Despite rising US Treasury yields, the dollar continued to decline on Thursday after Fed Chairman Jerome Powell said at a House Financial Services Committee hearing on Wednesday that the central bank will continue to be soft until significant progress is made towards achieving the inflation and employment targets set by it.

In his opinion, it may take more than three years to achieve the target inflation rate of 2%, and during this time the Fed intends to maintain the parameters of the current monetary policy, within which it buys $ 170 billion in Treasury bonds monthly and keeps the interest rate at the level of 0.25%.

Powell’s statements indicate that he is not worried about rising government bond yields and heightened inflation expectations, and the central bank will allow inflation to even exceed the 2% target for a while before discussing policy tightening (annual inflation at the end of 2020 was 1.3%, staying below the Fed's target for the eighth consecutive year).

Powell stressed in his speeches on Tuesday and Wednesday that the economy is far from full employment and full recovery. According to Lael Brainard, one of the Fed officials, the real unemployment rate is closer to 10%, not 6%. She announced this on Wednesday.

Powell said Tuesday that the central bank does not plan to raise its target range for federal rates from near zero until three conditions are met: inflation should reach 2.0%, forecasts should indicate continued price growth. at this or higher levels, while the labor market must achieve full employment. He reiterated Wednesday that he wants to see "real progress, not just predictions" before the Fed begins to tighten its policies.

Thus, Powell gave a clear and unambiguous signal to the markets: in the next few years, at least 3 years, the Fed's monetary policy will maintain its extra soft parameters, and this is a strong fundamental factor for the further weakening of the dollar, given also the huge federal budget deficit. growing national debt and the threat of a sharp rise in inflation, especially if the US government does adopt a stimulus program in the amount of $ 1.9 trillion. And to this Powell again called on the Congressmen.

But Powell stands his ground: "inflation expectations are still fixed at low levels".

Markets reacted instantly to Powell's second speech on Wednesday. Major commodity currencies such as the Canadian, New Zealand and Australian dollars strengthened especially strongly against the dollar.

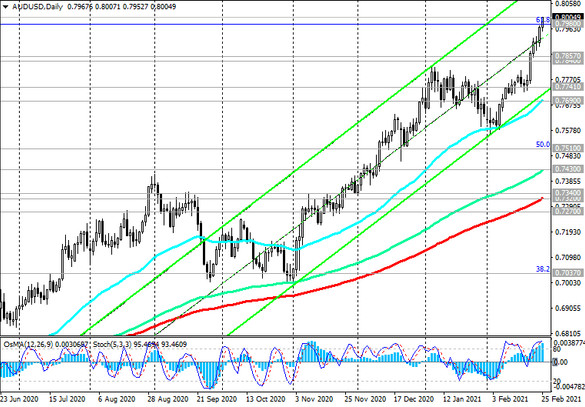

Thus, during today's European session, the AUD / USD pair broke through an important psychological level, for the first time since February 2018 exceeding the 0.8000 mark.

The upbeat outlook for the global economic recovery, successes in coronavirus vaccinations and the Fed's soft monetary policy are putting downward pressure on the safe dollar and upward pressure on stock markets, commodity prices and commodity currencies.

The RBA will hold its next meeting on Tuesday, and its current monetary policy will likely remain unchanged as well, despite the strengthening of the Australian currency and given the rise in prices for liquefied gas, iron ore, coal - Australia's main export commodities.

The current situation creates preconditions for further growth of the AUD / USD pair.

Market participants today will be looking at US macro data slated for release at 13:30 (GMT), including durable goods orders, US annual GDP for the 4th quarter (second estimate) and the weekly report from the Department of Labor with statistics on benefits on unemployment. The data is expected to indicate an accelerating growth in the US economy, which could strengthen the US dollar in the short term. However, its main trend at the current moment is downtrend.