The decline in the dollar during the Asian session was replaced by its growth at the beginning of the European session on Wednesday. At the time of this posting, DXY dollar futures are traded near 89.73 mark, 22 points higher than yesterday's and a new local nearly 4-month low of 89.51.

In the Asian session, the US dollar continued to decline on the next assessments of the prospects for inflation in the US and the policy of the Federal Reserve System. Recent comments from the Fed have allayed fears that rising inflation could stifle economic growth or prompt the central bank to suddenly tighten policy. Fed officials, as their recent comments suggest, are not concerned about the inflation data, and they have not changed their intentions about the prospects for a super-soft monetary policy of the central bank.

The volatility of the foreign exchange market in the first half of today's trading day can also be associated with the results of the meeting of the RBNZ, which ended today with the publication (at 02:00 GMT) of the decision on the interest rate.

The decision of the RBNZ to maintain the parameters of its current monetary policy was expected (the interest rate remained at 0.25%, and the volume of bond purchases - at the level of 100 billion New Zealand dollars). However, market participants were attracted by the accompanying announcement of the bank's management, from which it follows that they expect a rate hike in the 3rd quarter of 2022, to 0.5% from the current record low of 0.25%. Following the RBNZ announcement, the New Zealand dollar / US dollar pair jumped to 0.7290 from 0.7230, and at the time of this article's publication, it is traded above 0.7300 mark.

Meanwhile, there are no drivers on the market that would support the USD positions at the moment. Investors do not expect any action from the Fed, and the positive macroeconomic statistics from the US provide weak support to the dollar, because market participants are mainly guided by the position and actions of the Fed.

US Treasury yields also fluctuate in a range (mostly between 1.550% and 1.700%), stopping the rise, which also does not contribute to the rise of the dollar.

Today, there is no important news in the economic calendar, but tomorrow market participants will pay attention to the publication (12:30 GMT) of weekly data from the American labor market and to the dynamics of the number of jobless claims, as well as to the updated estimate of the US GDP for the 1st quarter and to the indicator of orders for goods durable. This indicator reflects the value of orders received by manufacturers of durable goods and capital goods (capital goods are durable goods used to produce durable goods and services), implying large investments.

Previous values of the durable goods orders indicator: +1% in March, -1.2% in February, +3.4% in January 2021, +1.2% in December, +1.3% in November, +1.8% in October, -18.3% in April, -16.7% in March, +2.0% in February, -0.2% in January 2020.

In theory, the relative growth of the indicator has a positive impact on the dollar; the market reaction to its negative value may be negative for the dollar in the short term. Data worse than the previous value will also negatively affect the dollar quotes (forecast for April +0.7%), although, as we noted above, the reaction of market participants to macro statistics from the US practically does not have a strong impact on the dollar lately.

Now, various statements from the FRS leaders have been acting on it much more strongly. And they (the leaders of the Fed) declare their commitment to persistently pursue the current super-soft policy until inflation and the labor market steadily reach acceptable levels. Yet the recent leaps in inflation are assessed by the FRS as a temporary phenomenon.

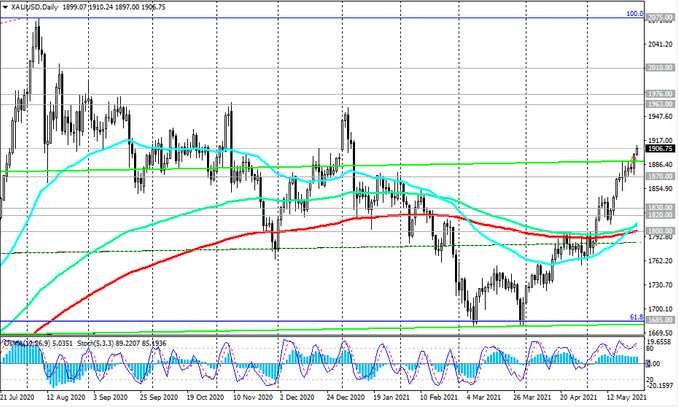

Against this background, gold quotes are breaking new 4-month records. Yesterday the XAU / USD pair touched the 1900.00 mark, and today it has confidently broken through it. At the time of publication of this article, the XAU / USD pair is traded near 1907.00 mark, maintaining positive dynamics and potential for further growth.