New data on inflation in the US, published on Wednesday, somewhat discouraged investors, also catching market participants by surprise, betting on further weakening of the dollar and growth of stock indices.

Inflation rates in the US in April exceeded forecasts. The US consumer price index rose 0.8% in April, the strongest monthly growth since 2009. Over the past 12 months, the inflation rate was 4.2% versus 2.6% for the period from March 2020 to March 2021. This is the strongest acceleration in inflation since 2008.

The core CPI, which excludes volatile food and energy prices, climbed 0.9% in April and posted a 3.0% year-on-year rise, the most significant gain since 1995.

The leaders of the US Federal Reserve System have not yet expressed any concern about the growing inflation and admit its temporary growth above the target level of 2%. Earlier, central bank officials said they expect inflation to accelerate this year and that the Fed is not ready to begin phasing out asset purchases, let alone raising interest rates.

Meanwhile, it is not difficult to assume that if the recently recorded sharp rise in consumer prices continues, the Fed may be forced to reconsider its plans.

A significant increase in the consumer price index (CPI) contributed to an increase in the yield of long-term treasury bonds. Thus, the yield on 10-year US bonds on Wednesday climbed to 1,700%, while the DXY dollar index added about 0.7%, climbing to 90.79.

On Thursday, the dollar continues to rise in the first half of the trading day. As of this writing, DXY futures are traded near 90.82, 87 pips above a local nearly 3-month low reached earlier this week.

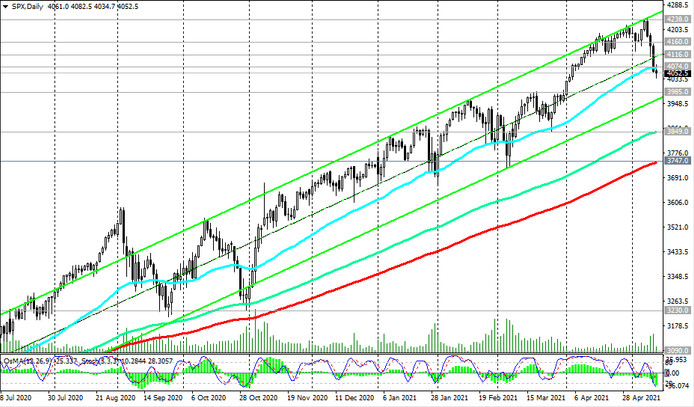

At the same time, futures for world and, above all, American stock indices fell sharply on Wednesday and are also declining today, and, moreover, for the 4th trading day in a row.

Yesterday, the S&P 500 and DJIA suffered their strongest three-day losses since late October after data on soaring consumer prices exacerbated fears about inflation.

As of this writing, US broad market S&P 500 futures are traded near 4052.0, 5 points below yesterday's low of 4057.0.

Inflation is unfavorable for any form of real return on investment instruments. It also raises uncertainty around the Fed's next moves in the coming months, economists say.

Inflationary expectations have so far been relatively subdued, but now the April rise in US consumer prices makes many economists and market participants doubt that the Fed will continue to be restrained despite the rising inflation. The Fed may have to be more aggressive and start cutting stimulus programs and raising interest rates earlier than its leaders planned. This is an alarming signal for buyers of risky assets (primarily stocks) of the stock market, betting on their further growth.

Most likely, market participants will want to wait for other confirming data on a new emerging trend of accelerating inflation. However, the sharp rise in US Treasury yields following the publication on Wednesday of higher-than-expected inflation figures for April, and the strengthening of the dollar may be the first warning signs of the beginning of a new trend in the dynamics of the dollar and stocks indices.