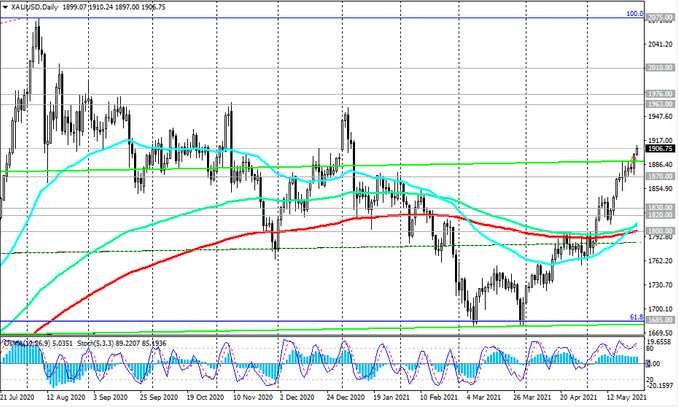

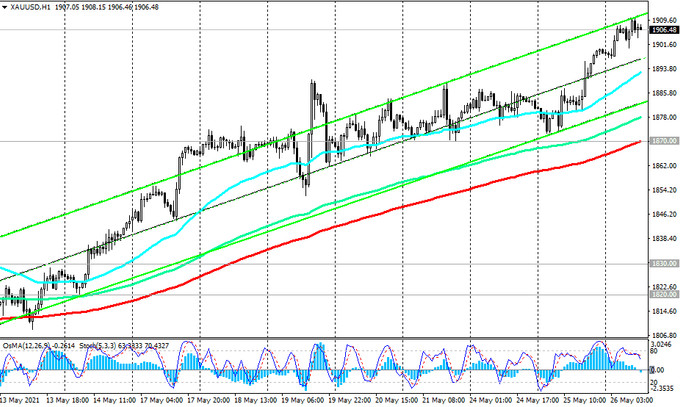

Amid a weakening dollar, the XAU / USD pair reached a new 4-month high today near 1910.00 mark.

Against the backdrop of rising inflation, Fed inaction and the prospect of further weakening of the dollar, the XAU / USD pair retains the potential for further growth.

In this case, the targets will be the marks 1963.00, 1976.00 (local highs), 2000.00.

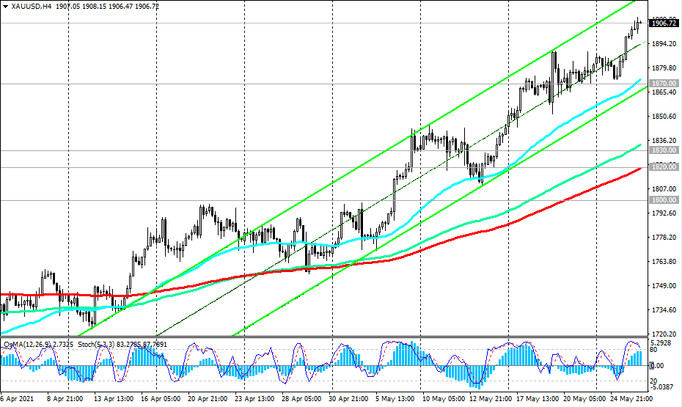

In an alternative scenario, XAU / USD will resume the downward dynamics, and the breakdown of the short-term support level 1893.00 (ЕМА200 on a 15-minute chart) will be the first signal for the pair to sell.

The breakout of the important support level 1820.00 (ЕМА200 on the 4-hour chart) will confirm the scenario for a decline and bring the pair back inside the descending channel on the weekly chart with targets at support levels 1800.00 (ЕМА200 on the daily chart), 1685.00 (local minimums and 61.8% Fibonacci level of the correction to the growth wave since November 2015 and the level of 1050.00), 1560.00 (ЕМА200 on the weekly chart, Fibonacci level 50% and the lower line of the descending channel on the weekly chart).

Support levels: 1900.00, 1893.00, 1870.00, 1830.00, 1820.00, 1800.00, 1700.00, 1685.00, 1635.00, 1560.00

Resistance levels: 1910.00, 1963.00, 1976.00, 2000.00, 2010.00

Trading recommendations

Sell Stop 1890.00. Stop-Loss 1912.00. Take-Profit 1870.00, 1830.00, 1820.00, 1800.00, 1700.00, 1685.00, 1635.00, 1560.00

Buy Stop 1912.00. Stop-Loss 1890.00. Take-Profit 1963.00, 1976.00, 2000.00, 2010.00