Today, the focus of the financial market participants is the ECB meeting. Despite the difficult tasks facing the bank, it is expected that following this meeting, the ECB leaders will decide to keep the interest rates unchanged.

ECB leaders are likely to focus on financing terms and the Emergency Asset Purchase Program (PEPP), signaling their readiness to ignore the recent acceleration of inflation in the Eurozone for now.

In the current situation, tough restrictive measures due to the coronavirus pandemic continue to have a strong negative impact on the region's economy, and ECB support remains critical for the economy.

Financial conditions are expected to remain extremely soft, but so far the ECB has managed to verbally intervene on rising yields on European government bonds and the strengthening of the euro, without backing up its claims with real action, such as an increase in asset purchases under the PEPP program.

Market participants expect new real actions from the ECB to support the Eurozone economy. But, most likely, the ECB leaders will repeat again that the bank is ready, if necessary, to use "all available instruments" to support the economy and soft financing conditions, i.e. will again confine themselves to verbal intervention.

The ECB's assessment of the growth prospects of the European economy is also likely not to undergo major changes compared to December forecasts.

Based on the above, the euro is unlikely to strongly react to the results of today's ECB meeting, unless, of course, unexpected statements follow from the bank's management. Many economists agree that this meeting will be a "walk-through" meeting, without specific actions and decisions on the part of the ECB.

Meanwhile, the dollar is declining today, moreover, for the third trading day in a row, almost copying the dynamics of the yield of US government bonds, falling also against the background of the growth of US stock indices.

As of this writing, the yield on 10-year Treasuries was 1.488% (versus a local high of 1.624% last week and versus a multi-year low near 0.500% in August last year). The DXY dollar index hit a 3-day low at 91.53 in early European session today, down from an intra-week (and 15-week) high of 92.52.

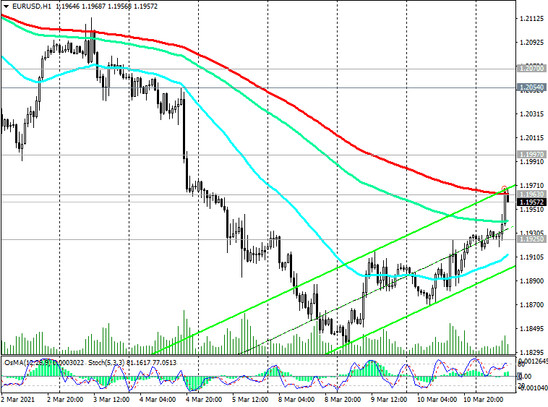

The weakening of the dollar following the fall in the yields of American bonds led to the growth of EUR / USD. At the beginning of today's European session, the pair rose to 1.1963, hitting a strong short-term resistance level (see Technical Analysis and Trading Recommendations).

Its breakdown will cause further growth of EUR / USD. However, most of this will be due to the weakening of the dollar, rather than the strengthening of the euro.

Recall that the ECB will publish its decision on the key rate and on the deposit rate at 12:45 (GMT), and during a press conference, which will start at 13:30 (GMT), a new surge in volatility is possible not only in euro quotes, but and throughout the financial market, if the ECB leaders make an unexpected announcement.