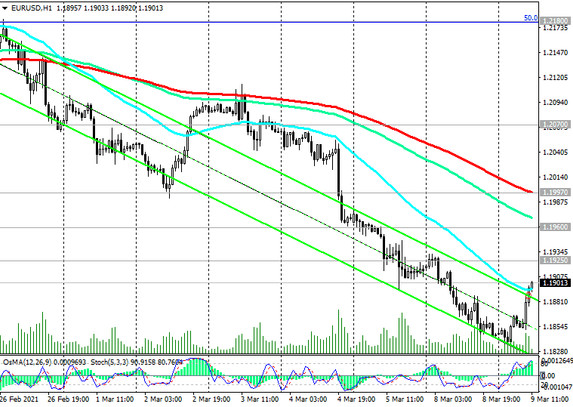

At the start of today's European session, EUR / USD is rallying, traded near 1.1900 mark at the time of this article's publication.

The pair is growing amid a weakening dollar, which, in turn, is declining amid falling yields on US bonds.

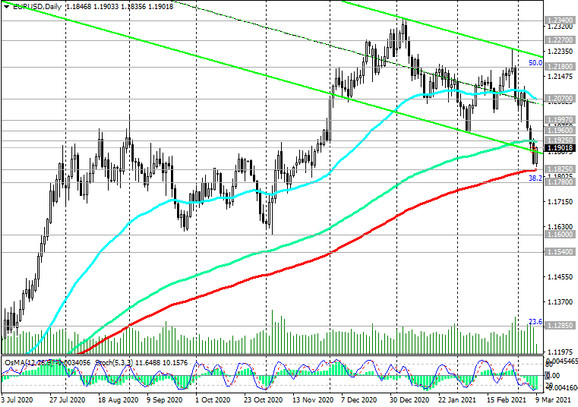

Having almost reached the strong support level 1.1825 (ЕМА200 on the daily chart), EUR / USD bounced and grows towards the resistance level 1.1925 (ЕМА144 on the daily chart).

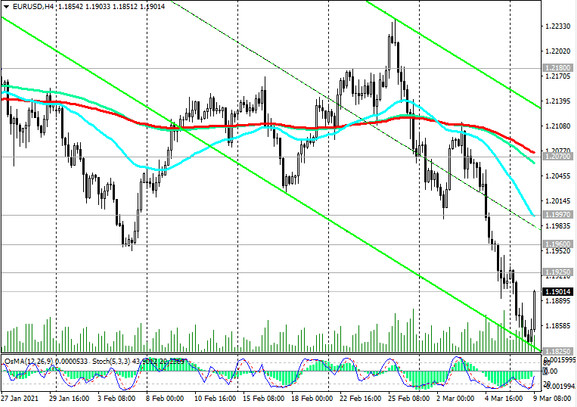

The indicators OsMA and Stochastic on the 1-hour and 4-hour charts turned to the long positions, also signaling an upward correction, which may last up to the resistance level 1.1997 (ЕМА200 on the 1-hour chart).

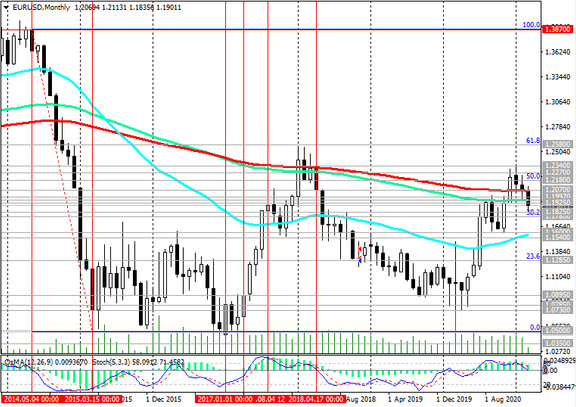

Below this resistance level, short positions with targets at support levels 1.1825 (ЕМА200 on the daily chart), 1.1780 (Fibonacci level 38.2% of the upward correction in the wave of the pair's decline from 1.3870, which began in May 2014) are still preferred. A break of these support levels will increase the risks of a resumption of the long-term bearish trend in EUR / USD.

At the same time, a breakdown of the resistance level 1.2070 (ЕМА200 on the 4-hour chart and ЕМА50 on the daily chart) will resume the bullish trend in EUR / USD.

Support levels: 1.1825, 1.1780, 1.1600, 1.1520, 1.1285

Resistance levels: 1.1925, 1.1960, 1.1997, 1.2070, 1.2100, 1.2180, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.1880. Stop-Loss 1.1930. Take-Profit 1.1825, 1.1780, 1.1600, 1.1520, 1.1285

Buy Stop 1.1930. Stop-Loss 1.1880. Take-Profit 1.1960, 1.1997, 1.2070, 1.2100, 1.2180, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600