As expected, the Fed did not change the parameters of monetary policy last Wednesday, signaling that the interest rate would remain at its lowest levels until the end of 2023.

At a subsequent press conference, Fed Chairman Jerome Powell made it clear that no adjustments are planned in the near future either. Purchases of Treasury securities in the volume of $ 80 billion a month and mortgage-backed securities in the amount of $ 40 billion a month will continue in the same volumes.

The Fed's forecasts for inflation and economic growth were revised upwards, despite the fact that the key rate will not increase until the end of 2023. The Fed intends to adhere to a flexible approach to the target inflation rate and is not very concerned about the growth of government bond yields.

Soft financing conditions, combined with accelerating vaccinations, the adoption of the next package of fiscal aid and the prospect of lifting quarantine restrictions and opening the economy, increases the Fed's tolerance for higher yields on government bonds, economists say.

Yesterday, the yield on 10-year US bonds rose and today continued to rise, reaching a new local 14-month high of 1.738%, simultaneously supporting the US dollar after its fall the day before. As of this writing, DXY futures are traded near 91.61 mark, 25 pips above yesterday's low.

The dollar also retains the status of a protective asset after news that some European countries have suspended vaccination with the drug AstraZeneca after it became known about its side effects.

The dollar remains stable and shows no signs of sustained weakening after yesterday's decision and statements by the Fed. The market appears to be getting used to the overly soft monetary policy of the Fed and other major global central banks.

At the start of today's European session, the US dollar looks set to take the lead from commodity currencies such as the Canadian, Australian and New Zealand dollars.

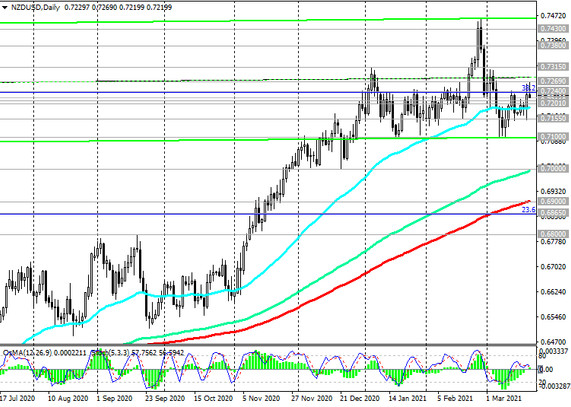

Thus, the NZD / USD, which rose sharply at the end of yesterday after the Fed meeting, is declining at the beginning of today's European session and has already moved into negative intraday territory. As of this writing, it is traded near 0.7220 mark after hitting a 2-week high at 0.7269 mark during today's Asian session.

As the National Bureau of Statistics reported yesterday, New Zealand's GDP contracted -1.0% in the 4th quarter (-0.9% on an annualized basis) compared to the 3rd quarter. The data turned out to be worse than expected.

The Bureau of Statistics noted that the most significant negative contribution to the GDP indicator for the 4th quarter was made by such sectors of the economy as construction, retail trade, as well as tourism and hospitality.

Despite having one of the lowest coronavirus incidence rates in the world in New Zealand, the impact of the pandemic has negatively impacted on annual growth rates. In 2020, New Zealand's economy was 2.9% smaller than in 2019.

The data presented suggests that fiscal and monetary stimulus measures are still needed.

The dairy price index released on Tuesday for the first half of March also had a negative impact on the NZD quotes, unexpectedly indicating a decline in prices by -3.8% after rising in the previous 2-week period. A significant portion of New Zealand's exports are dairy products, primarily milk powder. The Global Dairy Trade Dairy Price Index came out two weeks ago at +15%, indicating a rise in prices, and market analysts were looking for a +9.5% rise. The rise in world prices for dairy products provides additional support to the New Zealand economy, increasing the level of export foreign exchange earnings. At the same time, the decline in world prices for dairy products has a negative impact on the NZD.

From the news for today regarding the US dollar, and the NZD / USD pair, respectively, it is worth paying attention to the publication at 12:30 (GMT) of the weekly data from the US labor market.

Data on claims for unemployment benefits for the last reporting week will shed light on the state of the labor market. Economists estimate that the number of jobless claims for the week through March 12 fell to 700,000 from 712,000 a week earlier. Initial claims for benefits, although overvalued by historical standards, are close to the lowest since the start of the pandemic, and this is a positive factor for the USD.