Last Wednesday, the Fed kept the parameters of its current monetary policy, and its head Jerome Powell once again tried to calm the markets, saying that the central bank will not soon begin to adhere to a tighter monetary policy.

Powell also said Wednesday that the US economy is recovering faster than previously expected, and on the subject of accelerating inflation, he said that the recent rise in inflation mainly reflects "transition factors" and that the Fed will not change rates until the labor market recovers, and inflation will not reach the target level of 2%.

As you know, the Fed is currently pursuing an aggressive stimulating policy, keeping the interest rate close to zero (0.25%) and buying assets in the amount of $ 120 billion every month, trying to contain the growing yields on government bonds.

Powell's comments helped reassure investors and reassure them that the Fed would not change its course dramatically.

The dollar fell on Wednesday, while the US stock market remains bullish. Nevertheless, during today's Asian session, the DXY dollar index rose, receiving support from the renewed growth in US government bond yields. It seems that rising inflation in the United States is forcing investors to withdraw from reliable, but less profitable American bonds, shifting funds into more risky assets, in particular, in stocks.

Accordingly, the sale of US government bonds, which is accompanied by an increase in their yield, leads to an increase in demand for the dollar and its quotations.

Nevertheless, there is no reason to expect a more significant strengthening of the dollar in the current situation of inaction on the part of the FRS.

On Tuesday, the President of the USA Joe Biden announced a new program of assistance in the amount of $1.8 trillion, which, first of all, go to the education and support of families, and would be funded by taxes on high incomes (assuming a tax on income from capital gains, which relate to households earning more than $ 1 million, will be 39.6%, which is almost 2 times higher than the current tax). Most likely, the growth in the stock market will resume after such news.

The extra soft monetary policy of the central bank and aggressive stimulus programs from the US government will continue to support the economy. But such a policy and this process has a downside, implying an accelerated growth of inflation, and this will put pressure on the dollar, at least until the moment when the Fed announces its readiness to start smoothly curtailing its stimulating policy.

Today, market participants showing interest in the dollar and the assets of the American stock market will pay attention to the publication at 12:30 (GMT) of a block of important macro statistics for the United States.

Among other things, inflation indicators (price index and indices of personal consumption expenditure for the 1st quarter), annual GDP for the 1st quarter, as well as weekly data on the US labor market will be presented.

Last week, jobless claims continued to decline towards lows since the start of the coronavirus pandemic in the US in 2020, approaching 550,000. These are pretty optimistic numbers, indicating an accelerating recovery in the labor market, although more than half of the workers places lost during the pandemic have not yet been restored, economists say.

The U.S. GDP is also expected to grow 6.1% year-on-year in Q1 (up from 4.3% in the last quarter of 2020), in line with Q4 2019 levels. Further acceleration of economic activity suggests that the US economy as a whole has reached pre-crisis levels of real GDP.

Against this background, it is difficult to get short in the American stock market. And, given the already established inverse correlation of American stock indices and the dollar, its further weakening is most likely.

Thus, in the current situation, the most preferable are the dollar sales, primarily in relation to its main competitors in the foreign exchange market.

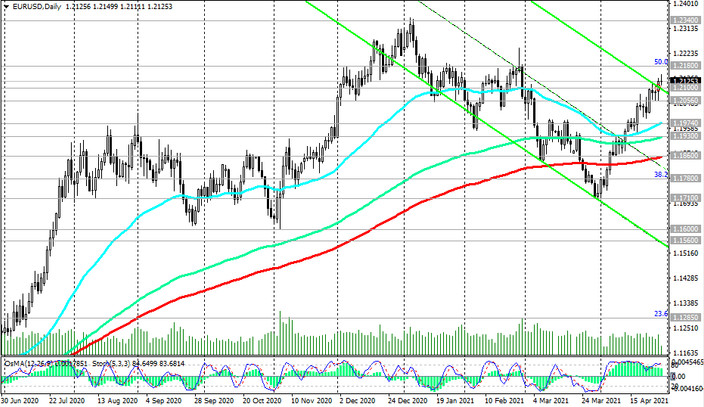

And we see that the EUR / USD pair is growing steadily this month, primarily against the backdrop of a weakening dollar.

At the time of this posting, EUR / USD is traded near the 1.2127 mark, in a bull market zone and maintaining a tendency towards further gains.