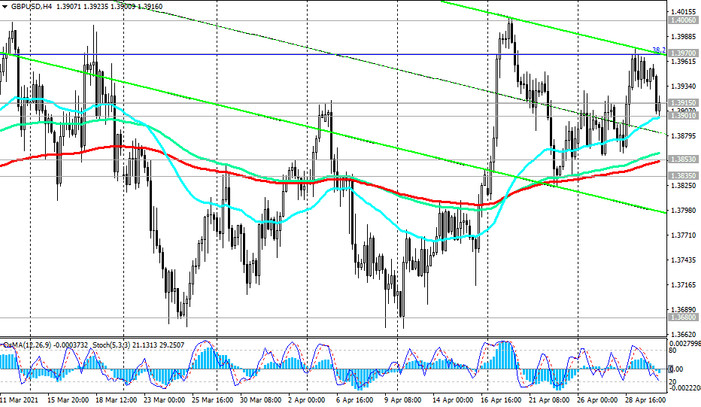

During today's corrective decline, GBP / USD reached the important short-term support level 1.3901 (ЕМА200 and the lower boundary of the ascending channel on the 1-hour chart).

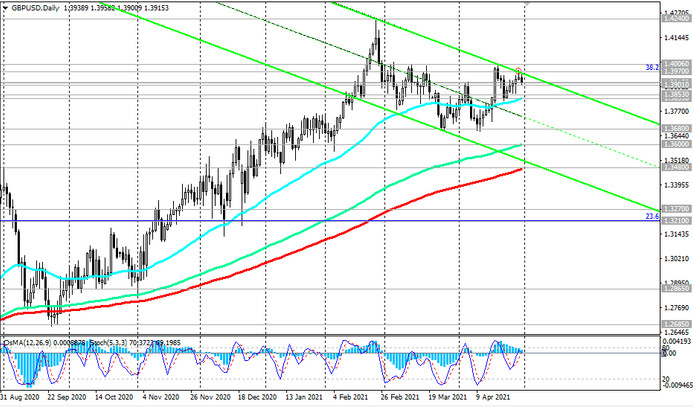

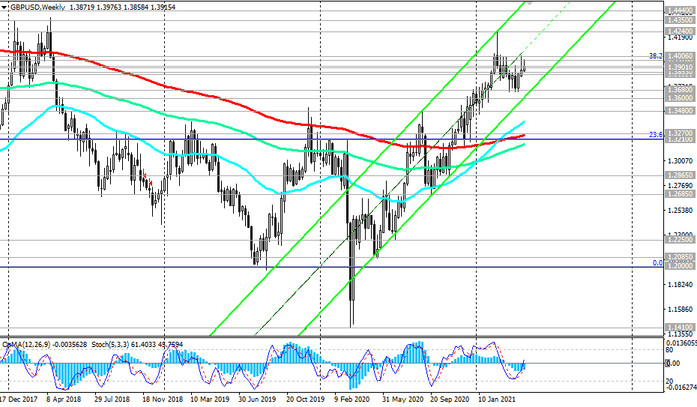

The breakout of this level did not happen, and after pushing off from it, the GBP / USD subsequently switched to growth, maintaining also the long-term upward dynamics above the support level 1.3835 (ЕМА50 on the daily chart) and moving within the ascending channel on the weekly chart.

Breakdown of resistance levels 1.3970 (the upper border of the descending channel on the daily chart and Fibonacci level 38.2% of the correction to the decline of the GBP / USD in the wave that began in July 2014 near the level of 1.7200), 1.4006 (local resistance level) may become a signal for a resumption long positions in GBP / USD with targets at resistance levels 1.4240, 1.4350, 1.4440, 1.4580 (50% Fibonacci level), 1.4830 (ЕМА200 on a monthly chart).

In an alternative scenario and after the breakdown of the support level 1.3901, GBP / USD may decline to support levels 1.3853 (ЕМА200 on the 4-hour chart), 1.3835, and after their breakdown - to levels 1.3600 (ЕМА144 on the daily chart), 1.3480 (ЕМА200 on the daily chart).

A breakdown of support levels 1.3270 (ЕМА200 on the weekly chart), 1.3210 (Fibonacci level 23.6%) will increase the risks of a resumption of the global bearish trend in GBP / USD and may provoke a deeper decline towards support levels 1.2250, 1.2085, 1.2000 (Fibonacci level 0%).

Support levels: 1.3901, 1.3853, 1.3835, 1.3680, 1.3600, 1.3480, 1.3270, 1.3210

Resistance levels: 1.3970, 1.4006, 1.4100, 1.4240, 1.4350, 1.4440, 1.4580, 1.4830

Trading recommendations

Sell Stop 1.3890. Stop-Loss 1.3980. Take-Profit 1.3853, 1.3835, 1.3680, 1.3600, 1.3480, 1.3270, 1.3210

Buy Stop 1.3980. Stop-Loss 1.3890. Take-Profit 1.4006, 1.4100, 1.4240, 1.4350, 1.4440, 1.4580, 1.4830