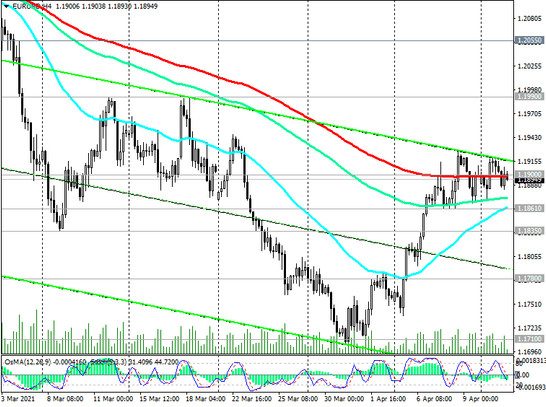

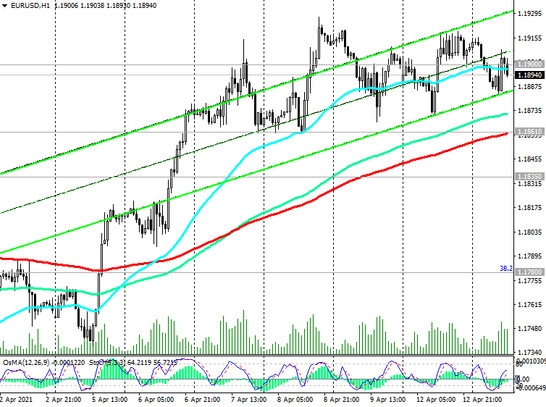

For the 5th trading day in a row, the EUR / USD pair is traded in a range near the 1.1900 mark, through which a strong resistance level in the form of a 200-period moving average on a 4-hour price chart passes.

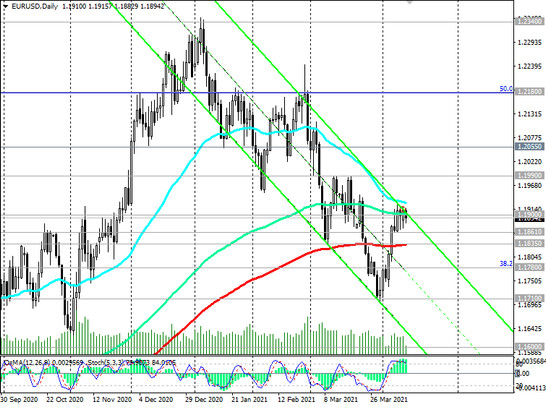

EMA144 and the upper border of the descending channel on the daily chart also pass through the 1.1900 mark, and another strong resistance level passes through the 1.1930 mark (ЕМА50 on the daily chart).

Therefore, it will not be easy for the EUR / USD pair to break through this zone. If the yield on US government bonds resumes growth, the dollar will continue to strengthen, and in this case EUR / USD will go down to the support levels 1.1861 (ЕМА200 on the 1-hour chart and local minimums), 1.1835 (ЕМА200 on the daily chart).

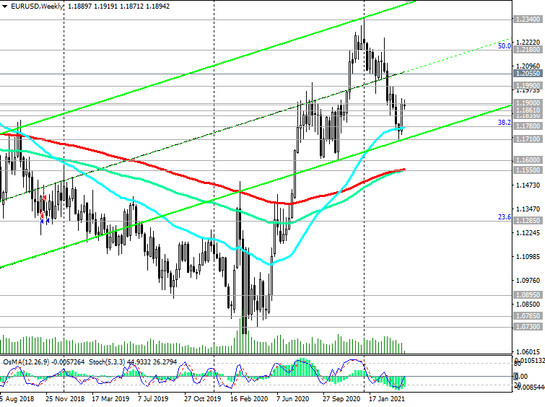

Breakdown of the support levels 1.1780 (Fibonacci level 38.2% of the upward correction in the wave of the pair's decline from the level of 1.3870, which began in May 2014), 1.1710 will resume the downward dynamics of EUR / USD and direct it towards the support levels 1.1600 (local minimums and EMA50 on the monthly chart), 1.1550 (ЕМА200 and ЕМА144 on the weekly chart). A break of the 1.1550 support level will increase the risks of a resumption of the long-term bearish trend in EUR / USD.

In an alternative scenario, and after the breakdown of the resistance level 1.1930, the EUR / USD will continue to rise to the resistance level 1.2055 (ЕМА200 on the monthly chart). More distant growth targets in this case are located at resistance levels 1.2180 (50% Fibonacci level), 1.2340 (this year's highs).

Support levels: 1.1861, 1.1835, 1.1780, 1.1710, 1.1600, 1.1550

Resistance levels: 1.1900, 1.1930, 1.1990, 1.2055, 1.2100, 1.2180, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600

Trading Recommendations

Sell by market, Sell Stop 1.1880. Stop-Loss 1.1935. Take-Profit 1.1861, 1.1835, 1.1780, 1.1710, 1.1600, 1.1550

Buy Stop 1.1935. Stop-Loss 1.1880. Take-Profit 1.1990, 1.2055, 1.2100, 1.2180, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600