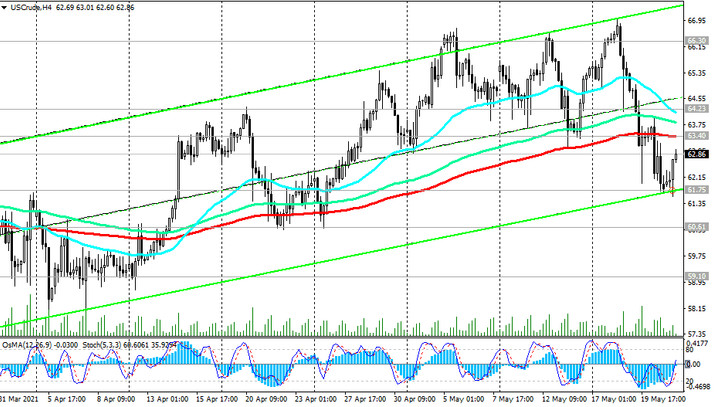

As of this writing, WTI crude oil futures are traded just below 63.00 mark.

Despite the prevailing long-term upward trend, it is premature to make purchases while the price is below the important short-term resistance levels 63.40 (ЕМА200 on the 4-hour chart), 64.23 (ЕМА200 on the 1-hour chart).

A signal to resume long positions will be a breakdown of the resistance level 63.40, and a breakdown of the resistance level 64.23 will become a confirmation signal.

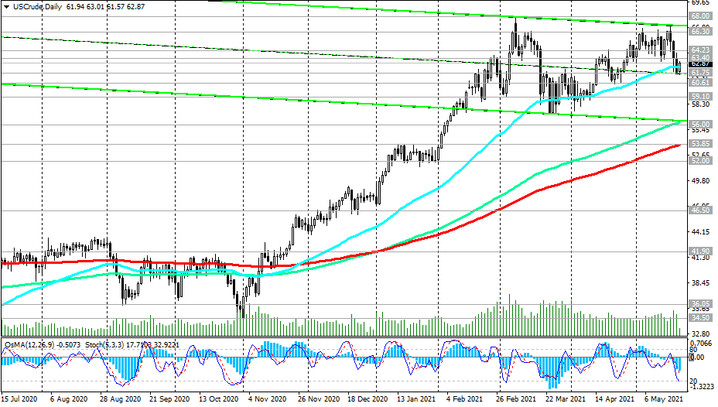

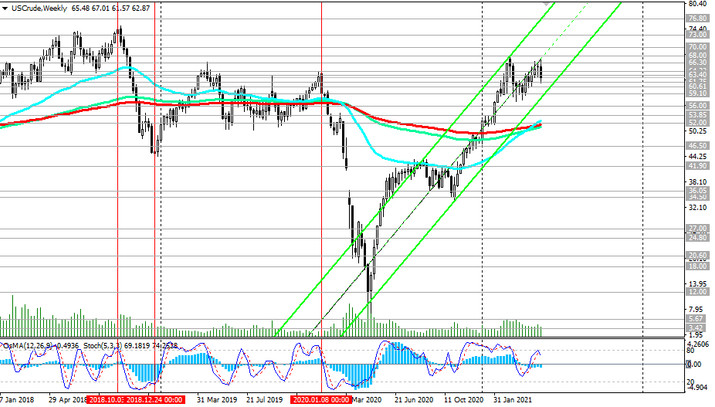

In an alternative scenario, the price will resume its decline towards the long-term support level 56.00 (ЕМА200 on the monthly chart), and in case of its breakdown - towards the key support levels 52.00 (ЕМА200 on the weekly chart), 53.85 (ЕМА200 on the daily chart).

Their breakdown can increase the risks of breaking the bullish trend. A breakdown of the 41.90 support level (balance line from July to November 2020) will resume the bearish trend for WTI crude oil.

In the meantime, WTI oil is traded in the bull market zone. Above the resistance level 64.23, long positions with targets at 70.00 and 77.00 will become relevant again (the upper border of the ascending channel on the weekly chart).

Support levels: 61.75, 60.61, 59.10, 56.00, 52.85, 52.00, 50.00, 46.50, 45.00, 41.90

Resistance levels: 63.40, 64.23, 66.30, 62.00, 66.30, 68.00, 70.00, 73.00, 77.00

Trading recommendations

Sell Stop 61.55. Stop-Loss 63.15. Take-Profit 61.00, 60.61, 59.10, 56.00, 52.85, 52.00, 50.00, 46.50, 45.00, 41.90

Buy Stop 63.15. Stop-Loss 61.55. Take-Profit 63.40, 64.23, 66.30, 62.00, 66.30, 68.00, 70.00, 73.00, 77.00