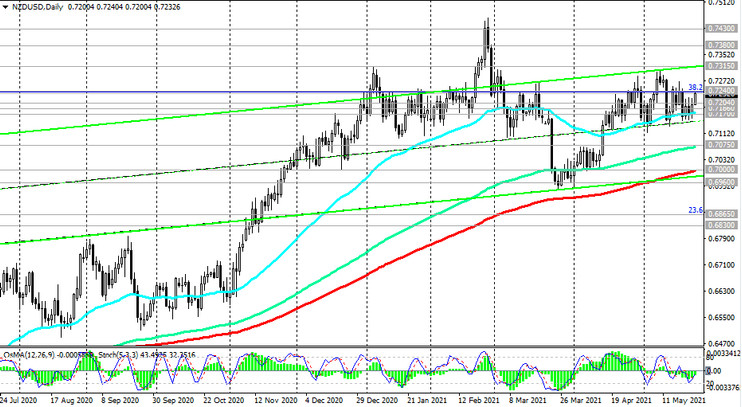

Having received support from strong macro statistics released earlier this trading week, the New Zealand dollar continues to develop its upward dynamics, including in the NZD / USD pair.

According to the Bureau of Statistics of New Zealand, retail sales in the first quarter of 2021 rose confidently by +2.5% against a decrease of -2.7% in the previous quarter and a forecast that implied a fall of -4.4%. Retail sales excluding car sales for the same period accelerated from +4.8% to +6.8% qoq, which is significantly higher than the forecast +1.9%.

NZD positions look significantly stronger than USD positions amid continuing uncertainty in the US. One of the factors in favor of strengthening the NZD is a stable environment in the field of combating the coronavirus pandemic, which allows the national economy to recover at a faster pace.

At the same time, the unemployment rate in New Zealand is declining (4.7% at the moment), approaching the upper limit of the target range of 3.5%-4.0%, and inflation is growing (1.5% at the moment), while as its target level is around 2.0%.

In addition, in favor of the strengthening of commodity currencies, which is the NZD, there is a positive trend on commodity markets, which favorably affects the trade balance of the export-oriented economy of New Zealand.

As the global economy further recovers and central bank policy remains soft and commodity prices continue to rise, commodity currencies have room to grow further, economists say.

Meanwhile, the US dollar remains under pressure against the backdrop of the Fed's position, whose leaders continue to signal their propensity to pursue super-soft monetary policy at its current parameters.

As of this writing, DXY dollar futures are traded near 89.66 mark, 34 points below Friday's close, updating the local 3-month low of 89.68 reached at the end of February.

Yesterday's comments from representatives of the Federal Reserve System eased fears of rising inflationary pressures and the likelihood of scaling down stimulus measures. Fed officials Rafael Bostic, James Bullard and Lael Brainard said any price hikes they thought would be temporary.

Market participants ignore the positive macroeconomic statistics from the US, relying in their investment decisions on the prospects for the Fed's policy, which refuses to recognize growing inflation as a threat to the economic recovery process.

The minutes of the US Federal Reserve meeting released last week underscored the leaders' wait-and-see attitude. According to the head of the Federal Reserve, Jerome Powell, the national economy will need several more months to begin discussing cuts in support programs. This week, investors expect the publication of American statistics on the dynamics of personal income and spending, which will help assess the current inflationary processes within the economy.

As for the NZD, market participants will now wait for the results of the RBNZ meeting, which will end on Wednesday with the publication (at 02:00 GMT) of the decision on the interest rate. Market participants do not expect changes in the vector of monetary policy.

It is expected that at this meeting, the RBNZ will not begin to reduce or increase the rate yet, but may speak in favor of lowering it in the coming months if the economic situation in the country and in the world worsens. Therefore, comments from RBNZ officials will continue to be important.

According to the bank's management, for a stable recovery of the New Zealand economy and inflation growth, "a lower rate of the New Zealand dollar is needed".

Probably, the head of the RBNZ Adrian Orr will reaffirm the bank's propensity to pursue a soft monetary policy, which will lead to continued pressure on the New Zealand currency. If the rhetoric of his statements turns out to be tougher in relation to the prospects of the bank's monetary policy, then the New Zealand dollar may sharply strengthen, including in the NZD / USD pair.