Despite the strong US macro statistics published the day before, the dollar was unable to develop the upward trend on Thursday. The DXY dollar index stayed in a range around 91.62 on Thursday.

According to data published on Thursday, the volume of retail sales in the United States increased by 9.8% in March (against the forecast of +5.9% and a decrease of -2.7% in February). The data of the Ministry of Labor on the number of applications for unemployment benefits were also positive. In the reporting last week, the number of initial applications decreased from 769 thousand to 576 thousand, which turned out to be much better than the forecast of 700 thousand.

The index of business activity in the manufacturing sector of the Federal Reserve Bank of Philadelphia also came out with a higher than forecast (42.0) value of 50.2. The data above the value of 50.0 indicates the acceleration of activity, which is generally positive for the national currency.

However, the DXY dollar index declines again on Friday. DXY futures are traded near 91.58 mark as of this writing, 178 pips below this month's high. It is most likely that the dollar will also end this week in negative territory.

It is obvious that strong US economic data can no longer support the US dollar, which is more responsive to the dynamics of US government bonds than to macro statistics. And their profitability has been declining lately. Thus, the yield on 10-year US bonds is currently 1.583%, which is significantly below the 1.775% mark, the local multi-month maximum reached at the end of March.

It seems that the positive factors of fiscal stimulus and relatively high rates of vaccination in the United States are already largely taken into account in the quotes of the dollar, which needs new drivers to resume growth. And they are not yet there. Despite the high rates of vaccination, the situation with the incidence of coronavirus in the United States remains tense.

At the same time, the Fed's full-power printing press, coupled with the central bank's inaction regarding accelerating inflation, as well as the US government's massive trillions of dollars in stimulus programs, exacerbating the already huge federal debt, create the prerequisites for further weakening of the dollar.

Until the Fed starts signal indicating that the stimulus policy will soon begin to roll back, the weakening of the dollar is likely to continue, despite the high pace of recovery in the American economy.

During the March meeting, Fed officials said they still intend to keep interest rates near zero until the end of 2023, and did not express readiness to wind down the bond purchase program. As Fed Chief Powell said at a press conference that followed, "the economic recovery is uneven and far from over, and the path that remains to be taken remains uncertain", noting that current "monetary policy will continue to provide strong support to the economy until its recovery is complete". In his opinion, the economy must "move even more significantly" towards target levels of employment and inflation before the Fed begins to cut purchases (since the end of June 2020, the Fed has been buying at least $ 120 billion of Treasury and mortgage bonds every month to contain the growth in the cost borrowings).

Jerome Powell said last Wednesday that well before the Fed considers raising interest rates, the central bank will begin to cut back on monthly asset purchases. About this, as previously promised Powell, the Fed will also warn financial market participants in advance.

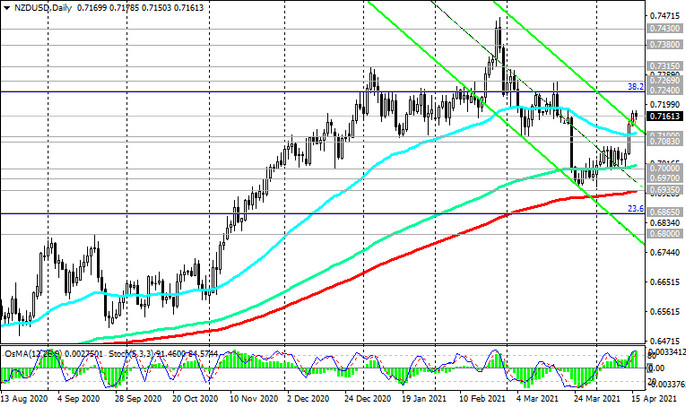

Against the background of the weakening USD and the continued growth of American stock indices, the main commodity currencies, including the New Zealand dollar, have also resumed their growth since the beginning of this month. Currently, the NZD / USD pair is traded near the 0.7160 mark, 180 pips above the opening price this month, while remaining in the bull market zone (see Technical Analysis and Trading Recommendations).

Last Wednesday, the central bank of New Zealand left the interest rate at 0.25%, and the maximum amount for purchases of government bonds - at the level of 100 billion New Zealand dollars (70.5 billion US dollars).

In an accompanying statement, the RBNZ said the prospects for economic recovery from the coronavirus pandemic are still unclear, noting that it will take "considerable time and patience" to reach the maximum stable employment rate and inflation target of 2.0%.

Many economists believe that the RBNZ will not change the interest rate until mid-2022, or even later. Thus, given the tremendous influence of the Fed's policy on the entire financial market, when determining the direction of further movement of the NZD / USD pair, first of all, one should focus on the dynamics of the USD. This means that in the current conditions and taking into account all of the above, we should expect further growth of the NZD / USD pair.

From the news for today regarding the US dollar and, accordingly, the NZD / USD pair, one should pay attention to the publication at 14:00 (GMT) of the preliminary consumer confidence index from the University of Michigan. This indicator reflects the confidence of American consumers in the economic development of the country. A high level indicates economic growth, while a low level indicates stagnation. In theory, the growth of the indicator should strengthen the USD (it is expected that this indicator will be released in April with a value of 89.6 against the previous values of 84.9 in March, 76.8 in February, 79.0 in January 2021). There is a steady trend towards a gradual recovery in the growth of the indicator, which is positive for the USD. However, as we noted above, the dollar reacts less and less to positive macro statistics. Most likely, after the publication of this index, if it exceeds the forecasted value, the American stock indices will rise, which may put pressure on the dollar.