As we noted above, the S&P 500 is down today for the 4th day in a row, gaining momentum following the publication on Wednesday of the higher-than-expected US CPI for April.

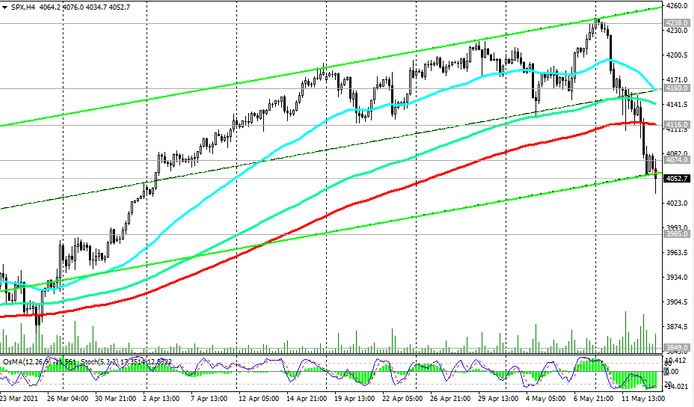

The price broke through the important short-term support levels 4160.0 (ЕМА200 on the 1-hour chart), 4116.0 (ЕМА200 on the 4-hour chart), 4074.0 (ЕМА50 on the daily chart), which is a signal, if not for opening short medium-term and long-term positions, then for temporary closing of long positions - for sure.

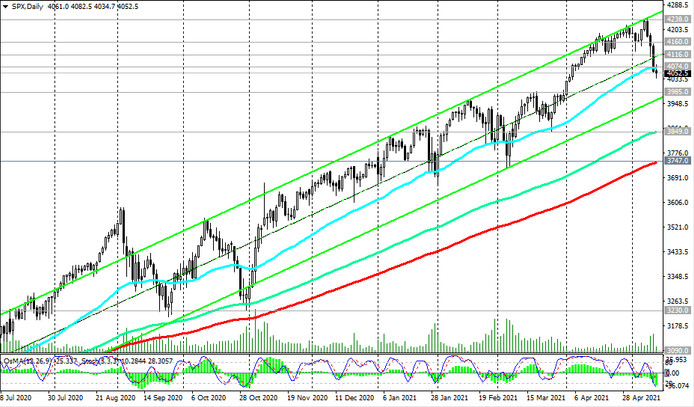

If the S&P 500 continues to decline, its closest target will be support level 3985.0 (lower line of the rising channel on the daily chart and March highs). In case of stabilization near this level, you can return to considering long positions. But for now, they should be abstained from.

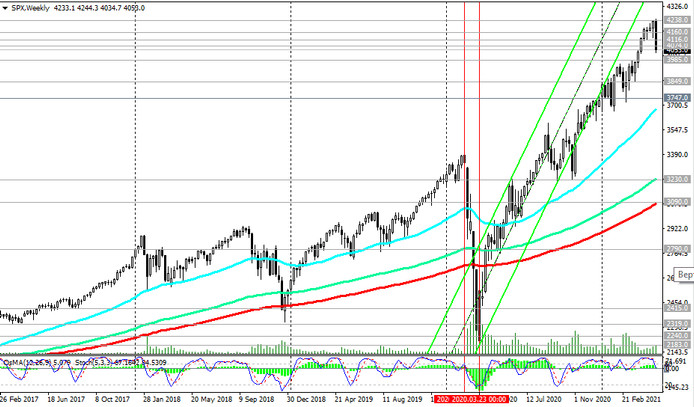

If the growth resumes from the current levels, then the first signal for buying the S&P 500 will be a breakdown of the resistance level 4074.0. A rise into the zone above the resistance level 4116.0 will confirm the resumption of the multi-year uptrend of the S&P 500. In general, despite the current decline, the long-term bullish trend of the S&P 500 and the American stock market remains.

Support levels: 4000.0, 3985.0, 3849.0, 3747.0, 3700.0

Resistance levels: 4074.0, 4116.0, 4160.0, 4238.0

Trading recommendations

Sell Stop 4030.0. Stop-Loss 4085.0. Targets 4000.0, 3985.0, 3849.0, 3747.0, 3700.0, 3600.0

Buy Stop 4085.0. Stop-Loss 4030.0. Targets 4116.0, 4160.0, 4238.0, 4300.0