The dollar fell sharply last Friday. The DXY dollar index fell by 1.17% last week, falling to February levels.

The reason for such a sharp weakening of the dollar was the publication last Friday of the monthly report on the US labor market, which turned out to be disappointing. According to the Ministry of Labor of the country, the number of jobs outside the agricultural sector in April increased by +266,000 (the forecast was +978,000 jobs), and unemployment, instead of the expected decline, rose to 6.1% from 6% in March. The employment rate has declined in almost all sectors of the economy.

Although economists believe that the labor market will continue to recover, this process will be slower. At the same time, the weak report of the Ministry of Labor reinforces the opinion and confidence of market participants that the leaders of the FRS, as promised earlier, will not begin to wind down the stimulus program in the near future and will not increase the interest rate before the end of 2023.

The dollar continued to weaken and the DXY dollar index continued to decline during today's Asian session. As of this writing, DXY futures are traded near 90.14, 7 points below Friday's close.

The dollar remains under pressure, also losing support from the yield of US government bonds, which stopped growing and stabilized near 1.600%, which is below the local multi-month high of 1.776% reached at the end of March.

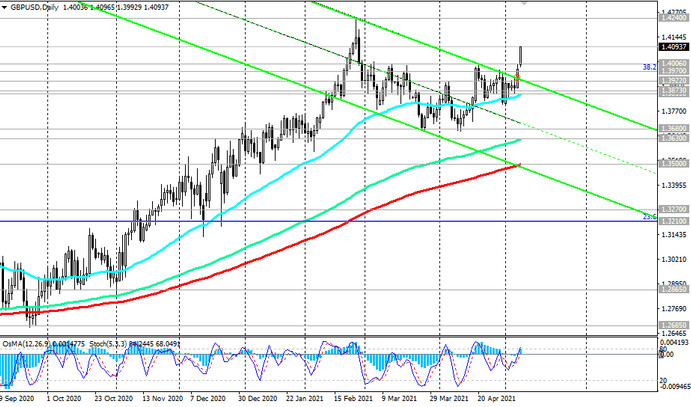

Meanwhile, the pound again becomes the leader of today's growth and strengthening against the dollar. The pair GBP / USD at the beginning of today's European session reached a local 11-week high near the level of 1.4100 and maintains a strong positive momentum and the mood for further growth.

In the morning, the pound also received support from the publication of Halifax data, according to which house prices in the UK in the 3-month period in April increased (in annual terms) by 8.2%. This is the highest annual growth rate in the last five years.

Today, UK authorities are likely to confirm a plan to further ease restrictions related to coronavirus. In addition, the pro-independence Scottish National Party, which won the parliamentary elections in Scotland, was still unable to obtain an absolute majority.

At 23:00 (GMT) the British Retail Consortium (BRC) retail sales report will be released. This indicator demonstrates the dynamics in the retail sector. A high reading is positive (or bullish) for the GBP, while a low reading is negative. The index is expected to rise by +14.8% in April (in annual terms) after rising by +20.3% in March. The data indicate a high rate of recovery in this sector of the UK economy, which was positively influenced by the phased lifting of quarantine restrictions against the background of relatively high rates of vaccination against coronavirus in the country.

All these factors are positive for the pound. On Wednesday, the attention of market participants trading the pound will be focused on the publication at 06:00 (GMT) of UK GDP data for March (expected to increase by 1.3%) and for the 1st quarter (expected to fall by -1.7% after +1.3% growth in Q4 2020).