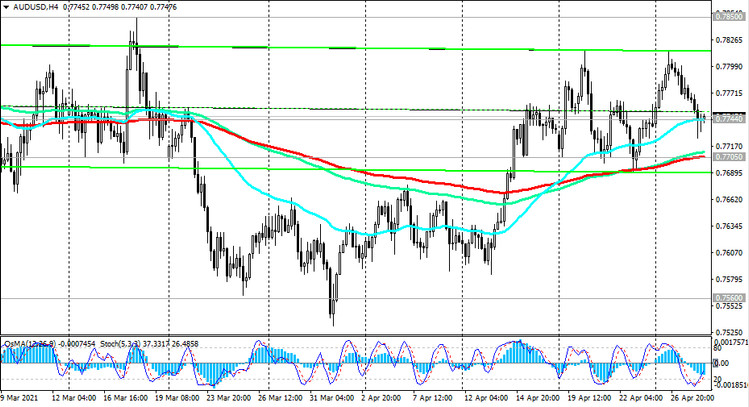

Having declined during today's Asian session, the AUD / USD pair still maintains positive momentum and a tendency to resume growth, trading at a strong short-term support level 0.7744 (ЕМА200 on the 1-hour chart).

AUD / USD also remains above the important support level 0.7705 (EMA50 on the daily and EMA200 on the 4-hour charts).

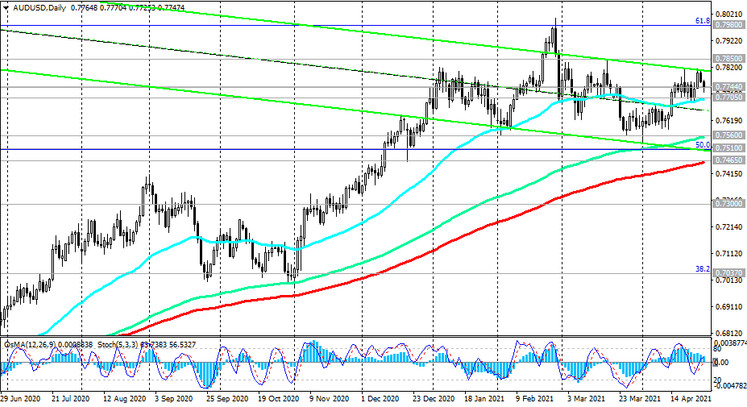

A breakdown of the local resistance level 0.7815 (April highs and the upper border of the descending channel on the daily chart) will be a signal for the resumption of long positions with a distant target at 0.8160 (the upper border of the ascending channel on the weekly chart).

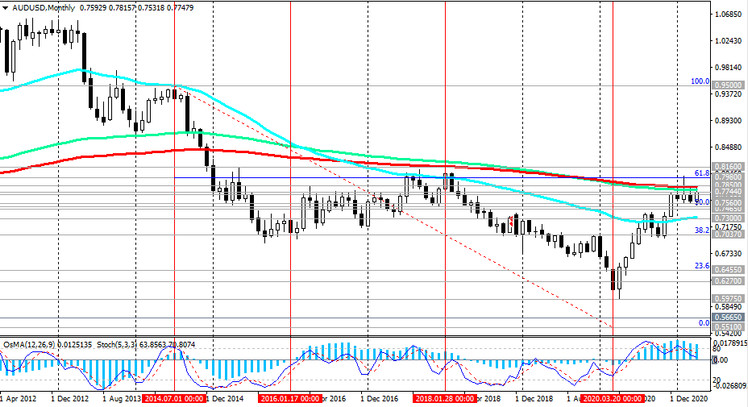

In an alternative scenario, the decline in AUD / USD will resume inside the descending channel on the daily chart and to support levels 0.7560 (ЕМА144 on the daily chart), 0.7510 (50% Fibonacci retracement to the wave of the pair's decline from 0.9500 in July 2014 to 2020 lows near the mark 0.5510), 0.7465 (ЕМА200 on the daily chart).

A breakdown of the support level 0.7300 (ЕМА200 on the weekly chart) will finally return AUD / USD into a long-term downtrend.

Support levels: 0.7744, 0.7705, 0.7600, 0.7560, 0.7510, 0.7465, 0.7300

Resistance levels: 0.7815, 0.7850, 0.7980, 0.8000, 0.8160

Trading Recommendations

Sell Stop 0.7720. Stop-Loss 0.7820. Take-Profit 0.7705, 0.7600, 0.7560, 0.7510, 0.7465, 0.7300

Buy Stop 0.7820. Stop-Loss 0.7720. Take-Profit 0.7850, 0.7980, 0.8000, 0.8160