The current week, among other things, is marked by increased volatility in the oil market.

Last Wednesday, the Energy Information Administration (EIA) of the US Department of Energy announced an increase in oil reserves in the country in the week of March 13-19 by 1.9 million barrels (gasoline stocks increased by 200,000 barrels, and stocks of distillates - by 3.8 million barrels). Thus, US oil inventories rose for five consecutive weeks.

However, oil market participants ignored this negative factor for oil prices and focused on the situation in the Suez Canal, where a container ship ran aground, suspending oil transportation. As reported in Bloomberg, it is likely to be possible to free the channel only on Sunday or Monday at the peak of the tide.

Oil market participants also for some time abstracted from the information about the increase in the number of new COVID cases in a number of European countries and emerging economies countries, such as India and Brazil, where oil consumption is an important factor for the oil market. India's daily increase in cases was the strongest this year, and Brazil became the second country to surpass 300,000 coronavirus deaths, the Associated Press and the BBC reported on Wednesday.

The outlook for the global economy has worsened, including due to the new wave of coronavirus, which may negatively affect the prospects for the oil market.

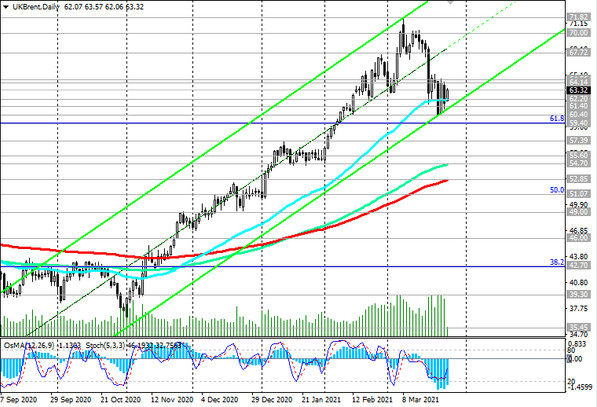

Today oil quotes are growing, however, according to the results of the week that has not yet ended, they remain in negative territory.

Meanwhile, the dollar remains positive, receiving support from the growing yields on US government bonds.

Yesterday, the DXY dollar index rose to a new local high of 92.94, which is in line with the levels of November 2020. After declining earlier in the week, the yield on 10-year US Treasuries is rising again today and now stands at 1.655% versus 1.754%, a local multi-month high reached last week.

As of this writing, DXY dollar futures are traded near 92.73 mark, retreating from yesterday's intra-weekly and local highs of 92.94. In turn, the decline in the dollar is reflected in the rise in commodity prices, in particular, oil, which is quoted in US dollars.

Nevertheless, the strengthening of the dollar continues to gain momentum. The United States is better than others in coping with the coronavirus pandemic, judging by the statistics of the country's vaccination campaign. The dollar gained support yesterday after the release of data that indicated a continued recovery in the US labor market. The number of initial applications for unemployment benefits in the country for the week of March 13-20 fell to its lowest since the beginning of the pandemic, amounting to 684,000 against 781,000 a week earlier.

The dollar also gained support on Thursday after Joe Biden held his first press conference as president of the United States. Biden promised 6% GDP growth and set a goal to provide the population with 200 million doses of vaccine within 100 days of the presidency.

In addition to strong macroeconomic statistics from the US, the dollar is also strengthening against the backdrop of a new round of deterioration in relations between Washington and Beijing.

Signs of economic recovery, the expected rise in interest rates and acceleration of inflation provoke a shift in investor demand towards the dollar, which, in addition, also continues to act as a defensive asset against the backdrop of a worsening epidemiological situation in several countries due to the coronavirus. New lockdowns in Europe, which is the largest consumer of oil, and in key emerging economies such as India and Brazil, are increasing demand for defensive assets and negatively affecting oil prices.

Today, as usual, oil market participants will follow the publication (at 17:00 GMT) of the weekly data of the oilfield services company Baker Hughes on the number of active drilling rigs in the United States. After their number reached 888 in November 2019, the number of active drilling rigs in the United States subsequently began to decline, and in March 2020, the pace of closure of oil rigs accelerated significantly due to a sharp decline in oil prices.

On the week before last, their number was 411 (against 402, 403, 309, 305, 306, 299, 295, 287, 275 in the previous reporting periods). It is obvious that the number of oil companies in the US is growing again, which is a negative factor for oil prices. Another rise is likely to have a negative impact on oil quotes, but, most likely, only in the short term.

In fact, the dynamics of the oil market at the moment will be determined by the dynamics of the dollar and stock indices, the volume of production and oil reserves in the world, as well as information regarding the situation with the coronavirus.