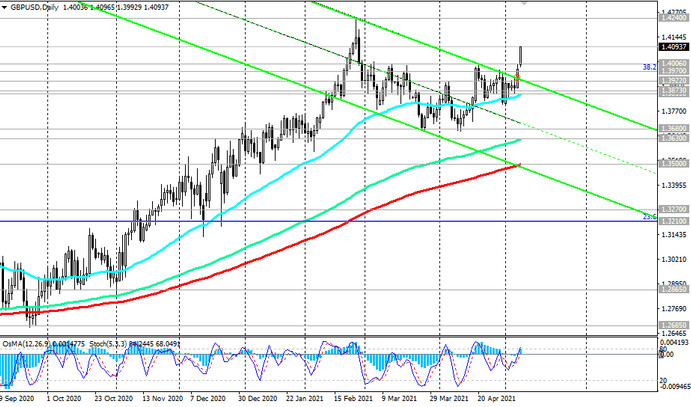

During the correctional decline, GBP / USD stabilized last week near the important support levels 1.3873 (EMA200 on the 4-hour chart), 1.3855 (EMA50 on the daily chart).

Further, against the background of a sharp weakening of the dollar, the pair rose sharply. Its growth in less than two trading days, including today, has already amounted to +1.57%. At the time of publication of this article, GBP / USD is traded near the 1.4100 mark, maintaining a trend towards further gains amid fundamental factors.

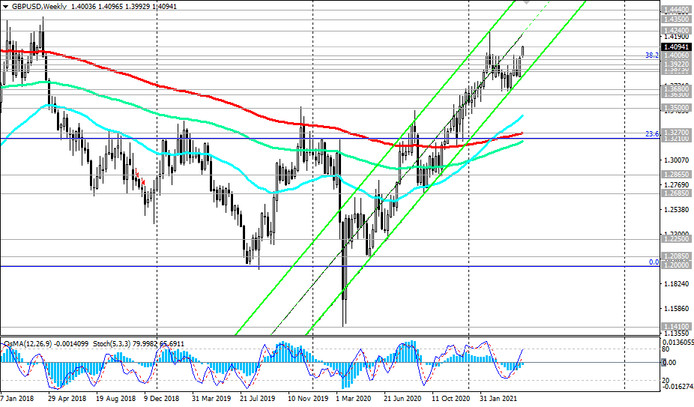

The growth targets for the pair are resistance levels 1.4580 (the upper border of the ascending channel on the weekly chart and the Fibonacci level 50% of the correction to the decline of the GBP / USD pair in the wave that began in July 2014 near the level of 1.7200), 1.4800, 1.4830 (ЕМА200 on the monthly chart).

In an alternative scenario, and after the breakdown of the support level 1.3855, GBP / USD may decline to the support levels 1.3800, and after their breakdown - to the levels 1.3630 (ЕМА144 on the daily chart), 1.3500 (ЕМА200 on the daily chart).

A breakdown of support levels 1.3270 (ЕМА200 on the weekly chart), 1.3210 (Fibonacci level 23.6%) will increase the risks of a resumption of the global bearish trend in GBP / USD and may provoke a deeper decline towards support levels 1.2250, 1.2085, 1.2000 (Fibonacci level 0%).

Support levels: 1.4006, 1.3970, 1.3922, 1.3900, 1.3855, 1.3680, 1.3630, 1.3500, 1.3270, 1.3210

Resistance levels: 1.4100, 1.4240, 1.4350, 1.4440, 1.4580, 1.4830

Trading recommendations

Sell Stop 1.4010. Stop-Loss 1.4120. Take-Profit 1.3970, 1.3922, 1.3900, 1.3855, 1.3680, 1.3630, 1.3500, 1.3270, 1.3210

Buy Stop 1.4120. Stop-Loss 1.4010. Take-Profit 1.4200, 1.4240, 1.4350, 1.4440, 1.4580, 1.4830