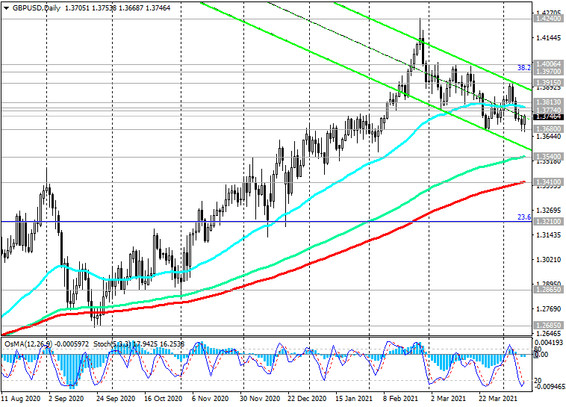

As a result of the strong fall observed last week, the pound turned out to be oversold and greatly undervalued (in scale of several weeks).

Economists associate the recent fall in the pound with growing fears about vaccinations in the UK, which may not be as successful as it seemed at the beginning of this campaign.

In turn, concerns about coronavirus vaccinations in the UK were prompted by media reports that the Strategic Advisory Group of Experts on Immunization (SAGE) announced a possible sharp slowdown in vaccination rates in the country until the end of July. This regulator may also suspend the use of the AstraZeneca vaccine for those under the age of 30. The growing concern about a possible slowdown in vaccination rates in the UK thus showed how sensitive the markets are to information regarding the coronavirus and vaccinations against it.

However, the UK government recently reaffirmed that the first vaccination for the entire adult population will be offered by the end of July.

Another positive factor that can become a driver for the recovery of the pound and the resumption of its growth may be the fact that from April 12, the UK begins to gradually lift quarantine restrictions. Although the citizens of the country will still have to comply with quarantine regulations, most of the service enterprises, including shops, cinemas, hairdressers, street restaurants, will start working.

The services sector (its most important part is financial services) employs most of the working-age population in the UK and it accounts for about 75% of GDP, while the UK's share of global exports of goods and services is 4.5%. Therefore, the restoration of the work of this sector in the most positive way should have a positive effect on the restoration of the growth of the entire economy of the country.

In this regard, it is worth paying attention to the publication on Tuesday (06:00 GMT) of a block of macro statistics for the UK, among which there will be data on both industrial production and the index of activity in the service sector. At the same time, it is expected that the volume of production in the manufacturing sector (this is an indicator that evaluates the state of this sector, which forms about 24% of British GDP) increased by +0.5% in February (after falling by -1.5% in January), although, in annual terms, production in the manufacturing sector decreased by -5.1% due to the negative impact of the pandemic on the British economy. The data is better than the previous value, and if it also turns out to be better than the forecast, it will provide good support to the pound.

At the same time, expectations for a recovery in the UK economy thanks to vaccinations remain strong and they will continue to support the pound.

Meanwhile, the dollar declines again at the start of the new week. As of this writing, DXY futures are traded near 92.12 mark, just above the local low of 92.01 hit late last week.

At the same time, the yield on US government bonds stopped growing after it reached 1.775% at the end of March, which corresponds to almost 15-month highs. The yield on US government bonds has stabilized near current levels, and the dollar has ceased to receive support from this.

The dollar remains under pressure from stimulus policies from the Fed and the White House: the Fed intends to maintain a policy of low interest rates until at least 2023, buying back bonds worth $ 120 billion every month, and the US government has adopted a stimulus plan worth $ 1.9 trillion, which acquired the status of law 11th of March.

Speaking at a virtual conference at the International Monetary Fund last week, Fed Chairman Jerome Powell reassured investors that the US central bank remains committed to its extra soft policies.

Thus, the room for GBP / USD decline below the local support level of 1.3680 remains limited.

Today, volatility in the GBP / USD pair may rise at 13:00 (GMT), when the speech of the representative of the Bank of England and member of the Monetary Policy Committee Silvana Tenreyro, if she makes unexpected statements.