Market participants have listened for so long to assurances from the Fed's leadership about their commitment to steadfastly pursue an ultra-soft monetary policy that they almost believed in them. And now, like a bolt from the blue, the statements of a member of the Fed's Board of Governors and Deputy Head for Banking Supervision Randal Quarles, who said that the leadership of the US central bank may consider the possibility of discussing the issue of reducing the purchase of assets at one of the next meetings, provided that economic performance improves steadily.

"I am very optimistic about the trajectory of the economy", Quarles said, adding that he expects annual inflation to temporarily accelerate to above the Fed's 2.0% target, thanks to healthy economic activity and lower unemployment.

"If in the coming months my expectations for economic growth, employment and inflation are met, and especially if these indicators turn out to be stronger than I expected, then, as stated in the minutes of the last Fed meeting, it will be important for the FOMC to start discussing the change. the pace of asset purchases at future meetings", Quarles also said.

In his opinion, positive expectations and prospects for economic growth make it possible to curtail the Federal Reserve's purchases of government bonds and mortgage bonds in the amount of $ 120 billion per month. Although, short-term interest rates will still remain close to zero, Quarles said.

Last week, the minutes of the April Fed meeting was published, which contained statements by central bank officials that inflation is temporary and the economy has a long way to recover.

On the eve of the President of the Federal Reserve Bank of San Francisco Mary Daly said that the reduction in asset purchases has already been discussed by representatives of the department, and soon this issue will be raised again.

Thus, more and more representatives of the Fed are talking about the possibility of reducing stimulus, although they are still in the minority.

Such statements on their part are alarming for investors who are betting on further weakening of the dollar. Therefore, the next meeting (in mid-June) of the Fed will be scrutinized for any changes in the rhetoric of statements by its leaders. Although, to say that the decision to start curtailing the incentive program will be made at this meeting is still premature.

The US economy still lacks more than 8 million jobs, and the recent surge in inflation is viewed by Fed officials as temporary.

Nevertheless, market participants closed part of their short positions on the dollar ahead of the publication of important macro statistics for the US today (at 12:30 GMT). This factor and yesterday's statements by the FRS representatives regarding the possibility of curtailing the stimulus program contributed to the strengthening of the dollar.

As a result, the DXY dollar index at the time of publication of this article remains in a range near yesterday's highs and 90.05 mark, which corresponds to the levels of the end of February.

At 12:30, weekly data from the US labor market will be published, including information on the dynamics of the number of jobless claims, as well as an updated estimate of US GDP for the 1st quarter and an indicator of orders for durable goods.

It is expected that the second estimate of the quarterly growth of US GDP will be better than the first estimate (6.5% instead of 6.4%), and the volume of orders for durable goods continued to grow (+0.7% in April vs. +1% in March, - 1.2% in February, +3.4% in January 2021). It is an important indicator reflecting the value of orders received by manufacturers of durable goods and capital goods (capital goods are durable goods used to produce durable goods and services), which implies large investments.

Strong macroeconomic indicators may put additional pressure on the US Federal Reserve to roll back measures to support the national economy. And this, in turn, can cause, if not a reversal of the downtrend, then at least a short-term period of dollar strengthening.

Data worse than the forecast and previous values will negatively affect the dollar quotes.

Meanwhile, the main competitors of the dollar in the foreign exchange market - the euro and the pound - are also traded in a range against the dollar today.

The dynamics of these currency pairs (EUR / USD and GBP / USD), due to the lack of significant fundamental news on the economy of the Eurozone and the UK, will mainly depend on the movement of the US dollar.

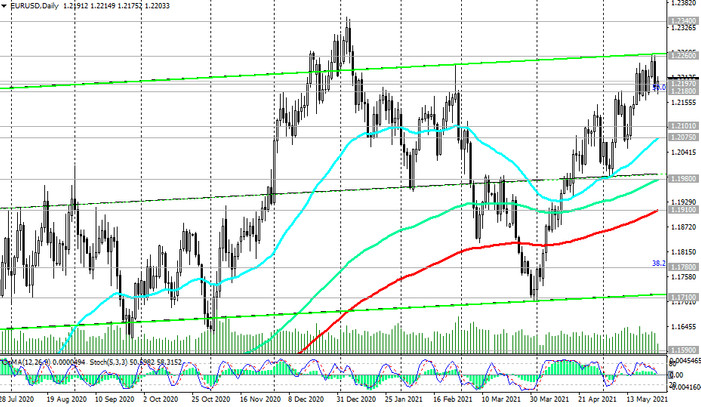

In view of this, it is also worth paying attention to the speech today at 15:00 (GMT) by US Treasury Secretary Janet Yellen, whose department is still expected to take actions aimed at gradually tightening monetary policy in the country, and on speeches (at 13:00 and 15:00 GMT) of member of the ECB Governing Council Isabelle Schnabel. Their unexpected statements may also increase volatility in the quotes of the dollar and the euro, and, accordingly, the EUR / USD pair, which at the time of publication of this article has stabilized at the short-term support level near 1.2197 mark (see Technical Analysis and Trading Recommendations).

Noteworthy macro statistics for the Eurozone will be published only on Friday at the beginning of the European trading session.