Despite the more positive than expected weekly US labor market data released on Thursday, the dollar declined again on Friday. According to data released on Thursday by the US Department of Labor, the number of applications for unemployment benefits last week amounted to 547 thousand, which was lower than the projected 617 thousand. Although the total number of beneficiaries remained at 3.674 million (forecast was 3.667 million), indicators show that the number of US jobs could rise sharply in April, by about 1.5 million, according to some economists. They estimate that unemployment claims have fallen sharply over the past few weeks since mid-March.

As follows from the official monthly report of the US Department of Labor, published earlier this month, the number of jobs increased by 916,000 in March (against the forecast of +647,000 and the previous value of +468,000), which was the strongest growth since August 2020. At the same time, the unemployment rate fell in the US in March to 6% from 6.2% in February.

This is strong data, suggesting an ongoing recovery in the US labor market and economy, hard hit by the coronavirus pandemic.

The official report on the number of US non-farm jobs for April will be released on May 7th. Judging by the downward trend in the number of new jobless claims, another strong monthly report on the US labor market can be expected. And this will be another strong positive factor for the US stock market and the dollar.

Although, it should be noted that the dollar has recently stopped reacting strongly to positive macro statistics. Market participants pay more attention to the rhetoric of statements made by representatives of the FRS regarding the prospects for monetary policy.

As follows from the minutes from the March meeting of the FRS published on April 7, most of the 18 participants in the meeting still expect interest rates to remain at a level near zero until the end of 2023, also not expressing readiness to wind down the bond purchase program.

"Participants expect recent fiscal stimulus packages and loose monetary policy to support consumer spending", - the minutes said, which also said executives continued to point to high outlook uncertainty. "Participants felt that the Committee's current leading indication (on open market operations) regarding federal funds rate and asset purchases is beneficial to the economy".

"The economic recovery is uneven and far from complete, and the path that remains to be taken remains uncertain", - Fed Chairman Jerome Powell said at a press conference after the March meeting. "Monetary policy will continue to provide strong support to the economy until its recovery is complete", - he said.

Fed officials have confirmed this position in subsequent speeches.

Thus, given the declining yields on US government bonds and the Fed's soft monetary policy, as well as accelerating inflation and growing federal debt amid a new package of fiscal stimulus measures worth $ 1.9 trillion, which acquired the status of law on March 11, we should expect further weakening of the dollar.

At the time of this posting, DXY dollar futures are traded near 91.04, ending their third consecutive week of decline. At the same time, the yield on 10-year US bonds maintains a downward trend that began at the end of last month after reaching a local multi-month maximum of 1.776%.

At the same time, the main US stock indices remain positive, despite the confusion of some large investors who are evaluating the recent proposal of US President Joe Biden to significantly increase the tax on capital gains for citizens with income of $ 1 million from the current 20% to 39.6%. , i.e. almost doubled.

Amid fears over the possibility of a strong capital gains tax hike yesterday, US stocks indexes fell sharply, and today their futures are traded in a narrow range, indicating confusion among investors.

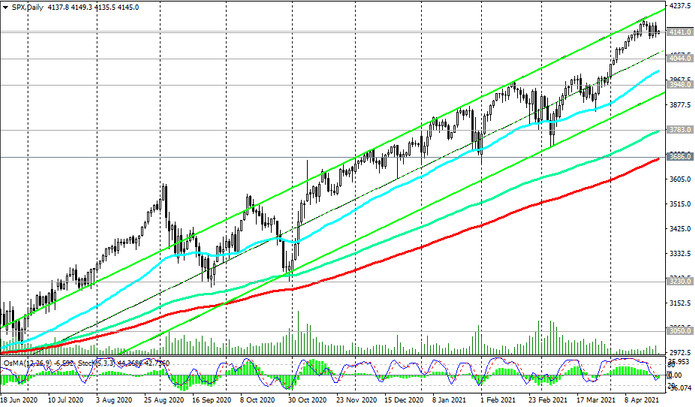

For example, the S&P 500 broad market index futures dropped 0.7% yesterday to 4137.0, and today it is traded at the start of the European session near 4143.0 mark, mostly in a range.

If the fears and confusion of investors about the new plan of the Biden administration to increase the tax on wealthy Americans persist, then a period of correction may begin in the American stock market. However, the time of the beginning of this correction and its duration are not yet clear. On the whole, the positive dynamics of stock indices remains against the background of stimulating policies from the FRS and the US government.

Today, volatility in the financial market may increase at 13:45 and 14:00 (GMT), when macro statistics from the US will be released regarding business activity in the services and manufacturing sectors of the US economy, as well as the situation in the US new real estate market. Corresponding PMIs from Markit are expected to rise in April to exceed 60. These are strong numbers, well above the 50, which separates acceleration from deceleration. These are positive factors for the dollar and American stock indices.