The new week began with a weakening dollar and falling yields on US government bonds. At the time of this posting, DXY futures are traded near 90.26 mark, also in the middle of the range that has formed in the last few days between local highs of 90.91 and local lows of 89.95.

Last Wednesday's inflation report, which surpassed economists' expectations and indicated its strong growth in April, contributed to the sharp strengthening of the dollar last week. According to data released on Wednesday, the US consumer price index rose 0.8% in April, the strongest monthly growth since 2009. In annual terms, inflation rose by 4.2% versus 2.6% between March 2020 and March 2021. This is the strongest acceleration in inflation since 2008.

The core CPI, which excludes volatile food and energy prices, climbed 0.9% in April and posted a 3.0% year-on-year rise, the most significant gain since 1995.

Nevertheless, by the end of last week, the enthusiasm of dollar buyers had practically disappeared, and last Friday the DXY dollar index dropped to the levels of the end of the previous week, completely losing the bullish momentum received on inflation indicators.

Despite the sharp jump in inflation in April, market participants are still convinced that this is not enough for the Fed to move to curtail the stimulus program

As follows from the earlier statements of the FRS leaders, they admit a temporary jump in inflation above the target level of 2%, believing that the rise in inflation will be short-lived.

Today at 14:05 (GMT) the speech of the Deputy Head of the Federal Reserve, Richard Clarida, will begin. He will likely re-emphasize the commitment of the Fed to continue to pursue the current monetary policy, in which the Fed buys back $ 120 billion in bond market assets every month and keeps the interest rate near zero, and declares that the current rise in inflation is temporary. Such statements by Clarida and other Fed officials, who are expected to speak this week, could put pressure on the dollar.

Meanwhile, in the countries of the Eurozone, the vaccination campaign continues to be rolled out, and in the UK - further easing of quarantine restrictions, which supports the euro and the pound in pairs with the dollar.

The continued opening of the British economy raises the optimistic outlook for its future growth and intensifies speculation that the Bank of England may soon begin to roll back its stimulus policy.

In this regard, it will be interesting to hear the opinion of representatives of the Bank of England management, whose speeches are scheduled for 14:15, 15:30 and 16:30 (GMT).

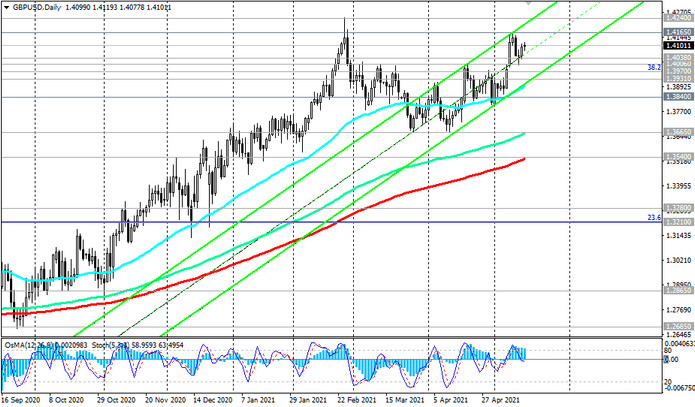

If there are harsh comments from their side regarding the monetary policy of the Bank of England, then the pound may strengthen sharply, and the GBP / USD pair (against the background of the “dovish” rhetoric of the FRS representatives) - test the strength the local resistance level 1.4165 (3- x monthly highs and highs for this month).

In an alternative scenario, GBP / USD will resume its decline, and the first signal for it will be a breakdown of the support level 1.4081 (see Technical Analysis and Trading Recommendations).

A plentiful release of important macro statistics for the UK is expected this week. The closest one will be released tomorrow at 06:00 (GMT). The latest data from the UK labor market will be published. Therefore, this week you should be prepared for the high volatility of the pound and the GBP / USD pair, respectively.