During today's Asian session, the dollar continued to weaken against most major currencies. The rise in major rival currencies and the weakening of the dollar were driven by more positive expectations about the outlook for a global economic recovery, as well as the latest data on acceleration in the pace of Covid-19 vaccinations in some countries.

However, at the beginning of today's European session, the main trend in the foreign exchange market, if not changed, then stopped by the strengthening of the dollar. So, at the beginning of today's European session, DXY futures were traded near the 90.15 mark, 15 points higher than yesterday's closing price.

The dollar also continues to receive support from the growing yields on US government bonds. At the time of publication of this article, the yield on US 10-year government bonds was 1.374% against a local multi-year low of about 0.500% reached in August 2020.

Investors are increasingly paying attention to the stable state of the American economy and its faster recovery compared to other countries, as evidenced by recent macro data from the United States.

Meanwhile, market participants will be awaiting a speech by Fed Chairman Jerome Powell in Congress today, which starts at 15:00 (GMT). Amid growing concerns about inflation and US Treasury yields, traders will scrutinize Powell's speech for possible signals of a withdrawal of stimulus.

Economists believe that a too strong acceleration of inflation may lead to the start of tightening of the Fed's monetary policy, since maintaining a soft policy in such an environment could lead to overheating of the economy.

Although, judging by the latest statements by the FRS leaders, they are not much worried about the growth in the yield of US Treasury bonds, since they see it as a sign of economic success and a sign of growing investor confidence in the continued recovery from the crisis. The growth in the yield of government bonds is accompanied by their sale and redistribution of funds in favor of the more risky assets of the American stock market.

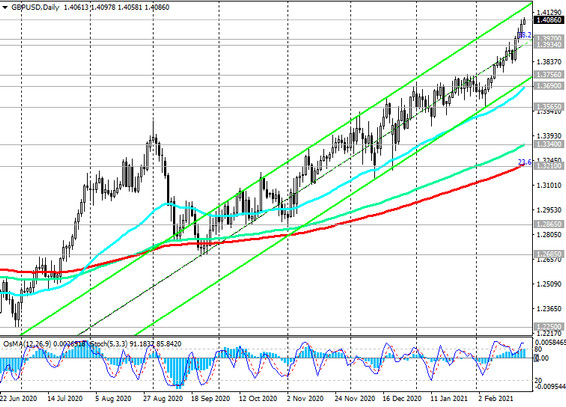

Meanwhile, the current leader in the foreign exchange market is once again the pound, which has strengthened, including against the dollar, after the publication of data from the British labor market. According to the Office for National Statistics, in October-December the unemployment rate in the UK rose to 5.1% from 5.0% in September-November. The number of people employed has decreased and the number of people leaving the labor market has increased. Meanwhile, in January, the number of employed people rose to 28.3 million (growth continued for the second month in a row), and the number of applications for unemployment benefits in January fell by 20,000. Overall, the data still point to a weak labor market, but it is healthier than at the peak of the pandemic last spring.

At the time of publication of this article, the GBP / USD pair was traded near the 1.4088 mark, maintaining positive dynamics and a tendency to further growth. However, for this the pair will probably have to consolidate for some time near the current levels for a new upward push. It is possible that Powell, in his speech, will give the dollar a new impetus to decline, and the GBP / USD pair, respectively, to grow.