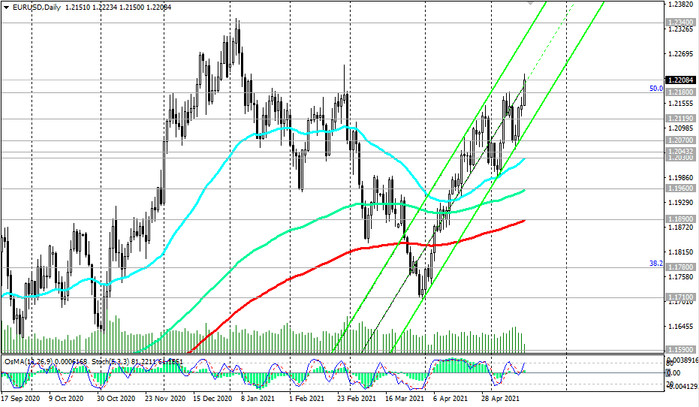

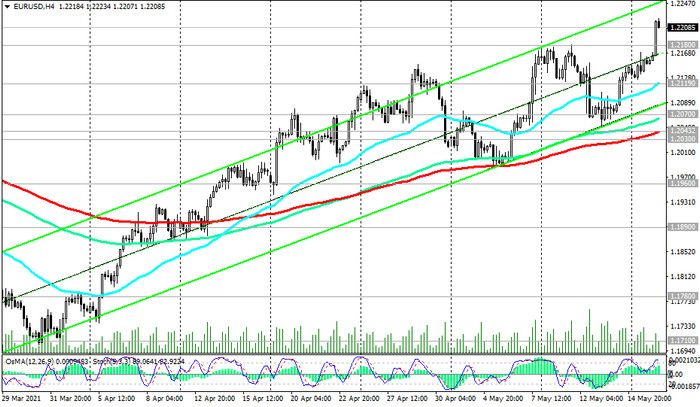

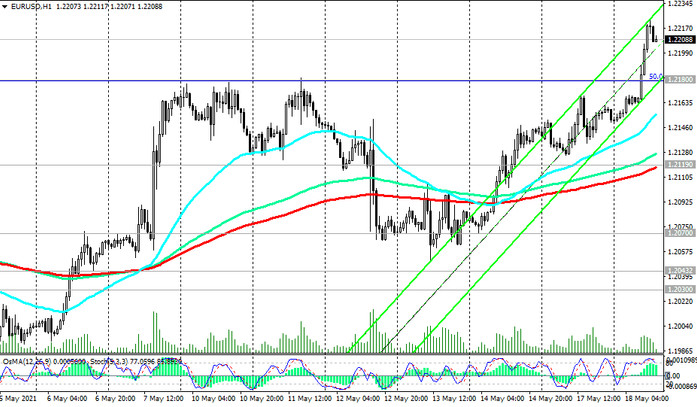

At the time of publication of this article, the EUR / USD pair is traded near 1.2200, remaining in the bull market zone and maintaining positive dynamics above the key support levels 1.1890 (ЕМА200 on the daily chart), 1.1960 (ЕМА144 on the daily chart).

EUR / USD also broke through the important resistance level 1.2180 today (Fibonacci level 50% of the upward correction in the wave of the pair's decline from 1.3870, which began in May 2014) and continues to grow within the upward channels on the daily and weekly charts, the upper boundaries of which pass through the levels 1.2340, 1.2450. More distant growth targets are located at resistance levels 1.2500, 1.2580 (61.8% Fibonacci level and 2018 highs), 1.2600.

In the alternative scenario and after the breakdown of the support levels 1.2043 (ЕМА200 on the 4-hour chart), 1.2030 (ЕМА50 on the daily chart), EUR / USD will resume its decline towards the key support levels 1.1960, 1.1890, and the breakdown of the support level 1.1590 (ЕМА200 and ЕМА144 on the weekly chart) will increase the risks of a resumption of the long-term bearish trend in EUR / USD.

The first signal for the implementation of this scenario will be a breakdown of the support level 1.2180.

Support levels: 1.2200, 1.2180, 1.2119, 1.2070, 1.2043, 1.2030, 1.2000, 1.1960, 1.1890, 1.1780

Resistance levels: 1.2300, 1.2340, 1.2450, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.2170. Stop-Loss 1.2230. Take-Profit 1.2119, 1.2070, 1.2043, 1.2030, 1.2000, 1.1960, 1.1890, 1.1780

Buy Stop 1.2230. Stop-Loss 1.2170. Take-Profit 1.2300, 1.2340, 1.2450, 1.2580, 1.2600