The consumer price index (CPI) in April rose +0.5% (+3.4% y / y) after rising +0.5% (+2.2% y / y) in March, the National Bureau of Statistics reported on Wednesday, which turned out to be higher than the forecast +0.4% and +3.2%, respectively.

The annual growth of inflation in Canada (+3.4%) in March was the highest level in the last 10 years. Thus, annual inflation in Canada in April exceeded the upper limit of the target range of the Bank of Canada (1% - 3%).

The consumer price index (CPI) reflects the price dynamics in relation to the retail prices of the corresponding basket of goods and services. The rise in CPI is a harbinger of a rate hike and a positive factor for CAD. However, this jump in inflation may turn out to be a temporary phenomenon (in previous months, annual inflation fluctuated between 0.1% and 0.6%). Therefore, despite such a strong report on inflation, the average reading of the consumer price index is still weak in order to the Bank of Canada can return to the issue of raising the interest rate.

Market participants ignored the inflation data released on Wednesday, and on Wednesday the USD / CAD pair rose, guided by the dynamics of oil prices and the strengthening of the US dollar.

The USD, in turn, strengthened on Wednesday after the publication of minutes from the April Fed meeting, from which it follows that “two committee members said about the risks that inflationary pressures could rise to undesirable levels before it becomes clear enough that action needs to be taken".

The day before, former Treasury Secretary and Presidential Adviser Lawrence Summers "added fuel to the fire", saying in media comments that the Fed's ultra-soft monetary policy, combined with huge stimulus spending from the federal government, creates the basis for a vicious circle on inflation. He also noted that the new approach of the FRS, which provides for the abandonment of the practice of anticipatory containment of inflation even before it overheats, is unreasonable in a situation when the US budget grew by 15% of GDP.

The minutes of the Fed's April meeting released on Wednesday showed that some executives want to start discussions on a plan to cut the massive bond buying program at their next meeting.

Their opinion is likely to be bolstered by the publication earlier this month of data showing a sharp rise in US inflation. The Labor Department reported last week that the CPI rose 4.2% in April (on an annualized basis). The core CPI, which excludes volatile food and energy prices, rose 0.9% from March, the fastest monthly growth since 1981 and well above economists' forecasts.

The April meeting took place before the release of data showing inflation in the US and a slower-than-expected rate of hiring. The number of jobs currently falls short of pre-pandemic levels by 8 million.

Following the April meeting, the Fed announced that it will continue to buy assets at the current pace until the economy shows “further significant progress” towards the Fed's targets - maximum employment and inflation, averaging 2%. At the same time, the Central Bank does not intend to raise interest rates until these goals are fully achieved or even exceeded.

“Based on the April labor market report, we have not made further significant progress”, said Fed Deputy Chairman Richard Clarida on Monday. Clarida also noted that central bank officials “need to watch and be attentive to the incoming data”, although he thinks that the recent rise in inflation is likely for the most part to be temporary.

Probably, after rethinking the results of the April Fed meeting and carefully studying the minutes published on Wednesday, market participants returned to selling the dollar. On Thursday, the DXY dollar index declines again. As of this writing, DXY futures are traded near 90.08 mark, 40 pips above the local and 3-month low of 89.68 hit on Tuesday, but 10 pips below yesterday's close.

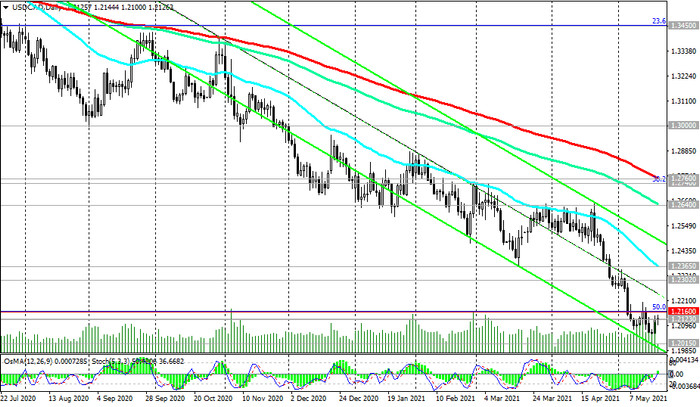

At the same time, the US dollar is growing against the Canadian dollar. As of this writing, USD / CAD is traded near 1.2127, 4 pips above the important short-term support level 1.2123. However, the breakout of this support level will resume the downward dynamics of USD / CAD (see Technical analysis and trading recommendations).

The current weakening of the CAD and the growth of the USD / CAD pair were most likely due to the continuing decline in oil prices for the third day in a row. CAD still largely retains the characteristics of a commodity currency and is sensitive to the dynamics of prices for oil, Canada's main export commodity.

Oil prices, in turn, are falling amid talks about the possibility of a new US nuclear deal with Iran. The day before, there were reports in the media that significant progress had been made in the negotiations between the United States and Iran on the nuclear deal. If successful in the negotiations, the United States can lift sanctions against Iran. This, in turn, may mean the introduction of additional volumes of Iranian oil to the market in the near future, which will put pressure on the price. At the same time, oil reserves in the United States remain at a high level. As reported on Wednesday in the Energy Information Administration (EIA) of the US Department of Energy, oil reserves in the country last week increased by another 1.321 million barrels, although this is less than the forecast of +1.623 million barrels.

On Friday, volatility in CAD and USD / CAD quotes will rise again when Canadian retail sales data are released at 12:30 (GMT).

The Retail Sales Index is published monthly by Statistics Canada and estimates total retail sales. The index is often considered an indicator of consumer confidence and reflects the health of the retail sector in the near term. A rise in the index is usually positive for the CAD; a decrease in the indicator will negatively affect the CAD. The previous value of the index (for February) was +4.8% after falling in March 2020 by -9.9%, in April - by -25% and growth in May by +18.7%. If the data for March turns out to be weaker than the forecast +2.3%, then the CAD may sharply decline in the short term.

From the news for today, market participants will pay attention to the publication at 12:30 (GMT) of weekly data from the US labor market. Initial jobless claims are expected to rise by 450,000 in the reporting week (after increases by 473,000, 507,000, 590,000 in the previous reporting weekly periods). There is a tendency for the indicator to improve, which is positive for the USD. The worse than expected data is likely to negatively affect the USD in the short term.