (ЕМА200 on the weekly and daily charts), 1.3160 (ЕМА144 on the weekly chart).

By staying below these key resistance levels, in fact, USD / CAD is in the bear market zone. The pair is decreasing towards the key and long-term support level 1.2450 (ЕМА200 on the monthly chart).

Its breakdown will strengthen the tendency to further decline, and a breakdown of the support level 1.2170 (Fibonacci level 50% of the downward correction in the wave of USD / CAD growth from 0.9700 to 1.4600) will finally return USD / CAD into a long-term bearish trend. So far, everything is in favor of short positions and further decline.

In an alternative scenario, the breakdown of the important resistance levels 1.2740 (50% Fibonacci level), 1.2748 (ЕМА200 on the 4-hour chart) will be a signal for a possible reversal and breaking of the bearish trend.

A breakdown of the local resistance level 1.2880 will confirm the revival of the bullish trend in USD / CAD and the prospect of growth to the resistance levels 1.3000, 1.3080, 1.3160. The first signal for the implementation of this scenario is a breakdown of the resistance level 1.2703.

Support levels: 1.2640, 1.2590, 1.2450, 1.2170

Resistance levels: 1.2703, 1.2740, 1.2748, 1.2775, 1.2880, 1.3000, 1.3080, 1.3160, 1.3200, 1.3300, 1.3450

Trading scenarios

Sell by market, Sell Stop 1.2670. Stop-Loss 1.2720. Take-Profit 1.2640, 1.2590, 1.2450, 1.2170

Buy Stop 1.2720. Stop-Loss 1.2670. Take-Profit 1.2740, 1.2748, 1.2775, 1.2880, 1.3000, 1.3080, 1.3160, 1.3200, 1.3300, 1.3450