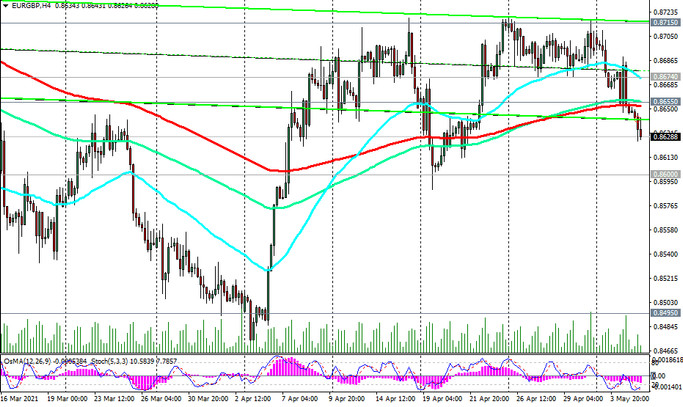

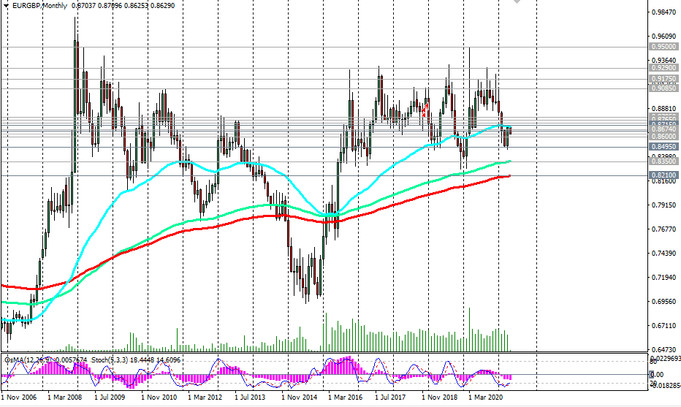

As we noted above, EUR / GBP is declining today for the third trading day in a row. Yesterday the pair broke through the important support level 0.8655 (ЕМА200 on the 4-hour chart and ЕМА50 on the daily chart) and today continues to develop the downward dynamics, declining within the descending channels on the daily and weekly charts.

EUR / GBP remains under pressure due to fundamental factors, which preserves the risks of its further decline.

Below the important short-term resistance levels 0.8674 (ЕМА200 on the 1-hour chart), 0.8655 (ЕМА200 on the 4-hour chart), only short positions should be considered.

The lower border of the descending channel on the weekly chart is near the level 0.8350 (ЕМА144 on the monthly chart), and it is likely that after the breakdown of the local support level 0.8600, mark 0.8350 will become the closest target in case of further decline of EUR / GBP. More distant targets are located at the support level 0.8210 (ЕМА200 on the monthly chart). So far, and below the resistance levels 0.8674, 0.8655, the downward dynamics prevails.

In an alternative scenario, the breakdown of the resistance levels 0.8715, 0.8740 (ЕМА200 on the weekly chart) will be a signal for the resumption of long positions. The first signal for the implementation of the alternative scenario is a breakdown of the resistance level 0.8655.

Support levels: 0.8600, 0.8495, 0.8400, 0.8350, 0.8210

Resistance levels: 0.8655, 0.8674, 0.8715, 0.8740, 0.8795

Trading Recommendations

Sell by market, Sell Stop 0.8620. Stop-Loss 0.8665. Take-Profit 0.8600, 0.8495, 0.8400, 0.8350, 0.8210

Buy Stop 0.8665. Stop-Loss 0.8620. Take-Profit 0.8674, 0.8715, 0.8740, 0.8795