In March, consumer prices rose in the UK. According to the Office for National Statistics, the consumer price index (CPI) rose 0.7% on an annualized basis after rising 0.4% in February, slightly worse than expected by 0.8%. The base CPI rose by +1.7% in March, the same as in the previous month. The CPI is a key indicator of inflation and it rose again in March, but not enough to provide significant support to the pound. Market participants were rather restrained in their attitude to this publication.

Economists believe that consumer prices may continue to rise in the coming months as the higher costs associated with Brexit may have contributed to this process.

Also, according to the forecast of some economists, after real GDP reaches pre-crisis levels in the first quarter of 2022, a stronger labor market and strong fiscal and monetary stimulus could accelerate headline and core inflation to 2.3% by the end of 2022. They also believe that a sustained economic recovery, coupled with structural factors, could keep inflation around 2.5%.

However, growing fears about vaccinations in the UK, which may not be as successful as it seemed at the beginning of this campaign, may negatively affect the expectations of the British economic recovery and the pound quotes. It still continues to receive support from the partial lifting of quarantine restrictions in the UK last week.

On Tuesday, the pound also strengthened after the publication of data from the British labor market, according to which unemployment fell in the reporting 3-month period to 4.9%, which is better than the forecast of 5.0% and the previous result of 5.0%. At the same time, the level of average wages (excluding bonuses) increased by 4.4% in the reporting 3-month period, including bonuses - by +4.5% after growth by +4.2% and +4.8% in the previous reporting period. This is very positive data for the pound. However, experts believe it will take time to fully recover employment. In addition, in their opinion, the problems associated with the new relations between the EU and the UK after Brexit will also put pressure on the level of employment.

Today and tomorrow, the publication of important macro statistics from the UK, which could cause a strong increase in volatility in the pound quotes is not expected. Volatility could rise sharply on Friday morning with UK retail sales at 06:00 (GMT) and Markit PMIs for the UK manufacturing and services sectors at 08:30. Business activity in these sectors of the UK economy is expected to pick up again in April, with PMIs coming out at 59.0 after 58.9 and 56.3, respectively, in March.

The service sector employs most of the UK's working-age population and accounts for approximately 75% of GDP. Financial services continue to be the most important part of the service industry. The data is better than the forecast and the previous value will have a positive impact on the pound. At the same time, a result above 50 is seen as positive and strengthens the GBP.

Meanwhile, the DXY dollar index rallies and the dollar strengthens in the first half of today's trading day, also receiving support from renewed growth in US 10-year government bond yields.

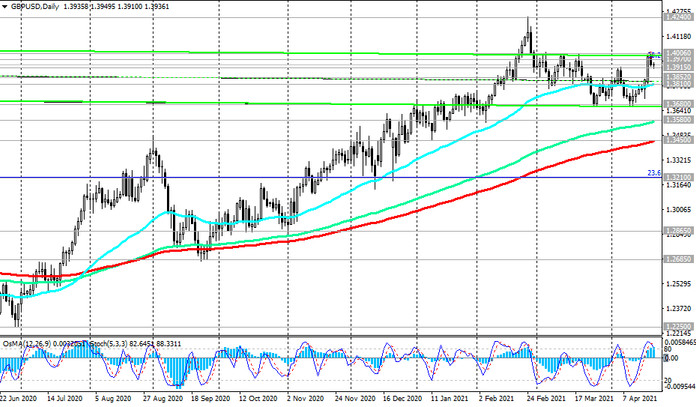

At the time of this article's publication, DXY futures are traded near 91.30, 46 pips above yesterday's low of 90.84 reached during the Asian session, while GBP / USD is near 1.3930, remaining in the bullish zone (see Technical Analysis and Trading Recommendations)