As reported last Friday in the US Department of Labor, the number of new jobs outside agriculture in March amounted to 916,000, which is higher than the 647,000 forecast and after an increase of 468,000 in the previous month. Unemployment fell from 6.2% in February to 6.0%. The presented data indicate a strong recovery both in the labor market and in the country's economy as a whole. The recovery in the labor market is gaining momentum as more people are getting the Covid-19 vaccine, states are lifting restrictions on business activity, and consumers are less afraid to visit food service establishments and shops, as well as to go on trips.

Economists say economic growth and hiring are supported by a combination of factors such as strong government incentives, increased consumer confidence, and accelerating vaccination rates.

“In the first two months of our presidency, we saw more jobs being created than at any time in history”, US President Joe Biden said Friday following the release of the Department of Labor's report. He also promised that "19 million jobs will be created in the economy".

According to data from job search site Indeed, manufacturing jobs in the US economy were up 50% in March from February 2020, and construction-related jobs were up 45%.

After receiving incentive payments, Americans have a wealth of cash at their disposal. They can use these funds to spend on consumer spending, which accounts for more than two-thirds of US GDP and which is an important element of the economic recovery.

While overall US employment remains below pre-coronavirus levels, economists expect US employers to create an average of 514,000 jobs per month over the next 12 months, bringing the total to over 6 million places during the 12-month period have not been observed for several decades.

Market participants reacted rather restrainedly to the Friday report of the US Department of Labor. Perhaps part of this was due to the Easter holidays. Easter Monday is celebrated in Europe today. Therefore, today at the beginning of the American trading session, we should expect an increase in volatility in the financial markets, especially at 14:00, when the PMI index of business activity (from ISM) in the services sector of the US economy will be published. The indicator is expected to rise to 58.5 in March against 55.3 in February, which is likely to have a positive overall effect on the USD. A result above 50 is seen as positive for the USD.

At the beginning of the European session, the DXY dollar index is moderately growing, adding 10 points to the opening price of today's trading day after reaching a local 21-week high at 93.47 last week. At the same time, the yield on 10-year US bonds stabilized above 1.700%, which corresponds to 15-month highs.

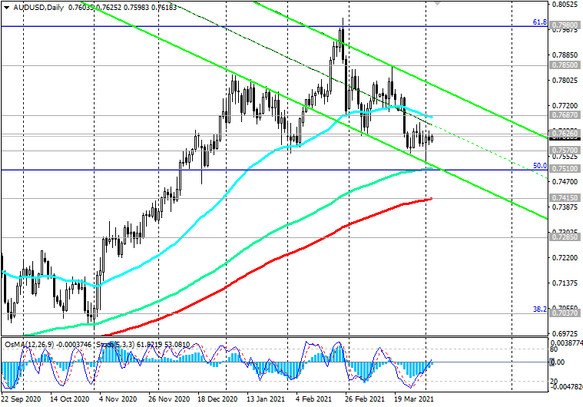

Meanwhile, the Australian dollar strengthened slightly against the US dollar today. At the start of today's European session, AUD / USD is traded near 0.7620, 17 pips above today's opening price.

Inflation data provided some support to the Australian dollar on Monday. According to TD Securities, the inflation indicator rose to +0.4% in March against +0.1% in February.

At the same time, traders trading the Australian dollar and the AUD / USD pair are cautious ahead of the RBA meeting. The RBA's rate decision will be published on Tuesday at 04:30 (GMT). No change in RBA policy is expected.

The main negative factors for the Australian economy are weak wage growth, a weak labor market and a slowdown in growth. Annual inflation has remained below the 2% -3% target for four years.

Unemployment in the country has remained above the 5% level for many years, unwilling to decline. Now the Australian economy is experiencing difficulties due to the coronavirus pandemic, which has hit the tourism and transport sectors hard.

It is expected that at this meeting the Central Bank of Australia will leave the rate at the current level of 0.1%, although unexpected decisions are not ruled out.

In an accompanying statement, the leaders of the RBA will explain the reasons for the decision on the rate. If the RBA signals the possibility of further easing of monetary policy in the near future, the risks of a fall in the Australian dollar will increase. Therefore, the comments of the RBA representatives will be very important in determining the direction of further movement of the AUD and the AUD / USD pair.